Page added on November 24, 2016

How to Boost the Global Economy? Higher Oil Prices

Forget the stagflation of the 1970s. Higher oil prices would be a boon for the global economy, according to Goldman Sachs Group Inc.

Pricey crude means economies such as Saudi Arabia take in more money than they can spend, which financial markets help distribute through the rest of the world, boosting asset values and consumer confidence, the bank’s analysts Jeff Currie and Mikhail Sprogis wrote in a Nov. 22 research note.

It’s a counter-intuitive notion, especially for anyone who lived through the 1970s, when Middle East turmoil hiked oil prices and pushed much of the developed world into recession. Back then, high oil prices meant money flowed from developed economies where consumption was high to emerging economies where consumption was low, taking money out of circulation and stagnating the economy.

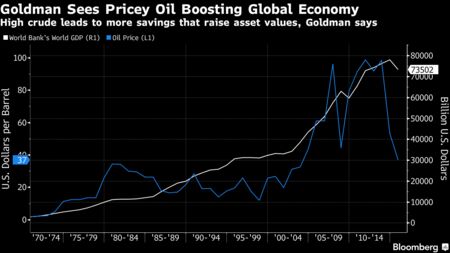

Things changed in the 2000s, Currie and Sprogis wrote. Modern financial systems took savings that were building up in lower-consumption, oil-producing countries and circulated them around the world. The theory helps explain why the global economy surged in the 2000s as oil climbed above $100 a barrel and then slowed amid the recent crude crash, according to Goldman.

“The difference between today and the 1970s is that oil creates global liquidity through a far more sophisticated financial system,” Currie and Sprogis wrote. “More sophisticated financial markets in the 2000s were able to transform this excess savings into greater global liquidity that increased asset values, lowered interest rates, and improved credit conditions that spanned the globe.”

Goldman earlier this week raised its forecast for West Texas Intermediate crude prices in the first quarter to $55 a barrel, from $45, as it expects the Organization for Petroleum Exporting Countries to agree on a production cut next week. Such a boost should be viewed as a positive for global growth, Currie and Sprogis wrote. WTI for January delivery traded at $47.95 a barrel, down a cent, at 10:12 a.m. Singapore time.

Excess Savings

Goldman is the biggest commodities dealer on Wall Street by sales and for that reason the views of its analysts carry extra weight among natural resources investors.

From 2001 to 2014, excess savings outside the U.S. grew to $7 trillion from $1 trillion as oil climbed, according to Currie and Sprogis. The savings helped drive up values of things like homes and financial assets and loosened credit markets for consumers.

In 2014, when oil prices began to fall, Middle Eastern economies began eating into their savings to meet budget requirements, reducing global liquidity. The correlation between oil prices and global growth won’t last forever. When these economies set their budgets so that spending and oil revenue are the same, the financial spillover effects will stop as they did in the 1980s and 1990s, Currie and Sprogis wrote.

6 Comments on "How to Boost the Global Economy? Higher Oil Prices"

Davy on Fri, 25th Nov 2016 4:46 am

The “existential dilemma” of having a reserve currency and why the US is trapped in repression.

“Dollar Shortage Goes Mainstream: When Will The Fed Confess?”

http://www.zerohedge.com/news/2016-11-24/dollar-shortage-goes-mainstream-when-will-fed-confess

In his latest “Global Money Notes” report, “From Exorbitant Privilege to Existential Dilemma”, Credit Suisse’s Zoltan Pozsar argues that “an FOMC determined to normalise interest rates has no choice but to become a Dealer of Last Resort in the FX swap market and provide qunatitative Eurodollar easing (“QEE”) for the rest of the world through its dollar swap lines.”

“According to Pozsar, Basel III and the money market reforms are tightening dollar funding markets causing an “existential trilemma” for the Fed in which “it is impossible to have constraints on bank balance sheets (restraining capital mobility in global money markets), a par exchange rate between onshore dollars and Eurodollars, and a domestically oriented monetary policy mandate. Something will have to give. It’s either the cross-currency basis, the foreign exchange value of the dollar or the hiking cycle. It’s either the Fed’s regulatory and monetary objectives, or control over the Fed’s balance sheet size. It’s either quantities or prices…”

mx on Fri, 25th Nov 2016 8:56 am

Higher oil prices are a TAX INCREASE on Everyone and Everything. So No.

penury on Fri, 25th Nov 2016 10:05 am

The first thing to note is the article is from “Bloomberg” and secondly quotes Goldman.When they start stating advantages they are talking about their group, not ours. All the benefits are for the top 4 per cent and the costs are paid by the rest. Any time Bloomberg and Goldman are in favor of something, bend over, here comes more.

Sissyfuss on Fri, 25th Nov 2016 8:57 pm

If that’s the case Pen, then higher prices on lubricants is guaranteed.

makati1 on Fri, 25th Nov 2016 9:13 pm

Sissy, animal, vegetable or mineral? lol

Bob Inget on Sat, 26th Nov 2016 12:06 pm

The highest priced note in Venezuela today is equal to three US cents. Clearly, it’s impossible for all but top 1% to feed themselves. Forget about buying imported consumer goods.

“Venezuela”

On Monday, Venezuela’s biggest bill bought you four pennies. Today (Friday) it will only buy three. The bolivar has lost 1/4th of its value in 4 days

“Nigeria”

http://www.tradingeconomics.com/nigeria/inflation-cpi 18.3% inflation rate

Google: ‘Nigeria famine’

Plus, there are perhaps 200,000 semi skilled well paid, free spending, oil workers currently unemployed in the US alone.

How hard is it to understand? Higher oil prices will indeed ‘boost the economy’. The trick, first boost domestic production, not only in the US.