Page added on July 28, 2014

Tech Talk – Changes in global supply and demand

At the beginning of the month I pointed out that there are three components to the coming Energy Mess. The first of these is the steady increase in global demand for oil and its products, the second is the decline in production from existing wells and fields, and the third is the shrinking pool of places from which new oil can be recovered to make up the difference between the first two.

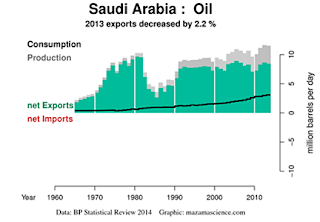

Internal demand gnaws away at that available for export, as the situation in Saudi Arabia clearly illustrates:

Figure 1. Changing relation between Saudi production, internal demand and thus available exports. (Energy Export Databrowser)

Internal consumption has now reached 3 mbd – out of a production of around 10 mbd, a trend bound to go higher, as the country’s population continues to grow, having risen from 20 million in 2000 to 28.3 million in 2012, with no significant change in rate apparent.

Back in 2011 Chatham House produced a report expressing concern over the future that this prefaces. The report began with this predictive plot:

Figure 2. Projected changes in Saudi production and consumption (Chatham House )

It is regrettable to note that there is really no viable justification given for the assumption that Saudi production will rise from the current 10 mbd to the roughly 14 mbd that the plot suggests by 2020. Without that increment the world is going to be in quite a bit of hurt somewhat earlier than the above graph would suggest – as perhaps will be the Kingdom of Saudi Arabia. (Hopes for large increases in domestic production of natural gas seem to have foundered in their tight shales and are switching to efforts to develop the tight sand deposits although the mechanisms of gas flow may not be as advantageous in the sand. Similarly there is little in the report to explain why demand – once it reaches the current levels, should suddenly stabilize for three years before starting back up. Without that “hiccup” the dark blue line (which is already down to around 7 mbd, not 8) will rather continue downward, rather than the optimistic uptick that Chatham House predicted.

On the other side of the house China provides a clear example of the changes in global demand, with imports in 2013 having increased by 5.8% over 2012, and with consumption now above 10 mbd.

Figure 3. Changing relation between Chinese production, internal demand and thus necessary imports. (Energy Export Databrowser)

The other country where demand can clearly be seen to increase is India. The recent flattening of demand is likely to prove only transient, given the policies of the new government.

Figure 4. Changing relation between Indian production, internal demand and thus necessary imports. (Energy Export Databrowser)

The Indian economy has been growing at around 7% a year since 2000 and the EIA anticipates that by 2020 it will become the world’s largest oil importer, even though overall demand will not surpass China’s – which is anticipated to rise to 15.7 mbd by 2025. Although a primary focus for the new government is to give every household at least one light bulb by 2019, a significant portion of this will come from solar power. This is particularly necessary in rural areas where there is poor to no grid service. However experience in Botswana would suggest that this policy can be more difficult to achieve and sustain, given the difficulty in getting adequate maintenance outside of the cities. The Energy and Resources Institute anticipates that growth will exceed 8%. (It should be noted that the Director-General of TERI is R K Pachauri – better known for his role at the IPCC). It might further be noted that while he was still Chief Minister in Gujarat before the election, the new Indian Prime Minister had raised the GDP of that state to an average of 13.4% in comparison with the national rate of 7.8%.

To a degree this problem of imbalance in the supply:demand situation that will develop in the next couple of years will be rectified by a change in the price structure of oil. Tightening of supply against even current levels of supply (let alone that needed to meet the July 2014 OPEC MOMR estimate of a continued growth in demand of the order of 1.16 mbd) will lead to an increase in price. It is that cost increase that will most likely impact countries such as India, who have, in the past, been bid out of a number of foreign oil investments by China, and who are likely to see that situation continue, of not get worse.

The presumption that Russia will be able to help China by exporting more oil East, while sustaining its exports to the West, is likely an unrealistic projection. Russia is already seeing their overall export levels decline, even before production itself significantly falls off, and the combination will tighten the market in the near future.

Figure 5. Changing relation between Russian production, internal demand and thus exports. (Energy Export Databrowser)

China is currently seeing an ongoing internal fight over the China National Petroleum Corporation (CNPC). Jiang Jiemin has been arrested and the investigation is progressing down his chain of command and influence.

CNPC is one of the world’s largest companies, with global operations and 2013 revenue of $432 billion. Its publicly listed subsidiary, PetroChina, trades in Hong Kong, Shanghai and New York and is the world’s fourth-biggest oil producer by market capitalization. Jiang ran both the parent and PetroChina from 2007 until last year, when he briefly headed the State-Owned Assets Supervision and Administration Commission (SASAC).

The investigation has already touched CNPC group operations in Canada, Indonesia, China and Turkmenistan, say people familiar with the proceedings. In addition to Jiang, the Chinese authorities have confirmed the arrests of CNPC vice president Wang Yongchun, PetroChina vice presidents Li Hualin and Ran Xinquan, and the listed unit’s chief geologist, Wang Daofu.

The arrests and investigations will likely slow the rate of Chinese investment in the foreign energy market, but is not likely to have any impact on internal energy consumption. Rather it may make it more difficult for China to sustain their necessary supply of oil as times become more troubled.

An increase in the price of oil, just as the links to foreign suppliers become questioned through this internal investigation that may spread beyond China, may weaken those links and give countries such as India an opportunity to achieve supplies that might otherwise be more difficult to achieve.

Bit Tooth Energy by Heading Out

31 Comments on "Tech Talk – Changes in global supply and demand"

rockman on Mon, 28th Jul 2014 6:44 am

“…there are three components to the coming Energy Mess.” The “COMING mess”? That’s so cute. And there I thought oil prices increasing 300% and US spending trillions of $’s/thousands of lives protecting ME oil exports as well as the hundreds of thousands of foreigners killed due to instabilities in oil exporting regions constituted a “mess”.

Must be great for the author to be in a position that none of these past events means sh*t to him. Unfortunately for hundreds of millions around the world the “mess” began years ago. Just one more example of an attempt to set a “new normal” to lull the public into complacency IMHO.

Makati1 on Mon, 28th Jul 2014 7:55 am

Another “what if…” and “maybe…” article using a lot of words to say nothing of value or import except to take a few digs at China and Russia using assumptions and not facts.

lobodomar on Mon, 28th Jul 2014 8:16 am

Rock, I don’t think the author said past events don’t mean s**t to him, only that it’s about to get much worse.

Regarding relatively recent past geopolitical events, I wonder how stockholders of american “defense” companies feel about their own positions.

Kenz300 on Mon, 28th Jul 2014 9:09 am

Quote — “the coming Energy Mess. The first of these is the steady increase in global demand for oil and its products, the second is the decline in production from existing wells and fields, and the third is the shrinking pool of places from which new oil can be recovered to make up the difference between the first two.”

————

China and India with their billion plus populations are driving the rise in oil demand……………..

As demand continues to outstrip supply the price of oil will continue to rise until demand levels off……….

Cities need to start preparing for a time when walking, riding a bicycle and mass transit become the norm.

Time to diversify our transportation options……..

Heading Out (Dave Summers) on Mon, 28th Jul 2014 9:19 am

Rockman:

All things are relative, but in terms of the events that will develop when the global exports of oil start to shrink the current problems are comparatively small.

And Makati, if you bothered to read the article you would have found that I am comparing predictions with actual events to illustrate the worsening situation, not much maybe in this, rather more of an “oh, dear!’

westexas on Mon, 28th Jul 2014 9:23 am

Re: Available Net Exports (ANE)

The data indicate that Global Net Exports of oil (GNE*) have been below the 2005 rate for seven, and almost certainly eight, straight years, while the developing countries, led by China, have (so far) consumed an increasing share of a post-2005 declining volume of GNE.

The reality we are facing is that given an ongoing decline in GNE, unless the Chindia region CUTS their consumption of GNE at the same rate as the rate of decline in GNE, or at a faster rate, the resulting rate of decline in ANE (the volume of net exports available to importers other than China and India) will exceed the GNE decline rate and the ANE decline rate will accelerate with time, on a year over year bassi. It’s a mathematical certainty.

In my opinion, we are experiencing an almost totally unrecognized, but nevertheless huge, rate of depletion in the remaining cumulative volume of Global Net Exports of oil available to importers other than China and India.

*Top 33 net oil exporters in 2005

Davy on Mon, 28th Jul 2014 10:17 am

I wonder when the point of criticality with GNE is due to hit? We hear about a decline in a few years of “all liquids” production (2017??2020??). If what you are saying is true then forced demand destruction will take charge before production destruction i.e. the geologic decline in all liquids. We would assume any supply decline because of GNE issues is going to drive a price spike at least initially. We also assume this will cause economic disruptions and possibly a financial correction in those importing countries affected. We are then looking at lower demand and lower prices. This lower demand lower prices is the environment production destruction begins as unprofitable production is shut out. This GNE could be our downward spiral initiation.

westexas on Mon, 28th Jul 2014 10:42 am

What has happened is clear. Normalized liquids consumption for China, India, (2005) Top 33 Net Oil Exporters and the US from 2002 to 2012, versus annual Brent crude oil prices:

http://i1095.photobucket.com/albums/i475/westexas/Slide14_zpsb2fe0f1a.jpg

China was up to 204% of 2002 consumption in 2013 (India and the Top 33 also showed increases). The US also showed an increase, up to 96% of the 2002 level, but US consumption remained well below both the 2002 and 2005 levels.

What is less clear is what will happen, and what I call the $64 Trillion question is what happens from 2012 to 2022, and in future years, but it would appear that we continued to slide, in 2013, toward a point in time that we cannot arrive at, i.e., when China & India alone would theoretically consume 100% of GNE.

At the 2005 to 2012 rate of decline in the GNE/CNI Ratio, China and India alone would theoretically consume 100% of GNE in the year 2030, theoretically leaving no net oil exports available to about 155 net importing countries.

In any case, following are the “Net Export Math Facts.”

Given an (inevitable) ongoing decline in production in a net oil exporting country, unless they cut their internal oil consumption at the same rate as, or at a faster rate than, the rate of decline in production, the resulting net export decline rate will exceed the production decline rate and the net export decline rate will accelerate with time, on a year over year basis. It’s a mathematical certainty.

Given an (inevitable) ongoing decline in GNE, unless the Chindia region CUTS their consumption of GNE at the same rate as the rate of decline in GNE, or at a faster rate, the resulting rate of decline in ANE (the volume of net exports available to importers other than China and India) will exceed the GNE decline rate and the ANE decline rate will accelerate with time, on a year over year basis. It’s a mathematical certainty.

shortonoil on Mon, 28th Jul 2014 11:16 am

“The first of these is the steady increase in global demand for oil and its products”

Global demand for oil, and its products is increasing, and will continue to increase. Consumption by the oil exporting nations will also continue to increase. This is not because of the increasing prosperity of the oil producing nations as some seem to indicate. In actuality per capita income of most of the Middle East is going down. It has been for many years. The actual culprit is much more subtle, and it rests in the thermodynamics of petroleum production. The quantity of energy needed to produce energy from petroleum is increasing, and will continue to increase until oil is no longer an extractable commodity.

Between 2012, and 2015 the energy to produce petroleum, and its products will increase by 7.8%. On a 72 mb/d bases that will be equal to an additional 1.83 Gb of petroleum that will be needed by 2015 to produce it. Demand will continue to increase, and exports will continue to decline. The only way to stop this would be to curtail production. The Laws of Nature tell us that no other avenue is available.

http://www.thehillsgroup.org/

Davy on Mon, 28th Jul 2014 11:48 am

Short, some of their increased consumption is from population expansion which is significant in a few of the oil exporters. This is causing increase energy consumption without the corresponding wealth increase. The thermodynamics of production is an important point many don’t consider especially economist.

JuanP on Mon, 28th Jul 2014 1:32 pm

Davy, “is going to drive a price spike at least initially. We also assume this will cause economic disruptions and possibly a financial correction in those importing countries affected.”

Didn’t we have a price spike, in 2008, at least initially, that caused economic disruptions and a financial correction in those importing countries affected, including us here in the USA?;)

I guess the future is like a rerun of the past.

dubya on Mon, 28th Jul 2014 2:03 pm

westtexas, you’re a one-hit-wonder, but what a blockbuster. I wish more than 100 people knew what you were talking about here in Export-Land.

Davy on Mon, 28th Jul 2014 3:47 pm

Juan, my guess is we are entering a stair step period but this period will still have the cyclical economic swings we have seen in the past. I don’t think economic cycles will ever change. If the financial system holds together eventually in a few years the economic system is going to be driven by energy stresses I would imagine. West Tex’s GNE and Shorts thermodynamic losses in energy production are about to come home to roost.

shortonoil on Mon, 28th Jul 2014 5:45 pm

I posted this at Ron site yesterday.

Ron said:

“Seriously, just guessing, and we are all just guessing, but I believe the decline rate the first year after peak will be around 1%, increasing to 1.5 to 2% the second year and increasing a few tenths of a percentage point after that until it hits 3 to 4%. Then all hell will break loose due to high oil prices, or collapsed economies or political insurrection.”

To substantiate your guess here is the computer output from our model using the skewed logistic function that we developed:

Year Total Decline %

2015… 0.97

2016… 1.99

2017… 3.06

2018… 4.20

2019… 5.39

2020… 6.63

2021… 7.91

2022… 9.23

2023… 10.59

2024… 11.99

2025… 13.41

The skewed logistic function, unlike the normal logistic function, gives a long plateau after the peak (a very, very slow decline) which the model shows occurred in 2005 (year end, 2006 start of year).

Our model, because it is an energy based model , considers only conventional crude with 3% condensate. That has probably been the historic average production of condensate from conventional. It also indicates that “all hell will break loose due to high oil prices” around 2020, or at an accumulated decline of about 6 to 7%. Our model, and your guesses give eerily similar projections.

Other factors could hold down oil prices for some time (CB intervention, declining economic activity, and etc.) but when it does eventually break loose, and it has to at some point, the impact will be crushing to the world’s economy.

http://www.thehillsgroup.org/

westexas on Mon, 28th Jul 2014 6:55 pm

Short,

Regarding 3% number for condensate, that’s what I concluded that we saw in Texas, in the early Eighties, comparing the EIA C+C number for Texas versus the RRC crude only number.

Latest annual RRC data put condensate as a percentage of C+C in Texas at about 15% for 2013.

shortonoil on Tue, 29th Jul 2014 9:11 am

“Regarding 3% number for condensate, that’s what I concluded that we saw in Texas, in the early Eighties, comparing the EIA C+C number for Texas versus the RRC crude only number.

Latest annual RRC data put condensate as a percentage of C+C in Texas at about 15% for 2013.”

Like all of the numbers that you publish, I’m sure that’s right; it is probably now about 15%. Because condensate is a very feeble energy source, and our model is an energy model we are using the historic percentage to allow us to compare the present with the past. The additional condensate now being produced is not altering the energy delivery capabilities of petroleum enough to affect the models margin of error. In essence we are ignoring the additional 12%. Condensate production is helping to put barrels into the overall inventory, but it is not doing much to drive the economy.

Thanks for your comment, they are always appreciated, and regarded highly.

http://www.thehillsgroup.org/

Davy on Tue, 29th Jul 2014 9:55 am

Short, the 1.99% figure on your “year decline” figures in 2016 is significant per what the markets can take. This is ominous considering it is 18 – 24 months away. The markets will not be able to discount that kind of contraction in economic energy delivered to the system. I can see hiding a plateau but not a contraction over 1%. 3% figure is catastrophic.

Northwest Resident on Tue, 29th Jul 2014 10:59 am

Davy — So you’re saying that I probably won’t have to eat my hat in 2015?

John on Tue, 29th Jul 2014 11:38 am

Davy, I don’t understand why a 3% contraction will be catastrophic. I refuse to believe that governments and central banks will allow a situation where fossil fuels will go untapped. They’ll just make up the rules as they go along. So I tend to dismiss the concept that oil extraction will stop due to economic constraints. Human needs will trump all financial considerations. The reduction in fossil fuels will be awful, but I seriously doubt the initial decline phase will bring catastrophe. By the way, thanks for all the commentary. I’m following along carefully.

Northwest Resident on Tue, 29th Jul 2014 11:49 am

John — A 3% contraction would be very difficult to hide, as Davy mentions. I’m sure you are aware of the fact that the shale oil business is highly dependent on massive infusions of investment. I read a couple of articles already this morning, and many others, that point out how dependent shale oil extraction is on QE, ZIRP and massive investment. What will investors do when they clearly see that the economy is contracting? Will they continue to be fooled by government and industry propaganda that paints the “all is well” picture of our energy situation, or will they be shocked into reality? That’s the question. The global economy is held together today by lies and illusion and constant streams of propaganda. When investor confidence vanishes, the global economy will not hold together. What investor is going to keep his money invested when he clearly sees that it is a losing proposition? If we get hit with a 3% contraction, look for investors to withdraw their money from the stock market and re-invest in doomer/prepper supplies — until the market collapses.

JuanP on Tue, 29th Jul 2014 11:56 am

Davy. We agree that we will cycle down until at some point the system breaks down ending BAU and resetting at a lower complexity level. And that whole process could repeat itself, too, ending with cycles within cycles all the way down to much lower complexity. Life will be about water, food, shelter, etc.

JuanP on Tue, 29th Jul 2014 12:11 pm

Davy “Short, the 1.99% figure on your “year decline” figures in 2016 is significant per what the markets can take. This is ominous considering it is 18 – 24 months away. The markets will not be able to discount that kind of contraction in economic energy delivered to the system. I can see hiding a plateau but not a contraction over 1%. 3% figure is catastrophic.”

The way I understood short’s comment was that 2% and 3% were the cumulative declines since 2005, the moment of the peak. The yearly decline in 2016, being 1.02, since the total decline since 2005 in 2015 was 0.97 and in 2016 being 1.99. This calculation is not totally exact from a mathematical point of view, but accurate enough to be of use.

JuanP on Tue, 29th Jul 2014 12:12 pm

Davy. Did I misunderstand your comment?

Davy on Tue, 29th Jul 2014 1:14 pm

Glad, someone is watching my back, apparently skimming again. Thanks for the correction Juan.

Davy on Tue, 29th Jul 2014 1:18 pm

John, I feel the systematic risk to the system will be at a breaking point when the 1% point is breached with 3% catastrophic. This is strictly theory because we are in uncharted waters. Speaking of waters on Lake Michigan now.

JuanP on Tue, 29th Jul 2014 1:32 pm

Davy. It was a tricky one. It fooled me, too, on my first pass. It was only reading your comments and going back that I eventually got it. Team work!

JuanP on Tue, 29th Jul 2014 1:38 pm

I don’t see a continued contraction as sustainable for an economic system that requires growth for its survival. Whether it is 1% or 3%, after a few years, the system would have to reset at a lower level.

John on Tue, 29th Jul 2014 3:04 pm

If I were king, I’d propose the way to keep people invested in markets once contraction begins is for central banks to continue adding money into the system, inducing inflation and rewarding those who continue investing. Make the person who goes all cash pay the price with a declining value for each dollar. I believe this is already happening, by the way.

Davy on Tue, 29th Jul 2014 3:53 pm

John, sooner or latter the Law of thermodynamics will dominate events. We can pretend all is well now but once the bumpy plateau is over our economy can do nothing but ride the energy gradient down per the laws of thermodynamics. What I am saying is even if you were King, Nature is still your God.

John on Tue, 29th Jul 2014 5:29 pm

Nature has always been my God, good Sir!

Davy on Tue, 29th Jul 2014 6:21 pm

John, only meant that as an analogy nothing personal friend.