Page added on October 21, 2014

How will Saudi Arabia respond to lower oil prices?

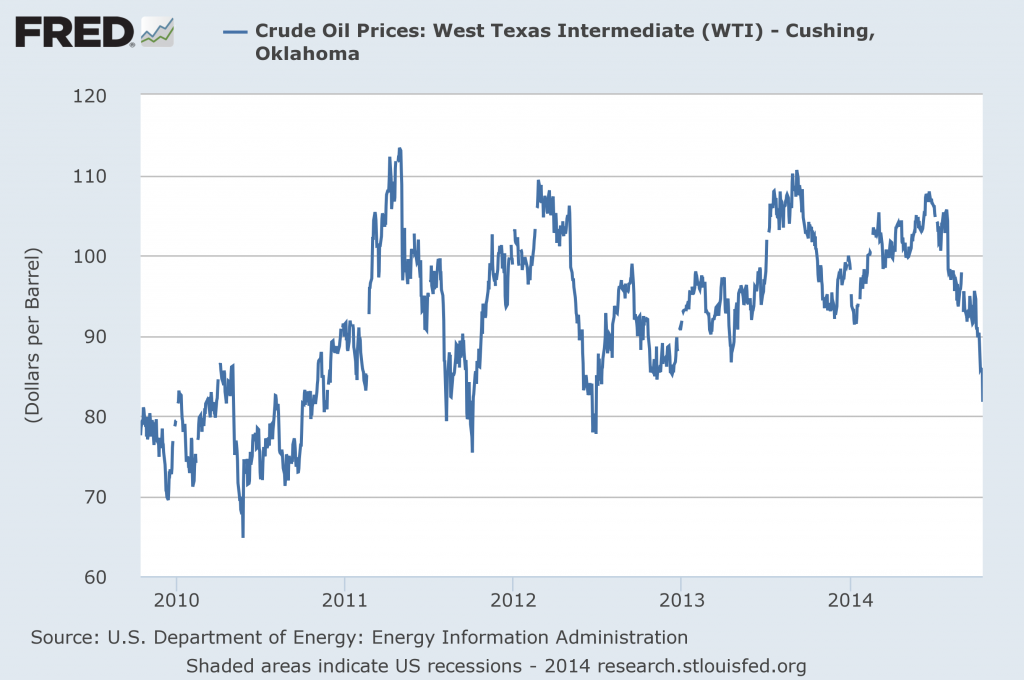

Oil prices (along with prices of many other commodities) have fallen dramatically since last summer. Some observers are waiting to see if Saudi Arabia responds with significant cutbacks in production. I say, don’t hold your breath.

Source: FRED.

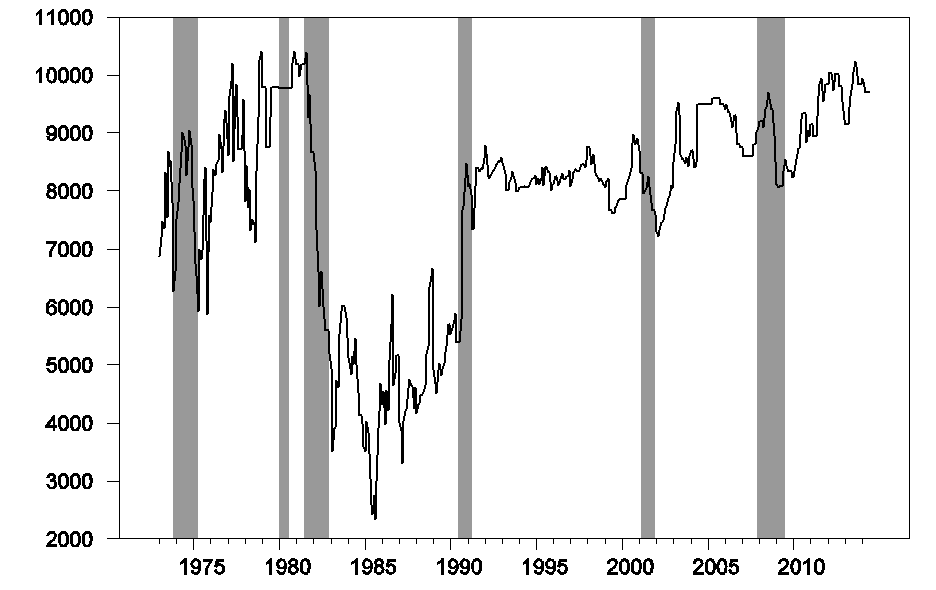

When oil demand fell in the 1981-82 recession, the Saudis cut production by 6 million barrels a day in an effort to soften the decline in oil prices. They also cut production in response to lower demand in the 2001 recession and the most recent recession. On the other hand, the kingdom boosted production quickly beginning in August 1990 and January 2003 in anticipation of lost production from Iraq in the two Gulf Wars. This historical behavior led many observers to believe that Saudi Arabia would always play the role of a swing producer to stabilize the price of oil.

Monthly crude oil production from Saudi Arabia, January 1973 to June 2014, in thousands of barrels per day. Data source: EIA. Shaded regions correspond to U.S. economic recessions.

But that’s hardly an accurate characterization of what happened during 2005-2007, when Saudi production declined even as prices skyrocketed. If that production decline was intentional, it was a dramatic departure from previous patterns. I think a better interpretation is that the market moves after 2005 became too big for the Saudis to control, and they gave up trying. I remain skeptical of the claim that Saudi Arabia is ever going to produce much in excess of 10 mb/d, regardless of what’s going on in the market.

Last week I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy.

As far as Libya is concerned, the politics on the ground remain quite unsettled. It makes sense to wait and see if anticipated production gains are really going to hold before anybody makes major adjustments.

In terms of surging U.S. production, the key question is how low the price can get before significant numbers of U.S. producers decide to pull out. If world economic growth indeed slows, and if most of the frackers are willing to keep going strong even if the price falls to $80 a barrel, trying to maintain the price at $90 could be a losing bet for the Saudis. They’d be giving up their own revenue just in order to keep the money flowing into ever-growing operations in Texas and North Dakota.

And if some of the U.S. producers do move into the red at current prices, it’s in the Saudis’ longer-term interests to let that pain take its toll until some of the newcomers decide to pack up and go home. If U.S. production does decline, prices would quickly move back up. But if that happens after a shake-out, the next time there would be less enthusiasm for everybody to jump into the game if they always have to keep an eye on whether they might be undercut again. This may be less of an issue for the U.S. tight oil producers, who can move in or out much more easily than operations like deepwater or arctic, where there are huge fixed costs, long lead times, and a much bigger unavoidable loss if you gamble on prices always staying high.

And as for worries of another global economic downturn, so far they are only that– worries. If and when we see a downturn materialize, then I would expect to see the Saudis cut back production.

But until then it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production as long as that’s the name of the game.

And if it comes down to a game of chicken, I know who’s going to win.

19 Comments on "How will Saudi Arabia respond to lower oil prices?"

Plantagenet on Tue, 21st Oct 2014 2:24 pm

I’m looking forward to the next OPEC meeting. While KSA may be happy with lower oil prices, they are hurting countries like Venezuela, Nigeria and iran badly. If KSA doesn’t cut oil production to help out its fellow OPEC members, then OPEC is essentially dead as an oil cartel.

rockman on Tue, 21st Oct 2014 3:45 pm

“If and when we see a downturn materialize, then I would expect to see the Saudis cut back production” ????…the KSA has been systematically cutting production for the last 6 months. They are now at a level not seen since 2010. IOW the KSA has been doing what it can to help preserve the higher oil price the US shale players require to keep drilling. Fortunately for the shale players the KSA, even at today’s prices, is still making a sh*tload of money selling oil compared to not that many years ago

paulo1 on Tue, 21st Oct 2014 5:54 pm

re: In terms of surging U.S. production,

This is a bit misleading. Increased LTO production was slow to ramp up and necessitated frantic drilling and investment. It also coincided with better automobile efficiencies and a lower domestic demand due to high prices and the declining spending power of consumers.

The decline in production will probably be far more rapid for a variety of economic reasons reasons, not the least of $80 oil and cost of rail transport. In a few years geology wins the day, anyway.

Paulo

Nony on Tue, 21st Oct 2014 7:00 pm

I don’t buy the “LTO will hesitate to jump back in” argument. Shale drilling is easily turned on and off. They have a lot of drilling locations identified in the EF and Bakken. They can just decide to go to more marginal ones when price rises and away from them when it drops. They make most of the money in the first couple years. And the time to get a new well in is pretty fast (these are explored areas, onshore, and rigs/completion crews will be in excess). We’re not talking Kashagan or even GOM deepwater.

Makati1 on Tue, 21st Oct 2014 8:33 pm

Two informative sites giving Saudi’s budget and breakdown. If I read them correctly, and do some math, they do not have much wiggle room for a prolonged low oil price.

http://www.tradingeconomics.com/saudi-arabia/government-budget

http://www.us-sabc.org/custom/news/details.cfm?id=1541#.VEcHkskwDd4

With government inflation numbers in the 3% area, and the growth of their population (legal and illegal), they are pushing the limits already. Or so it seems to me.

Makati1 on Tue, 21st Oct 2014 8:41 pm

Nony, it takes a constant flow of investment inflow to keep them pumping. When thousands of those investors dump their fast declining stock, what happens? No one will touch them again. After you lose your shirt, there is no another one to bet.

The West is running out of suckers with shirts. But that is the idea. The Empire needs a level playing field without any middle class to cause trouble. Or so it seems to me.

Look around. China is growing their middle class. So far, they have pulled more people out of poverty than resides in the US. Ditto for many of the Asian countries. Even here in the Ps, people are moving up. It is obvious everywhere you go. Not so in the US and EU where the steps are all down. That is part of the “Pivot East” by the Empire. Gotta kill that growth before it spoils their World Domination Plan.

Nony on Tue, 21st Oct 2014 8:45 pm

Increased LTO production was slow to ramp up.

One of the fastest increases in the history of the world (for new drilled production). Fastest in US history. Probably fastest in World history.

Nony on Wed, 22nd Oct 2014 5:54 am

Makita:

If prices go back up, drilling turns back on. There are companies up there. infrastructure, drilling locations, etc. This is not the offshore Arctic or the Caspian Seas.

They can hedge the production. The wells pay off in a couple years. This is a much more tangible investment than a biotech or an Internet stock.

There is plenty of capital looking for a return.

Davy on Wed, 22nd Oct 2014 6:43 am

NOo, it doesn’t matter what you say to Mak his only concern is western diminishment and eastern ascendance. He made that attitude clear in the above comment. The west is in a general decline or should we say plateau. Asia is in a cancerous growth. The west will leap frog Asia because the new reality is decline. The sooner this adjustment takes place the better and the west has started this shift. Asia is dependent on goods exports and food imports. Asia has dangerously urbanized with a serious carrying capacity overshoot. This reality will be tested in the descent. As for Shale NOo, the boom is over and the hangover is near. I doubt it will just turn off but the heady days are over.

Nony on Wed, 22nd Oct 2014 11:27 am

Davy: The East deserves to modernize. In the end it will be beneficial. They will transform into latte-zipping liberals like you after going through the robber baron 19th century stage.

Northwest Resident on Wed, 22nd Oct 2014 11:46 am

China is too late to the party. All the booze is nearly gone, the guests are already drunk and dropping like flies, there’s nothing but scraps left at the munchies-table and no fun to be had anywhere.

China has been used and abused. By making China the “world growth engine” during this last phase of the oil age, the Chinese have been treated to smog, pollution, dislocation, environmental degradation and a plastic existence in an illusionary world of modernization built on an entire mountain range of unpayable debt. Welcome to the party! Now go home.

Meanwhile, if this economist is right, our ride on the Economic Rollercoaster Of DOOM has reached the top of another peak and is ready to zoom down into another dip. Wild excitement for all!

From over on ZeroHedge, your personal guide to economic and financial bad bad news:

Saxo Bank’s Chief Economist Steen Jakobsen is predicting another ‘shock drop’ in the markets within a few weeks. With debt and low inflation continuing to create a nervous atmosphere behind most markets, Steen argues that we will hit fresh lows in mid-November. Steen takes the view that central bank policy is creating a ‘fantasy land’ for investors (no way, tell me it ain’t so) and he points out that the recent ‘day dive’ in markets was a closer reflection of reality.

… the economic cycle is not yet ready to adapt to a rising interest rate.”

Will the economic cycle ever again be ready to adapt to a rising interest rate?

JuanP on Wed, 22nd Oct 2014 1:10 pm

Nony, life is not about what you deserve. It is about what you do with what you get and how you react to what you experience.

Also, Davy drinks green tea, not lattes!

Don on Wed, 22nd Oct 2014 1:42 pm

After reading NWR’s comment all I could think of was this scene from Die Hard.

http://www.youtube.com/watch?v=qkyskI13KOs

Northwest Resident on Wed, 22nd Oct 2014 1:53 pm

Don, hell yeah! Welcome to the party, pal!

Davy on Wed, 22nd Oct 2014 2:42 pm

Yes, Juan, you know me well. NR, thanks for setting the NOo streight. Mak, any comment?

Nony on Wed, 22nd Oct 2014 4:42 pm

You all have the scarcity mindset. It is not about divvying up the pie, but growing it. China is not just a consumer, but a producer. A benefit to the world.

Davy on Wed, 22nd Oct 2014 4:51 pm

NOo what Pie? I see crumbs.

Northwest Resident on Wed, 22nd Oct 2014 4:58 pm

Nony — It’s called the “realistic” mindset because, in reality, the stuff we need in order to continue on as we have been is growing mighty scarce indeed.

GregT on Wed, 22nd Oct 2014 7:17 pm

“China is not just a consumer, but a producer. A benefit to the world.”

90% of the crap coming out of China is of no ‘benefit to the world’. Quite the opposite. As usual Nony, you are living in La-La land.