Page added on July 28, 2016

So Much For Peak Oil Demand

No matter how often it happens, I never cease to be amazed when someone casually cites weak or falling demand for oil as a reason to avoid the oil and gas sector. Just last week I engaged with someone who wrote “the face of flat to lower demand…has a profound long term spoiler effect for fossil fuels” and that “it will be the emergence of a totally new technology that will crush fossil fuels.”

Let’s address the second argument first.

I closely follow new technology developments that might impact oil and natural gas demand. So, should a totally new technology appear that does reduce demand for fossil fuels, you will hear about it here long before it becomes mainstream news. In that case we would definitely make some major changes to The Energy Strategist portfolios.

I can tell you that someone is always claiming a breakthrough that will put an end to our ever-growing consumption of crude oil, but those claims invariably fall apart under scrutiny. Generally it isn’t the technology that’s the problem, it is executing that technology in a way that is at least remotely cost-competitive with oil. For historical examples, see my 2012 article Investors Beware of Fuel from Thin Air or Audi’s Audacious Fib from 2015. Both of these claims garnered tremendous media hype, but I explain in the articles why they aren’t economically viable routes to cost-competitive fuel.

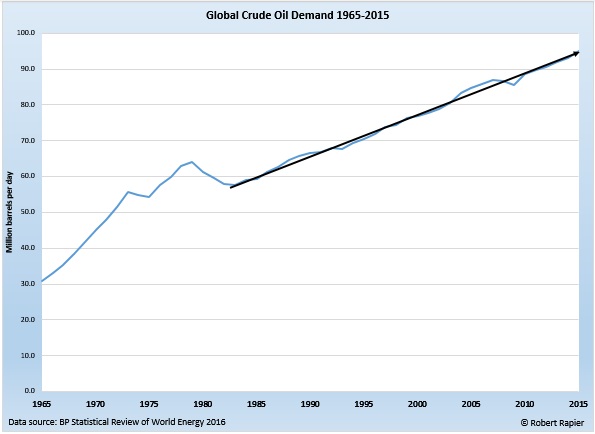

Of course if you are invested in oil companies, you certainly want to be on the lookout for signs of softening demand. Let’s start by looking at the data. In the 32 years since 1984, global crude oil demand has increased by 36 million barrels per day (bpd) – an average annual increase of 1.1 million bpd per year:

Year-over-year crude oil demand declined in only 3 of those 32 years, and in each case bounced back to the historical growth rate very quickly. Further, the average annual increase since 2010 has been well above the historical average at more than 1.5 million bpd per year.

When I point this out to people who had suggested that oil demand is flat or falling, they will often pivot to the notion that it won’t be long before electric vehicles (EVs), alternative fuels, and higher fuel efficiency standards take a big bite out of oil consumption. In recent articles that I wrote for Forbes, I provided two examples that are contrary to this narrative.

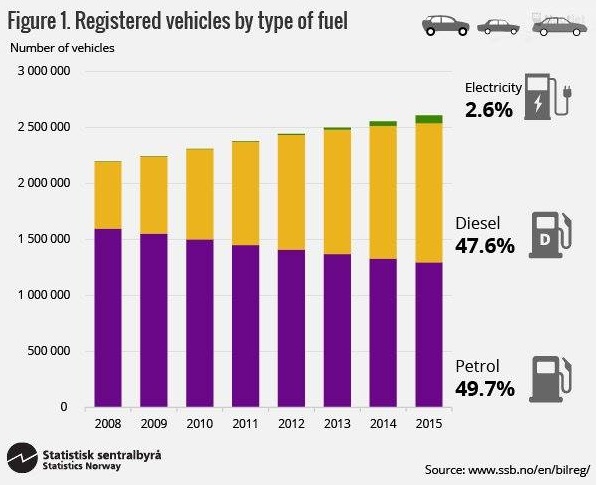

In the first article, I discussed Norway’s experience with EVs. Following years of very generous subsidies for EVs, Norway has the largest fleet of plug-in EVs per capita in the world. Norway’s growth rate for EVs has also been higher than that of any other country, averaging 110% per year for the past seven years.

One would expect then a decline in Norway’s oil consumption. After all, Norway is surrounded by members of the European Union (EU), where demand for oil since 2008 is down 14% (primarily in response to much higher oil prices). Nearby countries like Denmark (-14%), Sweden (-16%), and Finland (-21%) all had big declines.

But Norway’s oil consumption actually rose during that time:

The huge growth in electric vehicles didn’t translate into a reduction in demand in Norway, because it is set against a backdrop of a rising population and growing fleet of vehicles on the roads (as is the case worldwide). Seven years of triple-digit growth for EVs haven’t been enough to dampen demand for oil.

But how about in the U.S.? At least we know demand in the U.S. is down, right?

I addressed that in another article: U.S. Gasoline Demand Reaches Record Levels. Several years ago gasoline demand in the U.S. did fall as a result of much higher oil prices and the 2008-9 recession stemming from the housing bust. This led some pundits to suggest that U.S. gasoline demand had peaked. After all, the U.S. has also seen big improvements in fuel efficiency of new vehicles sold, an explosion of biofuel production and impressive growth as well for EVs.

But low fuel prices have a tendency to cause people to drive more. Thus, gasoline demand has bounced back, with the first six months of 2016 setting a record for gasoline consumption in the U.S. The Energy Information Administration (EIA) is now projecting that the full year will result in the highest ever gasoline consumption for the U.S. as well.

So much for peak demand.

Don’t get me wrong. It’s not that I am unwilling to consider the possibility of an impending and inevitable decline in crude oil demand. It’s just that this view isn’t supported by the historical evidence or recent developments, and I can’t make a case that something will change here in the next decade. And at the end of the day I base my opinions on evidence, not hope or wishful thinking.

18 Comments on "So Much For Peak Oil Demand"

Roger on Thu, 28th Jul 2016 8:12 pm

Yes, but concerning yourself with facts is so outdated. Nowadays, they tell us what we want to hear, and we believe it. Anyone not on board … we’ll just launch a personal attack, slander them, and shout them down. Works nearly every time.

alain le gargasson on Thu, 28th Jul 2016 8:25 pm

Don’t forget the physical principles and thermodynamics: “You can not create or destroy energy” or Lavoisier: “nothing is created, nothing is lost, everything is transformed “;

All the energy we consume are derived from primary energy present in our planet such as nuclear, geothermal and sun (light and heat) combined with our atmosphere (rain and wind) provided the ancient biomass (coal, oil and gas), current (our food and for ours domestics animals), acting in the sea (currents, waves and tides). Hydrogen and electricity are not natives, are chemical transformations or comes from mechanical energy and heat.

There is no new energy, we have used all those possibles. All things and objects that humanity use are nothing more than transformation of raw materials. You can’t create an electron, a molecule, iron ore, copper etc .. nothing.

“Who believes that growth can be infinite in a finite world is either a madman or an economist.” Kenneth Boulding (1910-1993), president of the American Economic Association.

A French Friend

Boat on Thu, 28th Jul 2016 8:49 pm

What happened with coal will happen to FF. This is a pretty solid prediction considering wind dropped over 60 percent in price in a few years. Solar prices are dropping price at a rapid clip also. In the US wind and solar already capture most of new market demand.

So the past is easy to predict but the future not much harder considering the data. That new battery plant is so big you can place 107 football fields inside it. Don’t bet against electric cars yet.

DMyers on Thu, 28th Jul 2016 9:27 pm

The problem here, Boat, is that one functional battery takes one football field. This creates problems on our four lane highway systems. And it means they can only produce 107 batteries at a time.

dave thompson on Thu, 28th Jul 2016 9:46 pm

There is nothing and I mean nothing, that will replace the energy density, versatility, power and convenience of FF crude oil for our transportation needs in this industrial civilization, period, end of story. I dare any one on this site to name what it is. You can not, transportation with FF has no replacement when it comes to FF energy inputs.

Stabilizer on Thu, 28th Jul 2016 10:31 pm

I can make two predictions about oil price with my crystal ball that are beyond argument.

I predict – if demand outstrips supply, prices will rise.

I predict – if supply outstrips demand, prices will fall.

Anonymous on Fri, 29th Jul 2016 1:28 am

Musks ‘gigafactory’ will never get built. But keep telling yourself it will. Anymore than his hyperloop or colonies on Mars will. Musk does not have the money, or even a market for his non-existent factory to fill. Of course, you are hardly the sharpest knife around here, and the fact that you think musk’s batteries, to go in those as-yet-nonexistent EV’s will turn things around for your corrupt and decadent amero-zionist empire just proves that.

I used to believe such nonsense too, back when, but my life more than 1/2 over and ‘tech’, no matter how defined, has not, and IS not, coming to rescue your empire, or anyone else’s. Best learn to deal with that. Beats pining for gig-battery factories in the desert that don’t exist.

makati1 on Fri, 29th Jul 2016 3:49 am

Here’s a few old commercials for Boat:

Remember TWA? I do.

https://www.youtube.com/watch?v=YLFeqsCaeJ4

or Pan Am? I do.

https://www.youtube.com/watch?v=c6uLqbGJPa8

What happened to comfort and convenience? Or even reasonable prices?

Answer: They died when the Us started it’s downward spiral in the 70s. Both are doomed to crash soon.

Those meals were yummy … then. Now? Well, the pigs on the farm might like them. Of the last 50 airline meals I have had, only one was what I might pay for in a restaurant or eat at home. And, yes, I have flown in over 60 flights in the last 10 years. I have seen the deterioration of US airlines personally. BTW: My first commercial flight was ~50 years ago.

Jim on Fri, 29th Jul 2016 4:01 am

The “Crude Oil” demand chart appears to be total petroleum liquids or total liquids, not actual crude oil, most commonly defined as 45 API Gravity or lower crude oil.

Boat on Fri, 29th Jul 2016 9:40 am

Jim on Fri, 29th Jul 2016 4:01 am

Since heavy conventional crude is worth less than tight and shale oil that argument is dead.

Jim on Fri, 29th Jul 2016 9:49 am

The argument–actually a statement of fact–is that total liquids and/or total petroleum liquids do not constitute crude oil.

Boat on Fri, 29th Jul 2016 10:22 am

Refineries pay for all oil regardless of the name by api.

https://www.eia.gov/todayinenergy/detail.cfm?id=26132

As you can see most liquids and/or total petroleum liquids is about 20 percent of US production.

Here is chart showing api by price.

http://www.phillips66.com/EN/products/business/crude_oil/gravityscale/Pages/index.aspx

Venezuela oil with an api of 18-19 gets docked much more in price than tight/shale oil. The label “conventional” is outdated and irevelent.

GregT on Fri, 29th Jul 2016 10:23 am

“Since heavy conventional crude is worth less than tight and shale oil that argument is dead.”

Conventional crude is not worth less Boat. Tight and shale oils in general, cost more to produce. It is the affordability of the oil, and the energy available to our economies that matter. The higher cost to produce ‘oils’ are not affordable to our economies, and the producers cannot turn a profit with much of it at current prices.

The world’s economies cannot recover from the global financial crisis with higher cost to produce energy. The era of abundant cheap oil has come to a close. Economies will continue on their downward trends, and at some point in the not so distant future, they will collapse in on themselves. Hilary will in all likelihood be the last POTUS.

Boat on Fri, 29th Jul 2016 11:24 am

Greggiet,

The refineries don’t care where the oil comes from. They care about price. This is why shale/tight oil is on the decline and middle east oil production is on the rise. If the wars in the middle east had not happened oil wouldn’t have had the big jump in price that spawned tight oil.

While your right about about transportation expense being higher and retarding some growth, nat gas and renewables over time have stabilized the cost of electricity. Nat gas around the world is much cheaper now. Where it’s windy, wind now beats nat gas and coal.

http://www.slate.com/blogs/moneybox/2015/05/21/oil_use_in_transportation_this_chart_shows_how_it_s_losing_ground.html

This chart shows the effect of efficiency and tech in transporation.

GregT on Fri, 29th Jul 2016 12:54 pm

Electricity is not a liquid fuel Boat, and does not do for us what oil and petrochemicals do in modern industrial society. Electric power generation is a byproduct of burning fossil fuels, and those same said fossil fuels and all of their byproducts are causing irreversible damage to the Earth’s natural ecosystems.

Keep playing the idiot Boat. Your attitude and others like your’s, are causing doom for not only your own future, but the future of our species, and all other species of life on this planet.

And Boat, it’s “you’re right”, not “your right”. Learn some basic english grammar if you ever expect anybody to take anything that you say seriously. Fucking moron.

Boat on Sat, 30th Jul 2016 9:30 am

greggiet,

You’re the one saying the world will collapse due to higher energy prices. I was pointing out that electricity is over 60 percent of btu production and pricing is stabilizing to dropping.

Oil is still critical but a dropping percentage of btu growth.

I realize this type of conversion is over your head but if others are kind to you, they might explain the impact to you.

Bob on Sat, 30th Jul 2016 5:16 pm

GregT,

It’s English, not english and yours not your’s.

Make these changes and maybe people will take your grammatical suggestions seriously next time.

Boat on Sat, 30th Jul 2016 5:46 pm

greggiet,

This is about the 4th time we’ve rode this merry go round. My carbon footprint is much smaller than yours and your family. Seems like your ideology has damaged your memory. This memory problem is wide spread amongst the doomer community.