Page added on June 13, 2017

Gail Tverberg: Falling Interest Rates Have Postponed “Peak Oil”

Falling interest rates have huge power. My background is as an actuary, so I am very much aware of the great power of interest rates. But a lot of people are not aware of this power, including, I suspect, some of the people making today’s decisions to raise interest rates. Similar people want to sell securities now being held by the Federal Reserve and by other central banks. This would further ramp up interest rates. With high interest rates, practically nothing that is bought using credit is affordable. This is frightening.

Another group of people who don’t understand the power of interest rates is the group of people who put together the Peak Oil story. In my opinion, the story of finite resources, including oil, is true. But the way the problem manifests itself is quite different from what Peak Oilers have imagined because the economy is far more complex than the Hubbert Model assumes. One big piece that has been left out of the Hubbert Model is the impact of changing interest rates. When interest rates fall, this tends to allow oil prices to rise, and thus allows increased production. This postpones the Peak Oil crisis, but makes the ultimate crisis worse.

The new crisis can be expected to be “Peak Economy” instead of Peak Oil. Peak Economy is likely to have a far different shape than Peak Oil–a much sharper downturn. It is likely to affect many aspects of the economy at once. The financial system will be especially affected. We will have gluts of all energy products, because no energy product will be affordable to consumers at a price that is profitable to producers. Grid electricity is likely to fail at essentially the same time as other parts of the system.

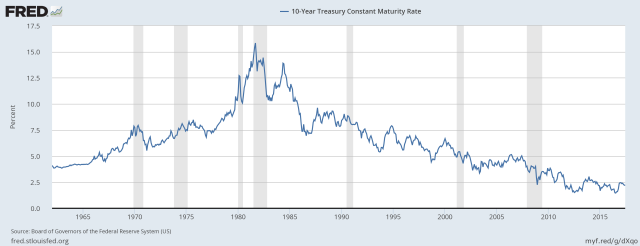

Interest rates are very important in determining when we hit “Peak Economy.” As I will explain in this article, falling interest rates between 1981 and 2014 are one of the things that allowed Peak Oil to be postponed for many years.

These falling interest rates allowed oil prices to be much higher than they otherwise would have been, and thus allowed far more oil to be extracted than would otherwise have been the case.

Since mid 2014, the big change that has taken place was the elimination of Quantitative Easing (QE) by the US. This change had the effect of disrupting the “carry trade” in US dollars (borrowing in US dollars and purchasing investments, often debt with a slightly higher yield, in another currency).

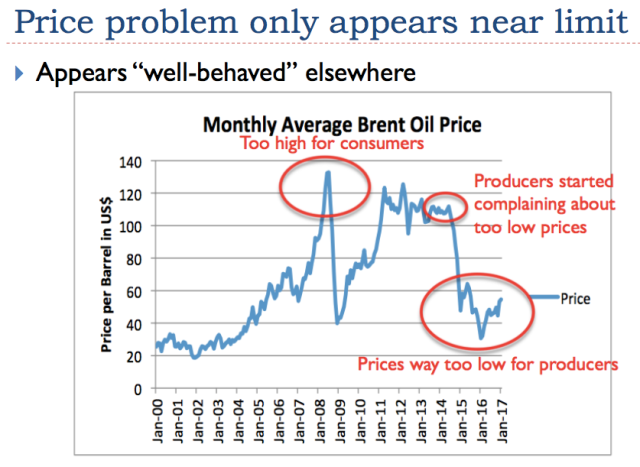

Figure 2. At this point, oil prices are both too high for many would-be consumers and too low for producers.

As a result, the US dollar rose, relative to other currencies. This tended to send oil prices to a level that is too low for oil producers to make an adequate profit (Figure 2). In addition, governments of oil exporting countries (such as Venezuela, Nigeria, and Saudi Arabia) cannot collect adequate taxes. This kind of problem does not lead to immediate collapse. Instead, it “sets the wheels in motion,” leading to collapse. This is a major reason why “Peak Economy” seems to be ahead, even if no one attempts to raise interest rates.

The problem is not yet very visible, because oil prices that are too low for producers are favorable for importers of oil, such as the US and Europe. Our economy actually functions better with these low oil prices. Unfortunately, this situation is not sustainable. In fact, rising interest rates are likely to make the situation much worse, quickly.

In this post, I will explain more details relating to these problems.

Low interest rates are extremely beneficial to the economy; high interest rates are a huge problem.

Low interest rates allow consumers to purchase high-priced goods with affordable monthly payments. With low interest rates, consumers can afford to buy more consumer goods (such as homes and cars) than they could otherwise. Thus, low interest rates tend to lead to high demand for commodities of all kinds, thus raising the price of commodities, such as oil.

Low interest rates are also good for businesses and governments. Their borrowing costs are favorable. Because consumers are doing well, business revenues and tax revenues tend to grow at a brisk pace. It becomes easier to afford new factories, roads, and schools.

While low interest rates are good, a reduction in interest rates is even better.

A reduction in interest rates tends to make asset prices rise. The reason this happens is because if someone already owns an asset (examples: a home, factory, a business, shares of stock) and interest rates fall, that asset suddenly becomes more affordable to other people, so the price of that asset rises because of increased demand. For example, if the monthly mortgage payment for a house suddenly drops from $600 per month to $500 per month because of a reduction in interest rates, many more potential homeowners can afford to buy the house. The price of the house may be bid up to a new higher level–perhaps to a price level where the monthly payment is $550 per month–higher than previously, but still below the old payment amount.

Furthermore, if interest rates fall, owners of homes that have risen in value can refinance their mortgages and obtain the new lower interest rate. Often, they can withdraw the “excess equity” and spend it on something else, such as a new car or home improvements. This extra spending tends to stimulate the economy, and thus tends to raise commodity prices. Suddenly, investments in oil fields that previously looked too expensive to extract, and mines with ores of very low grade, start looking profitable. Businesses hire workers to staff the investments that are now profitable, stimulating the economy.

Businesses receive other benefits, as well, when interest rates fall. Their borrowing cost on new loans falls, making new investment more affordable. Demand for their products tends to rise. The additional demand that results from lower interest rates allows economies of scale to work their magic, and thus allows profits to rise.

Companies that have large portfolios of investments, such as insurance companies and pension funds, find that the values of their assets (stocks, bonds, and other investments) rise when interest rates fall. Thus, their balance sheets look better. (Of course, the low interest payments when interest rates are low provide a different problem for these companies. Here, we are talking about the impact of falling interest rates.)

Of course, the reverse of all of these things is also true. It is truly bad news when interest rates rise!

Wages Depend on Interest Rates and Debt Growth

When interest rates fall, debt levels tend to rise. This happens because expensive goods such as homes, cars, and factories become more affordable, so customers can buy more of them. Thus, falling interest rates are very closely associated with rising debt levels.

We find that when we look at debt levels, rising debt levels seem to be highly correlated with rising US per capita wages, (especially up until China joined the World Trade Organization in 2001, and globalization took off). “Per capita wages” are calculated by dividing total wages and salaries by total population. Per capita wages thus reflect the impact of both (a) changes in the wages of individual workers and (b) changes in workforce participation. Using this measure “makes sense,” if we think of the total population as being supported by the wages of the working population, either directly or indirectly (such as through taxes).

Figure 3. Growth in US Wages vs. Growth in Non-Financial Debt. Wages from US Bureau of Economics “Wages and Salaries.” Non-Financial Debt is discontinued series from St. Louis Federal Reserve. (Note chart does not show a value for 2016.) Both sets of numbers have been adjusted for growth in US population and for growth in CPI Urban.

What does oil price depend upon?

Oil price depends upon the amount customers can afford to pay for oil and the finished products it produces. The amount customers can afford, in turn, depends very much on interest rates, since these influence both wages and monthly payments on loans. If the price that a significant share of consumers can afford is below the selling price of oil, we get an oil glut, as we have today.

It is important to note that oil and other energy products are important in determining the cost of finished products, such as cars, homes, and factories. Thus, high prices on energy products tend to ripple through the economy in many different ways. Many people consider only the change in the cost of filling a car’s gasoline tank; this approach gives a misleading impression of the impact of oil prices.

Affordability is also affected by growing wage disparity. Growing wage disparity tends to occur because of growing complexity and specialization. Globalization also contributes to wage disparity. These are other problems we encounter as we approach energy limits. Demand for commodities is to a significant extent determined by the wages of non-elite workers because there are so many of them. High wage workers tend to influence commodity prices less because their purchases are skewed toward a greater share of services, and toward the purchase of financial assets.

Because interest rates, debt, wages, and oil prices (and, in fact, commodity prices of all kinds) are linked, the system is much more complex than what most early modelers assumed was the case.

Hubbert’s Theory Underlies Many Mainstream Energy Beliefs

Today’s mainstream beliefs about our energy problems seem to be strongly influenced by Peak Oil theory. Peak Oil theory, in turn, is based on an analysis by geophysicist M. King Hubbert. This view does not consider interest rates, debt, or prices.

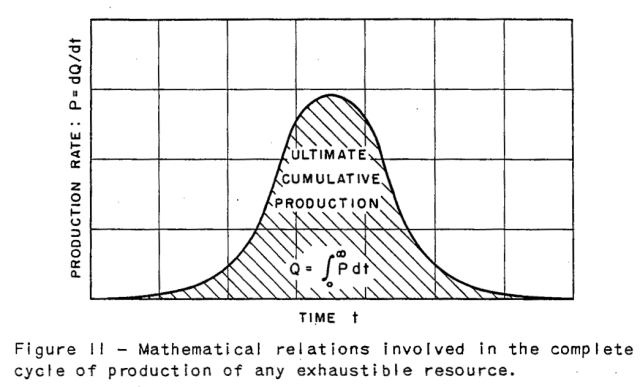

Figure 4. M. King Hubbert’s symmetric curve explaining the way he saw resources depleting from Nuclear Energy and the Fossil Fuels, published in 1956.

In this view, the amount of any exhaustible resource that we can extract depends on the resources in the ground, plus the technology we have to extract these resources. In general, Hubbert expected an approximately symmetric curve of extraction, as illustrated in Figure 4. The peak is expected when about 50% of the resource is extracted. Hubbert believed that improved technology might allow more exhaustible resources to be extracted after peak, making the actual extraction pattern somewhat asymmetric, with a larger share of a resource, such as oil, being extracted after peak.

With this theory, we can expect to extract a considerable amount of resources in the future, even if the energy supply of a particular type starts to fall, because it is “past peak.” With the relatively slow decline rate shown in Figure 4, it should be possible to “stretch” supplies for some years, especially if technology continues to improve.

At some point, the standard view is that we will “run out” of energy supplies if we don’t make substitutions or conserve the use of these nonrenewable resources. Thus, an increase in efficiency is viewed as one part of the solution. Another part of the solution is viewed as substitution, such as with wind and solar energy.

In the mainstream view, the major influence on commodity prices is scarcity, not affordability. The expectation is that scarcity will cause oil prices will rise; as a result, expensive substitutes will become cost competitive. The higher prices will also encourage more conservation and more high-cost technologies. In theory, these can keep the economy operating for a very long time. The very inadequate models that economists have developed have encouraged these views.

The Usual Energy Model Is Overly Simple

Hubbert assumed that the amount of oil extracted would depend only upon the amount of resources available and available technologies. In fact, the amount of oil extracted depends on price, in part because price determines which technologies can be used. It also governs whether oil can be extracted in areas that are inherently expensive–for example, deep under the sea, or heavily polluted with some other material that must be removed at significant cost. Because of this, if oil prices are high, new technologies can be brought into play, and resources that are expensive to reach can be pursued.

If oil prices are lower than really needed, for example in the $40 to $80 per barrel range, the situation is more complex. The problem is that taxes on oil are important, especially for oil exporters. In this range, many producers can continue to produce, but their governments collect inadequate taxes. Their governments find it necessary to borrow money to maintain programs upon which the populations of the countries depend. Governments with inadequate tax revenue tend to get into more conflicts with other countries, such as is happening today with other Middle Eastern countries fighting with Qatar.

The situation of inadequate tax revenue is inherently unstable. It can eventually be expected to lead to the collapse of oil exporting countries.

Factors Underlying the Rise and Fall of Historical Oil Prices

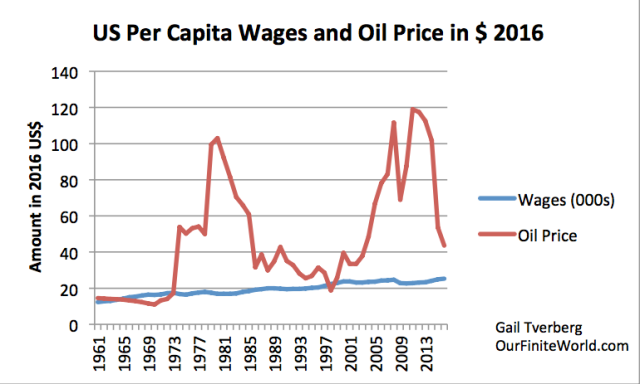

The fundamental problem regarding the cost of resource extraction is that we tend to extract the cheapest-to-extract resources first. Thus, the cost of extracting many types of resources, including oil, tends to rise over time. Wages grow much more slowly.

Figure 5. Average per capita wages computed by dividing total “Wages and Salaries” as reported by US BEA by total US population, and adjusting to 2016 price level using CPI-Urban. Average inflation adjusted oil price is based primarily on Brent oil historical oil price as reported by BP, also adjusted by CPI-urban to 2016 price level.

This mismatch between wages and oil price tends to cause increasing affordability problems over time, even as we switch to cheaper fuels and increased efficiency. Part of the reason why affordability problems get worse has to do with our inability to keep reducing interest rates; at some point, they reach an irreducible minimum. Also, as I mentioned previously, there is a growing wage disparity problem caused by growing complexity and globalization. Those with low wages find themselves increasingly unable to afford goods such as homes and cars that require oil products in their construction and use.

Looking at Figure 5, we see two major price “humps.” The first of these is in the 1970-1998 period, and the second is in the 1999 to present period. In the first of these two periods, we often hear that the run up in oil prices was the result of an oil supply problem. This occurred because the US oil supply peaked in 1970, and the Arabs made the situation worse with an oil embargo.

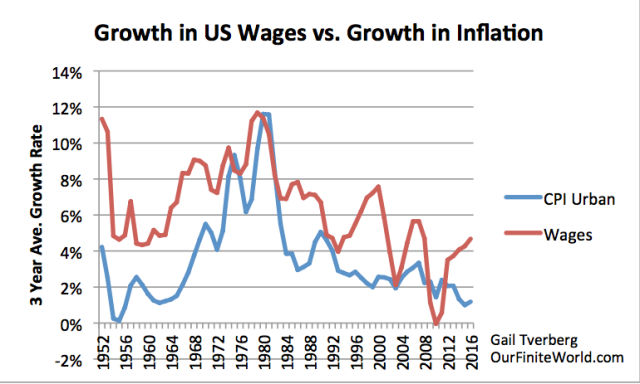

In fact, I think that at least half of the problem in the 1970-1981 period may have been that wages were growing rapidly during this period. The rapid run up in wages allowed oil prices to increase in response to a fairly small oil shortage. Thus, the run up in prices was caused to a significant extent by greater demand, made possible by greater affordability. Note that timing of wage increases is slightly ahead of the timing of increases in CPI Urban. This suggests that wage growth tends to cause price inflation. It seems likely that globalization reduces the influence of US wages on oil prices, and thus on price inflation, in recent years.

Figure 6. Growth in US wages versus increase in CPI Urban. Wages are total “Wages and Salaries” from US Bureau of Economic Analysis. CPI-Urban is from US Bureau of Labor Statistics.

The large increases in wage payments shown in Figure 6 were made possible by growing total population, by rapidly growing productivity, and by an increasing share of women being added to the workforce. Figure 6 shows that the big increases in wages stopped after interest rates were raised to a very high level in 1981.

Economists hope that rising oil prices will bring about new supply, substitution, and greater efficiency. In the 1970s and 1980s, oil prices did seem to come back down for precisely these reasons. I explain the situation in more detail in the Appendix. Rising inflation rates and interest rates were a problem during this period for insurance companies. One insurance company I worked for went bankrupt; another almost did.

We have not been able to achieve the same new supply–substitution–efficiency result in the 1999 to 2016 period, partly because whatever easy efficiency and substitution changes could inexpensively be made were made earlier, and partly because we are reaching diminishing returns with respect to extracting energy products, especially oil. Also, the wage disparity of workers is growing. Growing wage disparity makes debt growth increasingly ineffective in raising wages. Instead of debt growth funding more wages and more affordable goods for the working poor, the additional debt seems to go to the already rich.

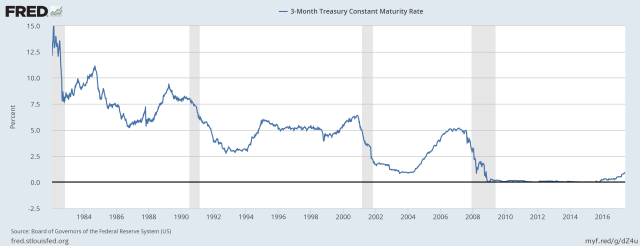

The decreases in interest rates since 1981 have given the economy an almost continuous upward lift. This long-term decrease tends to get overlooked because it has gone on for such a long time. The major exception to the long-term decrease in interest rates since 1981 was the big increase by the Federal Reserve in target interest rates in the 2004-2006 period (shown indirectly in Figure 7).

The problem started when Alan Greenspan dropped target interest rates very low in the 2001-2004 period to stimulate the economy, and then raised them in the 2004-2006 period to cut back growth (Figure 7). This seems to have been one of the major causes of the Great Recession. The other major cause of the Great Recession was fact that oil prices rose far more rapidly than wages during the 2003-2008 period. More information is provided in the Appendix.

Where We Are Now

We have many leaders who do not seem to understand what our real problems are, and how successful programs have been to date in keeping the system from crashing. Way too much of their understanding has come from traditional models regarding “land, labor and capital,” “supply and demand,” and “higher prices bring substitution.” These models are not suitable for understanding how the economy, as a self-organized networked system, really works.

These leaders seem to believe that QE worldwide is no longer working well enough, so it should be removed. In addition, securities currently held by central banks should be sold. Also, the growth in debt should be slowed, because it is getting too high. Whether or not debt is too high, this strategy will lead to “Peak Economy.” As I explained in an earlier post, debt is what pulls an economy forward. It is the promise (which may or may not actually be kept) of future goods and services. These goods will be made with energy resources and other resources that we may or may not actually have in the future. Once we pare back our expectations, the system is likely to spiral downward.

It is not entirely clear the extent to which interest rates have already started to influence the economy. Long term interest rates, such as 10 year Treasuries, have not yet changed in yield (Exhibit 1). But short-term interest rates clearly have increased (Figure 7). An increase from 0% to 1% is a huge increase, if someone is using very short-term interest rates to fund highly levered investments.

Worldwide, the International Institute of Finance reported an increase in debt of $70 trillion, to $215 trillion between 2006 and 2016. This sounds like a huge increase, but it only amounts to a 4.0% increase per year during that period. It is doubtful this is enough to support the GDP growth the world needs, plus the increase in commodity prices demanded by diminishing returns.

There is evidence the economy is already headed downward. A recent report indicates that in the US, the smallest increase in consumer credit in 6 years took place in April 2017.

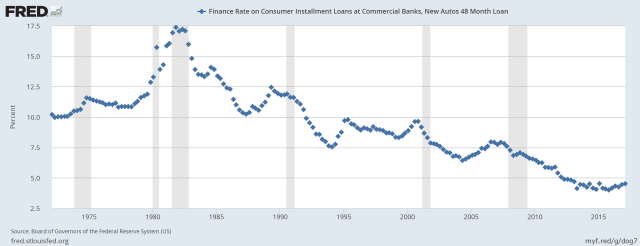

Another worrying area is auto loans. This is an area where interest rates have already begun to increase a bit, making monthly payments on cars higher.

The average finance rate in February 2017 was 4.52%, compared to an average finance rate of 4.00% in November 2015 (the low point). We don’t yet have information on what the increase would be to May 2017. A person would expect that if finance rates are following the interest rates on short to medium term US government securities, the finance rate would continue to rise. This interest rate rise would be one of the things that discounts provided by auto dealers would act to offset.

Because of the higher cost to the buyer of rising auto financing rates, a person would expect such a rise to adversely affect new auto sales. Higher interest rates would also affect lease prices and auto resale prices. We don’t yet know the extent to which higher interest rates are currently affecting auto sales, but the kinds of changes we are seeing are precisely the kinds of changes we would expect to see from higher interest rates. We have had a long history of falling interest rates (plus longer maturities) helping to prop up auto sales. Simply getting to the end of this cycle could be part of the problem.

Peak Economy is likely not very far away. We do not need to encourage it, by raising interest rates and selling securities held by the Federal Reserve. We badly need more people to understand the connection between interest rates and oil prices, and how important it is that interest rates not rise–in fact, more QE would be better.

Appendix – More Detail on Changes Affecting Oil Prices

(a) Between 1973 and 1981. Our oil problems started when US oil production began to decline in 1970, and Arab countries took advantage of our problems with an oil embargo. We immediately started work on extracting oil from other locations that we knew had oil available (Alaska, North Sea, and Mexico). Also, Japan was already making smaller cars. We started building smaller, more fuel-efficient cars in the US, too. We also began to substitute other fuels for oil in home heating and in the making of electricity.

(b) Between 1981 and 1998. In 1981, Paul Volker decided to force oil prices down by raising target interest rates to a very high level. He knew that such a high interest rate would lead to recession, which would reduce demand and thus prices. Also, earlier efforts at new oil supply and demand reduction approaches began to be effective. The new oil supply was somewhat higher priced than the pre-1970 oil. Falling interest rates made it possible for consumers to tolerate the somewhat higher oil prices required by the new higher priced oil.

(c) Between 1999 and 2008. Oil prices rose rapidly during this period, in large part because of rising demand. Globalization added huge demand for oil. Also, Alan Greenspan reduced target interest rates at about the time of the 2001 recession. (Target interest rates affect 3-month interest rates, shown in Figure 7.) At the same time, banks were encouraged to be more lenient in lending standards, and to offer loans based on the very favorable short-term interest rates available at that time. This combination of factors led to rapidly rising housing debt and much refinancing activity. All of this activity also added to oil demand.

Fortunately, these demand increases coincided with an increase in the cost of oil extraction. The world’s supply of “conventional oil” was becoming limited in supply, and began to decline in 2005. The higher demand raised prices, thus encouraging producers to pursue more expensive unconventional oil production.

(d) The 2008 Crash occurred after the Federal Reserve raised target interest rates in the 2004-2006 period, in an attempt to damp down rising food and energy prices. This interest rate rise made home buying more expensive. Oil prices were also increasing in the 2002-2008 period. The combination of rising interest rates and rising oil prices reduced demand for new homes and cars. Home prices fell, debt levels fell, and oil prices fell. Many people blamed the problems on loose mortgage underwriting standards, but the basic issue was falling affordability of oil, as oil prices rose and as higher interest rates took away the huge boost the economy previously had received. See my article, Oil Supply Limits and the Continuing Financial Crisis.

(e) 2009-2011 ramp up in prices was enabled by QE. This QE brought a broad range of interest rates to very low levels.

(f) 2011-2014. Oil prices gradually slid downward, because there was no longer enough upward “push” created by QE, since interest rates were no longer falling very much.

(g) Mid to late 2014 to Present. The US removed its QE, leading to a sharp reduction in carry trade in US dollars. Many currencies fell relative to the US dollar, making oil products less affordable in these currencies. As a result, oil prices fell to a level far below that needed by oil producers, especially oil exporters.

25 Comments on "Gail Tverberg: Falling Interest Rates Have Postponed “Peak Oil”"

Cloggie on Tue, 13th Jun 2017 8:04 am

My background is as an actuary, so I am very much aware of the great power of interest rates.

Gail the actuary. For an actuary everything is financial.

Did a search in her article for the words “frack” and “shale”, both with zero results.

I decided not to bother reading the article.

The old “King Hubbert” Bell Curve story no longer applies. This is the Third Carbon Age. With technology “all of a sudden” fossil fuel reserves become exploitable that weren’t before. Shale, methane hydrates, underground coal gasification, etc., considerably have the potential to extend the fossil fuel age, potentially for centuries to come. We shouldn’t do that but instead use existing reserves to rapidly set up a renewable energy base.

observerbrb on Tue, 13th Jun 2017 8:12 am

We’re going to witness the biggest clusterf+ck of the whole human history.

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2017/06/04/credit%20impulse%20update%206.12.jpg

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2017/06/04/C%26I%20loans%20June%2010.jpg

Early indicators are flashing red, they are anticipating a serious downturn in the next 6 months approximately.

I wonder what naysayers will say by then. O we deal with reality, or reality will deal with us.

Cloud9 on Tue, 13th Jun 2017 8:44 am

I think Gail like many of the rest of us were blindsided by the sheer power of inertia and the power of conjured money to keep this show on the road long past its expiration date. The Walking Dead is an apt metaphor for our current reality.

Ghung on Tue, 13th Jun 2017 8:52 am

The days of conjuring money from nothing are self-limiting and fracking (or other enhanced extraction technologies) won’t matter much when the day arrives that cheap money either isn’t readily available or isn’t available at all. I guess Cloggo thinks these companies operate in the black.

The US debt went above $1 trillion in the Reagan era and it took only about 35 years to balloon to $20 trillion. Those graphs don’t lie, nor does the global oil reliance increase. No amount of magic-wand-waving can fix that.

Apneaman on Tue, 13th Jun 2017 9:11 am

Human progress

Now Just Five Men Own Almost as Much Wealth as Half the World’s Population

https://www.commondreams.org/views/2017/06/12/now-just-five-men-own-almost-much-wealth-half-worlds-population

What does one spend it on? Buy the Atlantic ocean?

marmico on Tue, 13th Jun 2017 11:03 am

You should have stopped reading after the 3rd sentence.

“But a lot of people are not aware of this power, including, I suspect, some of the people making today’s decisions to raise interest rates.”

Tverberg is a twerp.

tagio on Tue, 13th Jun 2017 11:04 am

Cloggie said,

“[first quoting Gail]’My background is as an actuary, so I am very much aware of the great power of interest rates.’

Gail the actuary. For an actuary everything is financial.

Did a search in her article for the words “frack” and “shale”, both with zero results.

I decided not to bother reading the article.”

Hmmmm, “When I saw that the paper on the General Theory of Relativity was written by someone who was a clerk in a patent office, I decided not to read the paper.”

Cloggie, you realize, I hope, that the heuristic you employ for determining what you decide to pay attention to is simply that, it doesn’t actually determine the truth or validity of what you are ignoring, right? Your heuristic only establishes what you pay attention to, it doesn’t actually prove that “If I choose to ignore it, it is therefore false.”

But thanks for sharing.

rockman on Tue, 13th Jun 2017 11:40 am

Interest rates did or didn’t significantly effect the date of global PO. Tech did or didn’t significantly effect the date of global PO. Increased oil prices did or didn’t significantly effect the date of global PO.

The good news? The answer to these questions and similar ones isn’t critical since that date of GPO isn’t critical. Thus IMHO I see little value in debates over this issue.

Sissyfuss on Tue, 13th Jun 2017 12:22 pm

Tag, Cloghub is too hubristic for your heuristic.

Cloggie on Tue, 13th Jun 2017 12:42 pm

Cloggie, you realize, I hope, that the heuristic you employ for determining what you decide to pay attention to is simply that, it doesn’t actually determine the truth or validity of what you are ignoring, right? Your heuristic only establishes what you pay attention to, it doesn’t actually prove that “If I choose to ignore it, it is therefore false.”

But thanks for sharing.

Thanks for your observations, but I have already formed an opinion about why peak oil was postponed and my understanding of the subject is advanced to the the tune that I know that interest rates above the ground are hardly related to depletion patterns below the ground. Peak oil was postponed because of the becoming available of large quantities of oil, not taken into account by the likes of Hubert, Campbell and the guy with the French name.

Interest rates did or didn’t significantly effect the date of global PO.

That statement is always true, but will bring you little income in the world of oil consultancy. 😉

Thus IMHO I see little value in debates over this issue.

Please tell that to Tag and Siss; they won’t take it from me.

Tag, Cloghub is too hubristic for your heuristic.

Still mad at me for mentioning these agricultural export figures?

http://www.worldatlas.com/articles/the-american-food-giant-the-largest-exporter-of-food-in-the-world.html

Come on, you can be proud of “The American food giant, the largest exporter of food in the world” (see URL).

Davy on Tue, 13th Jun 2017 1:38 pm

People today really don’t have a good feel for what money is. What is reality today? Most of us are lost when it comes to any kind of understanding of reality. Money is unreal for most of us at certain levels but it is also our very foundation. We hear all kinds of mind pictures like print baby print money and conjured up money. We hear talk about 5 people own half the wealth in the world type things. What does all this mean? How can 5 rich men really own very much. It is more like the money owns them. How does trillions in debt mean anything at a certain point? Ascending levels of abstractions eventually dissolve into nothingness. What has meaning is real and physical. Real wealth is both tangible and intangible and it has finite expressions. Real is in the here and now not 20 years hence. It represent productive assets and abstract networks and systems that channel activity.

Too much debt just points to distortions. Repressed price discovery and excessive liquidity don’t change the balance sheet of the real and physical. Where repression, easing, and excessive debt have meaning is distortions or lack of. How well are resources, capital, and human labor applied to yield positive productive results? Distortions and excesses mean less effectiveness. A finite world has “actualness”. Extending and pretending is just a way of hiding the truth of “actualness”. It is human emotions not rational behavior. Trillions in debt is an expression of the human emotions of denial and avarice. A properly scaled human does not dwell in these places so we can say modern man is out of scale to nature and his own existence.

The abstract world of markets and economics loses relevance at some point. When this becomes global and macro the abstractions can become self-organizing and self-adaptive. This means in a way they become extra human. They express humanity in another dimension. Modernity in many ways is an enigma. Humans at this level are now mechanized in a lifeless process driven by creations that do not reflect human reality. We have created a surreal world where reality becomes impressionistic. This is also an indicator of late term civilization when decisions start to be irrational and systems dysfunctional. Nature is now rebalancing this chaos and turbulence.

Money as is expressed today in globalism is an expression of human turmoil. It is now an expression of our moral hazard. Money no longer is a guide to proper decisions. It is now a symptom of the result of the decay and decline of our late term civilization. Watch how money behaves to understand our future. If one reflects on money today everywhere globally we can see we are heading for an end game of loss of confidence and broken promises. This is what trillions in debt and 5 people owning half the world’s wealth really means.

Plantagenet on Tue, 13th Jun 2017 4:32 pm

What part of lower interest rates did M. King Hubbert not understand?

Cheers!

Northwest Resident on Tue, 13th Jun 2017 4:37 pm

I don’t see how anybody in their right mind and cognizant of the facts could deny the critical role that super-low interest rates play in keeping the shale/unconventional oil production industry going. Many if not most and perhaps all of these producers are piling on loads of debt and rolling it over as it comes due, and they could not survive without the ultra-low interest rates.

Check this out:

https://srsroccoreport.com/warning-the-global-oil-gas-industry-is-cannibalizing-itself-to-stay-alive/

antaris on Tue, 13th Jun 2017 5:04 pm

Super low interesting rates are keeping everything going. From city’s, provinces, states to federal governments, a good percentage of mortgages I would bet. Nobody me included learned ( I type this while laying in the hospital with a newly pinned fibula)

I just hope my leg heals so I can work to pay my business mortgage.

Harquebus on Tue, 13th Jun 2017 5:19 pm

Currency can be created from nothing. The oil that this currency buys is not. The first to say, “Stick your fiat crap” will start an avalanche that will destroy industries far and wide.

Venezuela is a peek into our near future.

makati1 on Tue, 13th Jun 2017 5:29 pm

Some promote fiat money for personal gain.(the 1%)

Others ignore the problems for the same reason.(Gail?)

Still others don’t have a clue.(Most of the world’s population.)

But, coming events will rock the world and change everything, and not for the better.

Shed debt like a coat on fire and avoid new debt like you would avoid Ebola. THAT is the only way to freedom and being able to sleep at night without stress. Live below your means and prep for the coming financial chaos. Or don’t. Your choice.

DerHundistlos on Tue, 13th Jun 2017 6:49 pm

Trump Supporters Have Built A Document With The Addresses And Phone Numbers Of Thousands Of Anti-Trump Activists

https://www.buzzfeed.com/ryanhatesthis/trump-supporters-have-built-a-document-with-the-addresses?utm_term=.uxXVlEp0PV#.jjBYENogXY

Rick Bronson on Tue, 13th Jun 2017 10:05 pm

Sorry Ms. Gail

Energy consumption continues to grow. Last year it grew only 1%, thanks to the energy efficiency. But supply from Wind & Solar seems to be infinite.

Rockman on Wed, 14th Jun 2017 5:26 am

CLoggie – “Interest rates….That statement is always true, but will bring you little income in the world of oil consultancy.;” Not that it’s germane to the the discussion but the Rockman got some of his biggest fees during periods when rates were much higher then they are now. High rates are offset by highly successful wells. Marginal plays, like the shales, are the ones that require the leverage of low rates. Especially by the pubcos that are primarily looking at increased value of BOOKED RESERVES offsetting the increase in debt. That’s what achieves their primary goal which is increased stock price and not profitability.

Rockman on Wed, 14th Jun 2017 5:39 am

NR – “I don’t see how anybody…could deny the critical role that super-low interest rates…”. I think you understand my statement that those rates are unimportant with respect to the date of GPO. But for others: Not because they weren’t a factor in the shale boom but because the actual date of GPO itself is unimportant. In fact the low rates + high oil prices + increased production proves that point. Consider the effect of the POD on the global eventually inflicted on the various economies, such as Greece et al, and now the huge negative effect low oil prices + high debt loads now being inflicted on much of the petroleum industrty. Neither of which is related to whatever the date of GPO was before the shale boom or what it is now.

Cloggie on Wed, 14th Jun 2017 6:09 am

Trump Supporters Have Built A Document With The Addresses And Phone Numbers Of Thousands Of Anti-Trump Activists

The old leftist LoseHound thinks in all earnest that he can destroy his own society through mass immigration with impunity and not expect civil war preparations all around him. Some people are so naive.

#AnnieGetYourGun

Rockman on Wed, 14th Jun 2017 10:19 am

Cloggie – In the field I regularly interact with far right homophobic anti-non christian well armed types all the time. I never challenge them because there’s no point: none of their attitudes are based on facts or common sense. While if confronted directly there could be violence the good news is that the vast majority are not proactive. Essentially “tin soldiers”. LOL. Hell, many didn’t even bother to vote until candidate Trump showed up.

Now liberals, like the one taking shots at R congressmen this morning, is a different matter. But being on the left they are poor marksmen: 50 to 100 rounds and all he does is tag 4 with nonlethal wounds? Had it been a Texas deer hunter with a single shot Ruger that went off the deep end there would have been 40 to 50 body bags laid out along the first base line. LOL.

joe on Wed, 14th Jun 2017 10:34 am

It’s a fairly positive corelation between interest rates and inflation, its underlying supply trends correctly mentioned by GT which have caused the current and probable new departure in global affairs. The US ever frightened to let go of globalisation is losing much more than manufacturing jobs, Saudi now supplies Asia more oil than it supplies the Americas, so from Saudis point of view, whoes really the daddy? Globalism has moved the supply chain east, and the US makes paper profits as it inflates and financialises its problems such that the loss of gold backing merely made inflation the limit of supply of dollars. Now that system is under threat, they cant even keep tiny QATAR from ignoring the US…….

GT is quite correct, raise rates and we’ll quickly see the real cost of tight oil and the truth of Peak Oil.

Cloggie on Wed, 14th Jun 2017 12:26 pm

Cloggie – In the field I regularly interact with far right homophobic anti-non christian well armed types all the time. I never challenge them because there’s no point: none of their attitudes are based on facts or common sense. While if confronted directly there could be violence the good news is that the vast majority are not proactive. Essentially “tin soldiers”. LOL. Hell, many didn’t even bother to vote until candidate Trump showed up.

https://lewrockwell.com/2017/06/patrick-j-buchanan/civil-war-near/

https://www.youtube.com/watch?v=aPm0NKcBZcY

energy investor on Wed, 14th Jun 2017 4:07 pm

Rick, If you looked at the next article you would see that oil demand is at 1.6% and rising despite the efforts to replace oil.

As Einstein is reputed to have said, “the most powerful force in the universe is compound interest”.

The interest rate rise of 1939 is a reputed cause for the depression of the 1930’s.

This won’t end well for Ms Yellen.