Page added on January 14, 2017

Oil – Past, Present, And Future King Of Energy

Summary

Several articles on Seeking Alpha have recently proclaimed the imminent decline of oil – I disagree.

Oil demand is strong and will continue to grow.

Numerous research groups agree, oil demand will grow, not decline.

Being an avid student of energy and an energy investor, I spend a great deal of time reading and studying energy trends. It is a subject I find interesting, which is why I take time to keep up-to-date by reading books, articles and reports on the subject. That is why I have found it interesting that several articles and comments on Seeking Alpha have proclaimed the end of oil in the near future. That is a thesis I do not believe in and will try to argue against in this article.

The problem I have with these articles is that they usually provide no real hard evidence to back up their claim. The majority of the writers proclaim the rapid rise in electric vehicles will bring about the end of oil. I disagree with that premise and hopefully, will provide compelling evidence to back up my claim that oil has decades left as the leading source of energy.

Where We Are

Before we look at where we are headed, let’s look at where we are. Oil and gasoline use have clearly been on a steady upward climb.

After a brief decline in demand in 2008/2009, related to the financial crisis, world oil demand has steadily increased from 90.58 million barrels a day (mb/d) in the first quarter of 2013, to 97.05 mb/d in the third quarter of 2016. The IEA forecasts demand growth in 2017 of 1.3 mb/d, which would put demand at over 98 mb/d. That is a growth rate of approximately 1.5% to 2% a year.

Gasoline demand is also on the rise everywhere. In August of this year, Americans used 9.7 mb/d of gasoline, the most ever. In India, the “nation’s gasoline consumption reached a record in August, surging 25 percent from a year earlier, while demand for diesel rose 13 percent, the fastest pace since March.” Virendra Chauhan, an oil analyst at Singapore-based consulting firm Energy Aspects Ltd., expects India’s oil demand to grow by 0.4 million barrels a day this year and by 0.2-0.3 million barrels a day next year. In China, the “National Reform and Development Commission on Aug. 26 said China’s gasoline consumption in July increased 5.8% year on year.” I do not have final figures for 2016, but in 2015, world gasoline demand grew by 3.3%.

I mention the statistics above, because it is important to understand that oil and gasoline demand are currently growing and as of right now, there is no evidence to indicate this will stop in the near future.

The Studies

I like to think that I am a pragmatist, I see what is occurring around me and react accordingly. If I saw gasoline demand falling and/or oil demand falling, I would accept that. But, the reality is, I do not. In addition, there are number of research studies that have looked at the future of energy and come to the same conclusion, oil will remain the dominant energy source for decades. To be clear, oil’s percentage of overall energy does decline, but oil demand grows. That occurs, because total world energy demand grows. Let’s take a look at each of these studies.

International Energy Agency – The IEA website states that the “IEA has four main areas of focus: energy security, economic development, environmental awareness and engagement worldwide.” They are not an oil industry group and in fact, are aggressively pushing forth a green energy agenda. Every year, the IEA publishes their “World Energy Outlook” which attempts to forecast world energy demand into the future. This year’s report was published in November and made the following forecasts:

Global oil demand continues to grow until 2040, mostly because of the lack of easy alternatives to oil in road freight, aviation and petrochemicals… In our main scenario, a 30% rise in global energy demand to 2040 means an increase in consumption for all modern fuels… Growth in oil demand slows over the projection period, but tops 103 million barrels per day by 2040.

The report adds that renewables will be the fastest growing sector of energy, a fact I do not disagree with.

Energy Information Agency – The EIA publishes a yearly International Energy Outlook, the 2016 outlook was released in May. In the IEO2016 Reference case, total world energy consumption rises from 549 quadrillion Btu in 2012 to 815 quadrillion Btu in 2040, an increase of 48%. Here are some excerpts from the report:

Most of the world’s energy growth will occur in the non-OECD nations, where relatively strong, long-term economic growth drives increasing demand for energy... The IEO2016 Reference case projects increased world consumption of marketed energy from all fuel sources through 2040… In the International Energy Outlook 2016 (IEO2016) Reference case, worldwide consumption of petroleum and other liquid fuels increases from 90 million barrels per day (mb/d) in 2012 to 100 million b/d in 2020 and 121 million b/d in 2040.

It should be noted, that “other liquid fuels” includes condensate and Natural Gas Liquids. However, the majority of the 121 mb/d is oil. The EIA, similar to the IEA, forecasts renewables will be the fastest growing sector of energy.

BP (NYSE:BP) – BP publishes a yearly Energy Outlook to 2035, which attempts to forecast the most likely scenario for future energy demand based on assumptions about future changes in policy, technology and the economy. This simple statement from the 2016 report, summarizes their findings:

Fossil fuels remain the dominant form of energy powering the global expansion: providing around 60% of the additional energy and accounting for almost 80% of total energy supplies in 2035. Renewables grow rapidly, almost quadrupling by 2035 and supplying a third of the growth in power generation.

And more specifically:

Oil demand increases by almost 20 mb/d over the Outlook, with growing use in Asia for both transport and industry… All of this increased demand comes from emerging economies, with China and India accounting for over half of the increase. In contrast, oil consumption in OECD economies continues its secular decline (-5 mb/d).

BP sees total energy demand rising 33%. Like the other reports, BP sees renewables growing rapidly, predominantly in the power generation area.

Exxon (NYSE:XOM) – Exxon, similarly to BP, publishes an annual Outlook to 2040 energy forecast. In the report, Exxon forecast global energy demand will rise 25%. Oil share of that energy demand will be 32%. If you look at the tables in the report, you will see that Exxon forecasts oil demand to grow 18% from 2015 to 2040. I know Exxon is an oil company, so it should be interesting to some, that Exxon forecasts renewables to grow 179%

MIT – Not sure how many people are familiar with the Massachusetts Institute of Technology’s Energy and Climate Outlook, but it is a very in-depth look at energy and climate change. In their 2015 report, MIT forecasts that “through 2050, fossil fuels account for about 75% of primary energy, despite rapid growth in renewables and nuclear (in part because the natural gas share of primary energy also increases).” To complicate things, MIT measures every energy category in exajoules, so bear with me. For oil, MIT shows demand growing from 182.6 EJ in 2015 to 227.9 EJ in 2040, which is growth of approximately 24%.

OPEC – OPEC publishes an annual World Oil Outlook which forecasts near-term and long-term oil demand. This year’s report, projects world oil demand will be 109 mb/d in 2040. That figure was trimmed from last year due to growth in electric vehicles.

The above reports, which varies in sources, all show very similar projections. Oil consumption will continue to grow, albeit, at a slow pace, and will continue to be the largest source of energy. The reports are also in general agreement, that renewables will grow rapidly from a low base, and overall world energy demand will grow anywhere from 25% to 40%. None of the forecasts envisions declining oil demand.

What Propels the Continued Growth in Oil

Population Growth – The more the earth’s population grows, the more energy, including oil, gets used. If there is one thing all scientist agree on, the world population is growing. The world population is currently estimated at 7.4 billion, by 2050 it is estimated the world’s population will be over 9 billion. Much of this growth will be in developing countries, the more these countries grow, the more energy will be used.

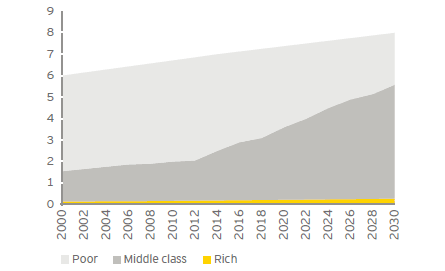

Rise of the Middle Class – As more people escape poverty, the demand for energy and oil will grow. Whether it is someone finally being able to afford a motorcycle, or someone being able to cook using a small stove, rather than wood, energy use rises as poverty is escaped.

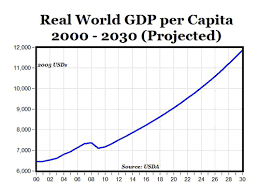

Over the next two decades, it is speculated over 3-billion people will enter middle class. As these people enter middle class, they will demand the same products and comforts that people currently in the middle class have. Three billion people wanting transportation, heating, cooling, etc. makes a big demand on energy, some of which will be powered by oil products. The world’s GDP will double from 2015 to 2040, with emerging countries GDP increasing 175 percent and developed countries GDP growing 60 percent.

The charts below, show the expected rise in world population and the rise in the world GDP, caused by expansion of the world’s middle class.

Transportation – The vast majority of oil’s use is in the transportation sector and as you can imagine, with the world’s population growing and the middle class expanding, the transportation sector will also grow.

Boeing forecasts that over the next 20-years, passenger air travel will grow 4.8% per year and cargo air travel at 4.2%. Forbes proclaimed that “air travel worldwide is likely to double over the next two decades, driven by factors such as low air fares, higher living standards, and an expected recovery in the world gross domestic production.” Airplanes are becoming more efficient, but the rapid growth in air travel will demand more fuel. Platts forecasts jet fuel demand will grow by 3% annually led by China which will see 10% annual growth in jet fuel demand.

World automobile growth will be staggering over the next several decades. According to Worldometers, the world’s automobile count is expected to almost double from the approximately 1.2-billion mark today to 2-billion automobiles by 2035.

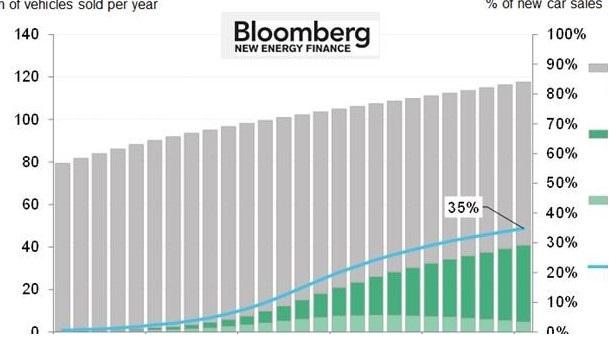

Many people would state that the majority of those cars will be electric, but that is not the case. Bloomberg projects the percentage of electric vehicles will be 35% in 2040. IHS Markit, projects electric vehicles will make up 15% to 35% of world market sales in 2040. I did not find any study that projected electric vehicles will eliminate gasoline powered vehicles, or even project electric vehicles will be the largest percentage of vehicles on the road in the future.

So how much oil would be saved by the wide spread adoption of electric cars. Not much according to the Union of Concerned Scientist. They state that “widespread adoption of electric cars and trucks could save 1.5 million barrels of oil a day by 2035.”

You might wonder, how could the wide spread adoption of electric vehicles result in only 1.5 mb/d savings in oil. The math tells the story. Currently, there are approximately 1.2-billion cars on the road. The majority are gasoline powered, so let’s say, 1.1-billion are currently gasoline powered. In 2035, there will be 2-billion cars on the road, if 35% are electric vehicles, that means, 1.3-billion will still be gasoline powered. Electric vehicles will have grown, but the fact remains, 1.3-billion will still be gasoline powered. That is a higher number of gasoline powered cars than there are now.

I find the chart below interesting, in that it tells the electric vehicle story perfectly. The chart shows the expected growth of electric vehicles from 2015 to 2040. As you can see, electric vehicles grow rapidly from a low starting point in 2015 to almost 40-million vehicles in 2040. However, gasoline vehicle sales that number just under 80-million in 2015, still number approximately 80-million in 2040.

Transportation fuels used for air travel, automobile travel, heavy duty trucks, railroads, shipping, and heavy duty construction equipment will continue to grow for decades to come.

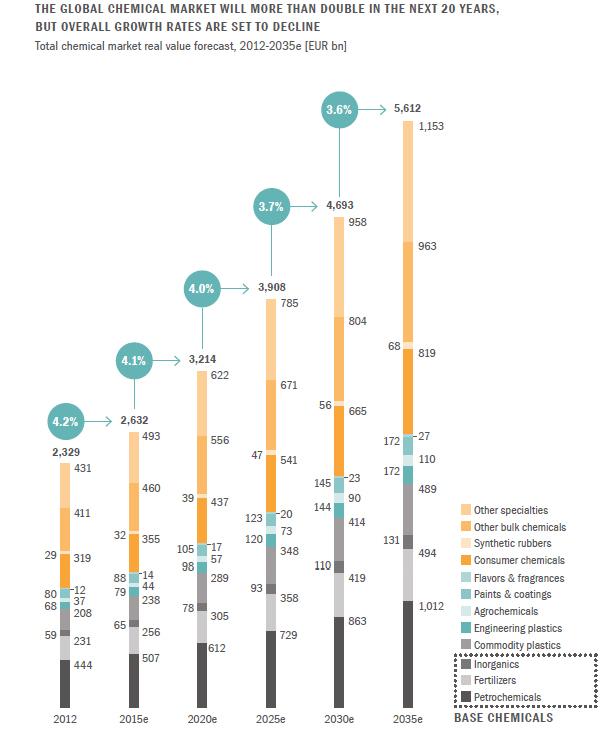

Chemicals – The demand for chemicals throughout the world is expected to grow rapidly over the the next several decades. The global demand for chemicals grew from around 100 million metric tons to 150 million metric tons between 2000 and 2010, and is expected to surpass 200 million metric tons by the end of this decade, growing at a pace faster than the global GDP. Speaking at a Singapore chemical plant, former Exxon Mobil CEO Rex Tillerson stated that “global chemical demand will grow at a faster pace than GDP as people seek higher standards of living and purchase more household and packaged goods manufactured with chemical products.”

The chart below shows the expected growth in chemicals, many, not all, of these products require oil. As chemical use grows, so will the demand for oil.

Investing in Oil Stocks – I hope I have provided enough compelling evidence to convince you, oil as a needed and valued commodity is not going away anytime soon. If you believe as I do, that oil will be an important commodity for decades to come, then an investment in a oil company stock would make sense.

Before you invest, you should be aware that oil is a commodity and the stock will fluctuate with the commodity price cycle. For as long as there has been oil, there has been boom and bust cycles, and that continues today. As such, I think an oil company investment should be a part of a diversified portfolio, not an all-in bet.

An investor should wait for a period of low commodity prices and then take a position in a company of their choosing. I own Exxon Mobil and have owned it for years. I first bought XOM in October 2008. Oil had started the year well over $100 a barrel and fell to under $50 a barrel. As you can imagine, the large oil company stocks fell sharply and I purchased a large position in XOM at $67.66 a share. I have held the stock ever since and have added whenever the stock fell back close to that price.

Had I bought XOM when the price of oil was over $100, I would today, likely be sitting on a loss. So I cannot emphasis enough, knowing the commodity price cycle is important.

I own XOM, but an investment in Chevron (NYSE:CVX), Royal Dutch Shell (NYSE:RDS.A), Conoco Philips (NYSE:COP), or BP would be fine as well. I like to collect rising dividends, as it makes the stock easier to hold when it goes through one of it’s price fluctuations. I selected XOM, because it is diversified with a large natural gas operation, refining plants and a large chemical division.

If you are less interested in dividends, I would recommend EOG Resources (NYSE:EOG) as it is, in my opinion, the best shale operator in the United States. Be aware, that a shale company like EOG will fluctuate in price much more than an integrated company like XOM, as it much more levered to the price of oil.

Conclusion – The world is very large and getting larger every day. The demand for products by the world’s population grows larger every day. This growth will require all energy sources to meet the growing demand. Renewables will play a growing role in meeting the demand, but oil, as it always has, will remain the king of energy.

Disclosure:I am/we are long XOM.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

13 Comments on "Oil – Past, Present, And Future King Of Energy"

aidan on Sat, 14th Jan 2017 10:36 am

CONCLUSION (above); “the world is very large and getting larger every day”. Oh no it isn’t! – in fact that is the whole problem which makes such ‘endless growth’ nonsense, well…..nonsense.

rockman on Sat, 14th Jan 2017 10:48 am

“…the world is very large and getting larger every day”. Oh no it isn’t!” So your argument is that global population IS NOT increasing? Care to offer some links to support that assertion?

Duane on Sat, 14th Jan 2017 1:00 pm

Infinite growth on a finite planet is not possible. At some point the oil runs out no matterthe demand.

Sissyfuss on Sat, 14th Jan 2017 1:03 pm

Tell me you didn’t co-write this article Rockamundo and I won’t believe you.

R1verat on Sat, 14th Jan 2017 1:37 pm

Right on Duane! This is an unrealistic article that assumes continued growth, unlimited oil & a population that will be unaffected by climate change.

GregT on Sat, 14th Jan 2017 2:02 pm

“Infinite growth on a finite planet is not possible.”

It really does not get any simpler to understand, does it. Which begs the question; What the hell is wrong with the human race?

Apneaman on Sat, 14th Jan 2017 2:12 pm

Any species, including the humans, that gets in the way of the cancer’s growth will be dealt with accordingly.

Nearly 70,000 birds killed in New York in attempt to clear safer path for planes

Bird-killing programs at airports ramped up in response to 2009 accident when jetliner was forced to land in Hudson river after birds were sucked into engine

https://www.theguardian.com/world/2017/jan/14/new-york-birds-killed-airport-miracle-on-hudson-sully

R1verat on Sat, 14th Jan 2017 2:15 pm

GregT I would love to know the answer to this myself! You would think that, considering the repercussions of being wrong (NTHE), that there would be some kind of urgency in addressing this issue.

With that said, there is a vein of thought that we are already screwed because of a 40 yr lag in emissions impact to the environ. That regardless of what is done, it is too late to affect the dire outcome.

I suspect human greed has alot to do with this!

GregT on Sat, 14th Jan 2017 2:30 pm

That was a rhetorical question R1verat.

I would opine that human greed has everything to do with it.

Apneaman on Sat, 14th Jan 2017 2:52 pm

Greg, what is greed? Are not all living things grasping, consuming and reproducing to the best of their evolutionary abilities?

“Open-ended growth appears to be inherent in nature, all the way from the DNA to the arthropods to mammals, including humans. Open-ended growth is the psychology of a cancer cell. I am not sure I know of a species which has learnt how to limit its own growth. Unfortunately species which transcend their environmental resources can hardly survive – the final arbiter of the climate impasse will be nature itself.”

~ Andrew Glikson, Earth and paleo-climate scientist, Australian National University”

https://theconversation.com/what-can-nietzsche-tell-us-about-the-paris-conference-51236#comment_842655

rockman on Sat, 14th Jan 2017 9:47 pm

“Tell me you didn’t co-write this article Rockamundo” The Rockman invest in an oil company stock??? That’s crazy talk. Seriously. LOL.

Boat on Sun, 15th Jan 2017 1:13 pm

Ape,

Even a doomer skeptic like myself understands there will be growing negitive costs in economies from climate change. What’s your best chart going out to 2050. Will it show projected damage in any particular area. When do humans start dying off. Peak population perjections. Give me some rubber hits the road links.

GregT on Sun, 15th Jan 2017 2:45 pm

“When do humans start dying off.”

Humans are already dying off due to climate change Boat, and the mass migrations have already begun. Economies are also already being affected by climate change, as you should well know living in the Houston area. No links necessary, if one chooses not to be ignorant of ones surroundings.