Page added on September 10, 2015

Iran Gets Ready to Sell to the World

Before the most recent round of sanctions went into effect three years ago, Iran was able to sell oil to 21 countries. By mid-2012, that was down to six: China, India, Japan, South Korea, Taiwan, and Turkey. Rather than immediately pull back on production, and risk damaging oil wells by slowing them down, Iran decided to store its excess crude. As it scrambled to build onshore tanks, the government loaded millions of barrels onto its suddenly out-of-work fleet of crude-carrying vessels.

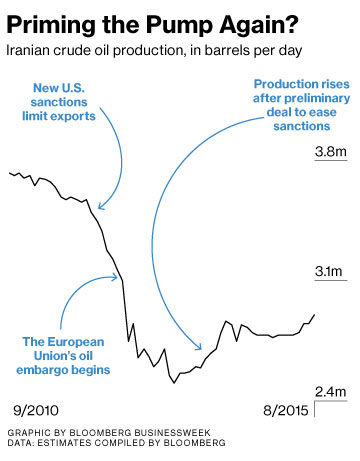

The Iranians eventually reduced their oil output by about a third, to a low of 2.5 million barrels a day in mid-2013, according to data compiled by Bloomberg. As exports fell to 1 million to 1.5 million barrels a day, Iran kept filling its tankers with oil it couldn’t sell. By this summer, a large portion of its tanker fleet, one of the world’s biggest, sat parked off the coast, filled with 50 million to 60 million barrels of crude and condensate, a lighter form of oil used to make petrochemicals.

Since the nuclear agreement between Iran and six other nations was reached on July 14, the regime has been preparing to ramp up its exports and sell that stored oil. A small number of Iranian tankers believed to have been storing crude has left the Persian Gulf in the past several weeks, according to data compiled by Bloomberg. Three of those ships have since disappeared from detection by failing to report their location.

Iran’s crude output has been rising for two years and now stands at about 2.9 million barrels a day, the highest level since 2012. It won’t be allowed to sell that extra crude until sometime next year, when the International Atomic Energy Agency verifies that Iran has complied with curbs on its nuclear program. The monitoring needed for that to happen probably won’t be in place until January or February, say three Western diplomats familiar with the nuclear monitoring process.

Oil Minister Bijan Namdar Zanganeh says sanctions will be lifted sooner. When they are, he says, production will rise immediately by a half-million barrels per day, and after four to five months, by an additional half-million barrels. He says that by then, “we will reach to a figure between 3.8 and 3.9 million barrels a day.” Saudi Arabia is pumping 10.5 million barrels daily.

Even if Iran can increase production as quickly as Zanganeh claims, it may have to incentivize buyers by offering lower prices or by trading oil for goods or services, says Sara Vakhshouri, president of SVB Energy International, an energy consulting group in Washington. That’s because the Saudis have used long-term contracts to lock in customers who not long ago bought Iranian oil.

The sanctions put in place in 2012 shrank the economy by about 10 percent by March 2014, according to the U.S. Congressional Research Service. A report by Anthony Cordesman of the Center for Strategic & International Studies in Washington estimates that Iran needs about $170 billion to develop its oil and gas potential. The decline in oil prices has led to a drop in Iran’s own investment in its oil and gas sector—from $40 billion in 2011 and 2012 combined to only $6 billion last year, Zanganeh says. The International Energy Agency estimates about half of Iranian production comes from oil fields that are more than 70 years old.

Much of the money Iran has made through its remaining crude exports since 2012 is being held in escrow accounts in the various countries still buying Iranian crude. To reduce Iran’s access to cash, Congress passed a law requiring that Iran spend oil revenue only on goods from its customer countries. The Department of the Treasury estimates Iran will be able to retrieve half that amount, or about $56 billion. That’s still not enough to restart full oil production. And so the government is looking for foreign investment.

Since July, political and business delegations from Austria, Germany, Italy, and Spain have visited Tehran. “I think European companies are very eager to be involved in our projects,” Zanganeh says. Iran has not met with U.S. companies, he says. “It seems they have received the order from the U.S. government not to have the meeting. The doors are open for them like others.”

Some Iran watchers say Western companies will proceed with caution. “You’re not going to see an energy gold rush in terms of capital investment in Iran anytime soon,” says Mark Dubowitz, executive director of the Foundation for Defense of Democracies in Washington and a supporter of tougher sanctions. “The majors are still reluctant to make multibillion-dollar commitments to Iran.”

15 Comments on "Iran Gets Ready to Sell to the World"

Makati1 on Thu, 10th Sep 2015 8:17 pm

OK, so do the math:

Two years, even averaging ~500,000 bbls/day not sold = 350+ million bbls in ‘storage’ at a minimum, not 50 million. The largest oil tanker in the world holds ~3,120,000 bbls.

So, how many super tankers sit off of the Iranian coast? 100+? Even if half of it is stored on shore, that is a lot of tanks and ships. Too many, it seems to me.

Plantagenet on Thu, 10th Sep 2015 9:02 pm

When the sanctions end and Iran increases its oil exports, the current oil glut will get even worse. Some here have claimed that Iran won’t affect the oil glut because it will take years for Iran to ramp up its oil production, but as this article shows Iran already has lots of oil in storage that they can beginning selling as soon as the sanctions are ended.

Cheers!

Boat on Thu, 10th Sep 2015 10:02 pm

Plant,

Lowest price gets the sale. Iran loves capitalism.

meld on Fri, 11th Sep 2015 4:36 am

Oh this should be good. Oil glut just as we’re starting to scrape the bottom of the barrel production wise. So basically this will send a large amount of folks out of business who are in the “hard to get” oil patch. I’ve No idea how this is going to turn out in the short term.

BobInget on Fri, 11th Sep 2015 9:50 am

http://www.usatoday.com/story/money/2015/09/11/oil-could-plunge-20-goldman-sachs-says/72054790/

Goldman is busy ‘talking their book’. (short oil)

What’s more, it’s working!

Repercussions from this sort of self fulfilling propaganda will end in disastrous shortages.

BobInget on Fri, 11th Sep 2015 10:08 am

Iran has been shipping oil to China for years.

It’s well known. Tankers simply turn off transponders hiding whereabouts.

It’s that heavy, few refiners want oil, that’s sitting around.

FORGET CHINA, it’s India we should be looking at. Population run amok. Case study.

India’s economy is growing far faster then China’s is receding.

http://in.reuters.com/article/2015/08/19/india-fuel-imports-idINL3N10U4HH20150819

http://www.ibnlive.com/news/business/indias-oil-imports-to-be-90-by-2020-report-1054769.html

(Japan imports 100%, so there)

BobInget on Fri, 11th Sep 2015 10:18 am

Meld, others concerned .

If you are investing, this day Sept 11, marks a new low point in Energy Reporting.

Mark my words GS released bearish news today because they sensed an imminent turn-around. I’ll bet GS goes long starting around 2:PM Eastern.

I’m wrong more often then right. That’s investing.

Place your bets ladies.

joe on Fri, 11th Sep 2015 10:44 am

Probobly, Saudi will reduce output as Iran increases production. By then as the Article says, Saudi will be supplying locked in customers who have probobly been promised a price band, say 40-50dlr oil. Iran will be left to find new business in Europe and Asia as North Sea oil depletes and they will let the price creep up again to make supernormal profits, no doubt at higher prices shale etc will come back in. But next time, more cautiously. Saudi has paid allot in opportunity cost, and it’s gamble to use the oil as a disincentive to speedy Iranian negotiating has not paid off. Saudi will have to cut. If it does not, then it faces a collapse in oil prices and it’s own budget. Right now it’s within tolerances it can live with. The Yemeni war is probobly going to be far more significant for them than oil prices. It’s using the UAE flag as a cover for its invasion and genocide of a minority people within Islam, yet nobody is calling for THEM to be let into Europe. Wonder why?

BobInget on Fri, 11th Sep 2015 10:51 am

Wish I were as articulate and well informed as Joe.

Your dad, bob

Makati1 on Fri, 11th Sep 2015 7:23 pm

I see the Fed was in the Market late today to pump up the red into green before the close. LMAO

Shades of 1929 all over again.

Boat on Fri, 11th Sep 2015 7:58 pm

Joe,

I agree with you about the high opportunity as you call it. I do disagree they will cut any oil production for anybody. Oil prices will go back up and they will be pumping full steam. It will be difficult for Iran to grow their oil production with even cheaper oil p rices. They have much less money and their infrastructure needs a lot of work. Who will invest at low oil prices.

Iran and the Saudi have been conspiring to kill each other for a long time. This is nothing new.

Also tar sands, fracking and deep well drilling is more expensive than Irans development. Irans problem is trust. Who wants to help them.

Ted Wilson on Fri, 11th Sep 2015 9:03 pm

While Saudi Arabia can sell only Oil, Iran can sell both Oil and Natgas.

If they start selling more Natgas, then Saudi’s will be in trouble.

Good to go Iran.

Makati1 on Sat, 12th Sep 2015 9:59 am

Boat, “Who wants to help them.”

How about China and Russia? They are already there and investing.

Boat on Sat, 12th Sep 2015 2:24 pm

I can understand China wanting to invest in oil in Iran, but Russia? That would just add to the glut and drive the price of oil down further.

Makati1 on Sun, 13th Sep 2015 5:38 am

Boat, maybe the Russians would prefer to partner with the only other country that still has huge untapped oil and gas reserves? Something like OPEC used to be?

Why did OPEC form other than to control their joint income? Ditto for Russia and Iran. Control, not competition. Both know that they hold the future in their oily hands while the other ‘mature’ fields die.