Page added on October 31, 2013

US will always remain a crude oil importer

US shale oil has so far replaced 2 mb/d of its crude oil imports which peaked at around 10 mb/d in 2005. If this effort can be doubled the US would still need to import around 6 mb/d.

US crude oil imports vs production

History: US crude imports skyrocketed in the early 1970s after the US peak. High oil prices as a result of the 1stand 2nd oil crises in 1973 and 1979 triggered a recession and therefore a drop in oil demand and a reduction in crude oil imports. After Alaska’s peak crude imports increased again until the 3rd oil crisis which started in 2005. Despite the shale oil boom which began in serious in 2011, the US still imports around 2 mb/d (25%) from the Persian Gulf and 3.5 mb/d (44%) from OPEC. So there would be a long way to go for the US to become independent of crude oil imports.

The reduction in crude exports more or less corresponds to the increase in shale oil production so that refinery input basically remains on the same level.

Data are from here:

crude production: http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_a.htm

Outlook for shale oil

This graph shows 3 crude oil production scenarios of EIA’s Annual Energy Outlook published in May 2013. Actual production appears to follow the “high resource scenario”.

Only another 2.5 mb/d can be expected by the mid 2020s which would reduce imports to 5.5 mb/d . This shows that the US will always be dependent on crude oil imports.

But it could also be that actual production reflects a fast extraction path resulting in an earlier peak.

The following graph shows the permanent battle in shale oil fields to grow production. As an example in Bakken, decline in old wells has now reached 60 kb/d EVERY MONTH which is 6.3 % of production (red columns), up from 5.5 % 2 years ago.

For November 2013, it is expected that new wells (blue columns) will yield 85 kb/d so the net increase is only 85-60=25 Kb/d. As the monthly decline is increasing with the number of old wells, drilling of new wells has to ever increase. Once this is no longer possible, production will peak.

Data from: AEO 2013 http://www.eia.gov/forecasts/aeo/pdf/0383(2013).pdf

Short term energy outlook http://www.eia.gov/forecasts/steo/report/

and Drilling Report Oct 2013 http://www.eia.gov/todayinenergy/detail.cfm?id=13471

This typical production profile of a shale oil play shows the steep declines experienced in such an oil supply system. If, for argument sake, drilling were to stop (e.g. in another credit crunch) total production would follow these declining lines.

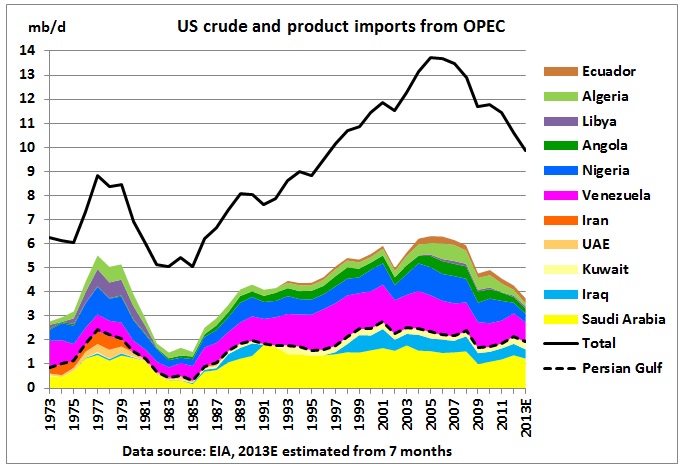

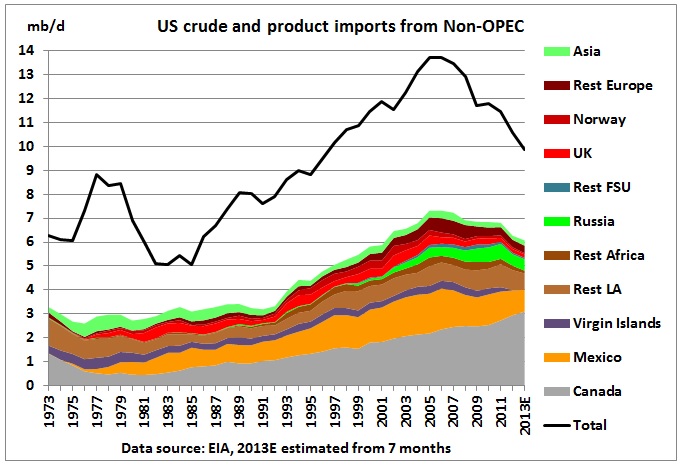

US crude and product imports by country of origin

US crude and product imports peaked in 2005 at 13.7 mb/d and are now running at around 10 mb/d.

Canada, Mexico, Venezuela and Saudi Arabia are the main suppliers, making 60% of total imports.

Imports from Canada have increased steadily (syncrude from tar sands) but imports from Mexico have declined because of peak oil in this country.

Imports from Europe are also in decline, somehow offset by imports from Russia.

Oil imports from OPEC have declined from around 6 Mb/d in 2008 to 3.7 mb/d in 2013 which is mostly crude. Only 240 kb/d were petroleum products.

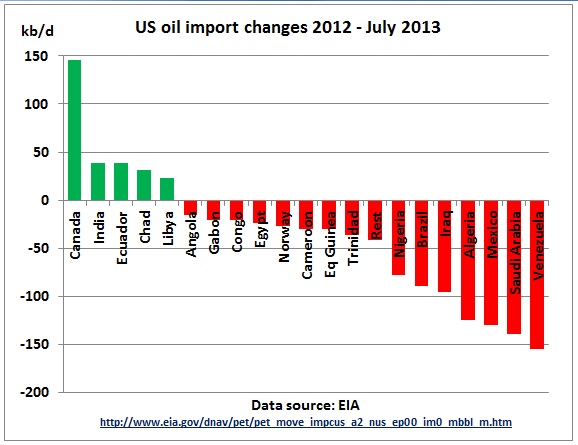

Oil imports were reduced over a wide range of countries, especially vulnerable suppliers like Nigeria, Iraq, Algeria, Saudi Arabia and Venezuela (56% of the total reduction)

Conclusion

US shale oil has replaced around 2 mb/d of crude oil imports. If EIA’s projections are correct, crude imports could be reduced by another 2-2.5 mb/d. That would leave the US still with a crude import requirement around the 6 mb/d mark. To call this energy independency is more than an exaggeration.

14 Comments on "US will always remain a crude oil importer"

Dave Thompson on Thu, 31st Oct 2013 5:11 pm

The US will “always” have to import oil until there is no more oil to import. That is coming soon to a planet near you!

bobinget on Thu, 31st Oct 2013 6:45 pm

Again this report largely overlooks domestic natural gas. In particular, gas to liquids as a partial replacement for imported diesel and jet fuel and not as a major rival to gasoline, diesel in CNG busses, long and short distance trucking, light trucks and cars.

shortonoil on Thu, 31st Oct 2013 8:05 pm

A barrel of light sweet crude provides 1.2 million BTU to the end consumer. A barrel of shale oil provides less than 500,000 (perhaps much less). Comparing imported high quality crude to shale oil is comparing apples and oranges. Shale oil wouldn’t provide the US with energy independence because it doesn’t have much energy to provide!

When you see mentioned that the US is producing X amount of shale oil; divide by three, and you’ll have a more accurate number.

rockman on Thu, 31st Oct 2013 8:12 pm

I wouldn’t say they’ve overlooked GTL in the US because you can’t overlook what doesn’t exist. SASOL keeps saying they might build the first GTL in the US but so far no ground breaking. And then there are the words of the great Shell Oil themselves: “We have spent nearly 40 years researching technology to convert natural gas-to-liquid (GTL) into products used for transport fuel, lubricants and the raw materials for chemicals and detergents. Our experience includes operating the first commercial GTL plant in Bintulu, Malaysia, and building the world’s largest GTL plant, Pearl GTL, in Qatar. As recent advances in technology help unlock vast new supplies of natural gas, we are also now exploring a potential GTL plant on the US Gulf Coast.” Maybe they just need another 40 years to make it work in the US.

Exploring a potential GTL plant in the US? And even when NG was bottoming out at close to $2/mcf no reports of Shell committing to building a plant. And now still no commitment when NG is selling for $4/mcf. Wonder if Shell will make the big move to GTL when prices double again. Just MHO but I think I would wait for at least one gallon of profitable GTL motor fuel is produced in the US before I would toss it out as a solution.

CNG certainly looks to have some potential for commercial vehicle use. At least until enough is utilized for those purposes to cause the price of NG to increase beyond the point where it is no longer competitive.

bobinget on Fri, 1st Nov 2013 12:05 am

rockman, you and others might find this interesting.

http://images.sdsmt.edu/learn/speakerpresentations/Sonnenberg.pdf

I believe it’s on topic.

No Data on Fri, 1st Nov 2013 12:20 am

The petroleum consumption of all coounties was posted in EIA website in June

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=5&pid=53&aid=1

but for the NatGas and Coal, its still not posted.

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=3&pid=26&aid=2

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=1&pid=1&aid=2

What does this mean.

Oil companies run the US Government.

eugene on Fri, 1st Nov 2013 1:00 am

When the “big boys” aren’t investing in something, I figure there’s more to the story than we know. Contrary to the endless comments re “our endless” supply of natural gas, the same story is there as in oil. We are madly chasing an ever decreasing resource screaming all is well into the darkness. Kinda like when I was a kid and had to go into a dark house, would talk/sing to screw up my courage and ignore my fear. For me the truth is obvious, the easy stuff is gone and we are developing the crap we bypassed with all the issues that come along with crap. Useful but far, far from our salvation.

BillT on Fri, 1st Nov 2013 1:10 am

If the big boys are not interested it is not profitable. They know more than we do about what is happening in hydrocarbons and they want to keep it that way. If say, they told us that there was only 5 years of oil left, what would happen to their stocks? Ditto for NG or any other ‘resource’ dependent operation. Their power and wealth would evaporate faster than vodka on a stove.

No, we will be kept in the dark until the dark is all we have left.

Luke on Fri, 1st Nov 2013 9:00 am

The point is not the ability to replace another 2.5 million bbpd conventional crude imports by domestic shale oil. The point is eventually the economic consequence. The EROI of shale/tar oil is at best 6:1 as conventional (import) crude still is 30:1. But if you take into account EROI of the end product gasoline/diesel you pour into your thirsty SUV or truck it is much worse. Drilling, transportation, raffinary, distribution take their (lost) energy part, so presently the EROI of gasoline is 9:1. And don’t forget from each 100 liters gasoline you buy at the gas station your modern “economic/hybrid” car still burns off 70 liter of gas into the atmosphere for nothing as the other 30 liter is effectively used to bring tons of steels and some kgrams human entit(y)(ies) from A to B. And this number will go down further if shale/tar oil take over a part of imported conventional crude. The optimistic EIA headliners (supported by Big Oil and Oilbamics) is disguising the truth. “Energy independence” if based on increasing unconventional fossils production will turn out to be a real economic nightmare!

rockman on Fri, 1st Nov 2013 11:41 am

Thanks Bob. Probably the best detailed report I’ve ever seen on the Niobrara. Any nerdy types out there that want a good petroleum geology lesson would find it illuminating. I’ve done very little work in the Rockies but years ago a friend was working in the area when the Niobrara got hot. He told me he could stand in the door of his work trailer and see derricks all the way to the horizon. The problem with RM NG has always been a lack of pipeline to transport it out of the region. That has improved in the last 10 years but still holds back development. If someone were to make GTL economics work it would likely be in a trend like the Niobrara. The capex cost is so high you need many years just to recover the initial investment. Which means you need a long term (10+ years) supply of NG at an acceptable price. That would be tough in a more volatile market like the Gulf Coast but could be easier to assume in some areas of the Rockies IMHO.

shortonoil on Fri, 1st Nov 2013 4:37 pm

“The EROI of shale/tar oil is at best 6:1 as conventional (import) crude still is 30:1.”

The term EROI can be applied to anything, biological organisms, solar crop cycles, anything. The term ERoEI refers to petroleum production at the well head, or in the case of bitumen production at the mine mouth. The ERoEI of the “average” barrel of light crude (API 30-45) was 9.6:1 in 2012. Heavy crude is actually higher (because its exergy, or energy content is higher), but the increased energy needed to refine it more than compensates. Mayan Heavy (API 21) produces 28% residuals that must be further refined with vacuum distillation which is almost twice as energy intensive as atmospheric distillation.

The ERoEI of conventional crude (API 30-45) is now declining by 0.24 points per year, but this rate is slowing. By 2030 the decline rate will be 0.10 points per year. The ERoEI of shale oil is hard to determine, but it may lay below the theoretical breakeven point of 6.9:1. This would mean that it requires more energy to extract, process, and distribute than it delivers. The differential would have to be made up from other fuels, but it is certainly not much above 7.0:1.

Incidentally, the last time that the ERoEI of conventional crude was 30:1 was in 1980. Every one point drop in the ERoEI of conventional crude (2012) reduces the amount of energy it delivers to the general economy by 12%.

Osh University on Mon, 19th Feb 2024 2:13 pm

Osh University sets the stage for your medical aspirations with its bachelor of medicine program. Dive into a world-class education that blends theoretical knowledge with hands-on experience, preparing you for the challenges of the ever-evolving medical landscape.

Tempo Garments on Mon, 19th Feb 2024 2:18 pm

Get your little explorers ready for the winter with a kids thermal suit from Tempo Garments. Our range, which is designed with warmth and comfort in mind, provides high-quality insulation for cold days.

Shalamar Hospital on Mon, 19th Feb 2024 2:21 pm

Shalamar Hospital is your trusted healthcare destination, offering the expertise of a renowned stomach specialist . Expect top-notch care for gastrointestinal health.