Page added on August 26, 2015

Deflationary Collapse Ahead?

Both the stock market and oil prices have been plunging. Is this “just another cycle,” or is it something much worse? I think it is something much worse.

Back in January, I wrote a post called Oil and the Economy: Where are We Headed in 2015-16? In it, I said that persistent very low prices could be a sign that we are reaching limits of a finite world. In fact, the scenario that is playing out matches up with what I expected to happen in my January post. In that post, I said

Needless to say, stagnating wages together with rapidly rising costs of oil production leads to a mismatch between:

- The amount consumers can afford for oil

- The cost of oil, if oil price matches the cost of production

This mismatch between rising costs of oil production and stagnating wages is what has been happening. The unaffordability problem can be hidden by a rising amount of debt for a while (since adding cheap debt helps make unaffordable big items seem affordable), but this scheme cannot go on forever.

Eventually, even at near zero interest rates, the amount of debt becomes too high, relative to income. Governments become afraid of adding more debt. Young people find student loans so burdensome that they put off buying homes and cars. The economic “pump” that used to result from rising wages and rising debt slows, slowing the growth of the world economy. With slow economic growth comes low demand for commodities that are used to make homes, cars, factories, and other goods. This slow economic growth is what brings the persistent trend toward low commodity prices experienced in recent years.

A chart I showed in my January post was this one:

The price of oil dropped dramatically in the latter half of 2008, partly because of the adverse impact high oil prices had on the economy, and partly because of a contraction in debt amounts at that time. It was only when banks were bailed out and the United States began its first round of Quantitative Easing (QE) to get longer term interest rates down even further that energy prices began to rise. Furthermore, China ramped up its debt in this time period, using its additional debt to build new homes, roads, and factories. This also helped pump energy prices back up again.

The price of oil was trending slightly downward between 2011 and 2014, suggesting that even then, prices were subject to an underlying downward trend. In mid-2014, there was a big downdraft in prices, which coincided with the end of US QE3 and with slower growth in debt in China. Prices rose for a time, but have recently dropped again, related to slowing Chinese, and thus world, economic growth. In part, China’s slowdown is occurring because it has reached limits regarding how many homes, roads and factories it needs.

I gave a list of likely changes to expect in my January post. These haven’t changed. I won’t repeat them all here. Instead, I will give an overview of what is going wrong and offer some thoughts regarding why others are not pointing out this same problem.

Overview of What is Going Wrong

- The big thing that is happening is that the world financial system is likely to collapse. Back in 2008, the world financial system almost collapsed. This time, our chances of avoiding collapse are very slim.

- Without the financial system, pretty much nothing else works: the oil extraction system, the electricity delivery system, the pension system, the ability of the stock market to hold its value. The change we are encountering is similar to losing the operating system on a computer, or unplugging a refrigerator from the wall.

- We don’t know how fast things will unravel, but things are likely to be quite different in as short a time as a year. World financial leaders are likely to “pull out the stops,” trying to keep things together. A big part of our problem is too much debt. This is hard to fix, because reducing debt reduces demand and makes commodity prices fall further. With low prices, production of commodities is likely to fall. For example, food production using fossil fuel inputs is likely to greatly decline over time, as is oil, gas, and coal production.

- The electricity system, as delivered by the grid, is likely to fail in approximately the same timeframe as our oil-based system. Nothing will fail overnight, but it seems highly unlikely that electricity will outlast oil by more than a year or two. All systems are dependent on the financial system. If the oil system cannot pay its workers and get replacement parts because of a collapse in the financial system, the same is likely to be true of the electrical grid system.

- Our economy is a self-organized networked system that continuously dissipates energy, known in physics as a dissipative structure. Other examples of dissipative structures include all plants and animals (including humans) and hurricanes. All of these grow from small beginnings, gradually plateau in size, and eventually collapse and die. We know of a huge number of prior civilizations that have collapsed. This appears to have happened when the return on human labor has fallen too low. This is much like the after-tax wages of non-elite workers falling too low. Wages reflect not only the workers’ own energy (gained from eating food), but any supplemental energy used, such as from draft animals, wind-powered boats, or electricity. Falling median wages, especially of young people, are one of the indications that our economy is headed toward collapse, just like the other economies.

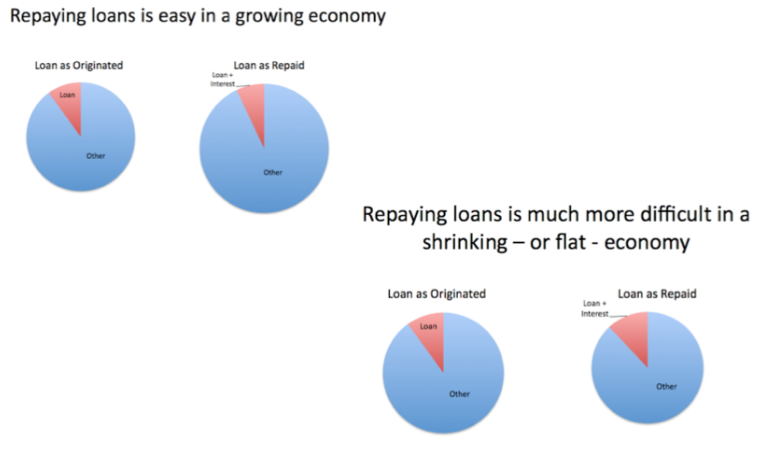

- The reason that collapse happens quickly has to do with debt and derivatives. Our networked economy requires debt in order to extract fossil fuels from the ground and to create renewable energy sources, for several reasons: (a) Producers don’t have to save up as much money in advance, (b) Middle-men making products that use energy products (such cars and refrigerators) can “finance” their factories, so they don’t have to save up as much, (c) Consumers can afford to buy “big-ticket” items like homes and cars, with the use of plans that allow monthly payments, so they don’t have to save up as much, and (d) Most importantly, debt helps raise the price of commodities of all sorts (including oil and electricity), because it allows more customers to afford products that use them. The problem as the economy slows, and as we add more and more debt, is that eventually debt collapses. This happens because the economy fails to grow enough to allow the economy to generate sufficient goods and services to keep the system going–that is, pay adequate wages, even to non-elite workers; pay growing government and corporate overhead; and repay debt with interest, all at the same time. Figure 2 is an illustration of the problem with the debt component.

Where Did Modeling of Energy and the Economy Go Wrong?

- Today’s general level of understanding about how the economy works, and energy’s relationship to the economy, is dismally low. Economics has generally denied that energy has more than a very indirect relationship to the economy. Since 1800, world population has grown from 1 billion to more than 7 billion, thanks to the use of fossil fuels for increased food production and medicines, among other things. Yet environmentalists often believe that the world economy can somehow continue as today, without fossil fuels. There is a possibility that with a financial crash, we will need to start over, with new local economies based on the use of local resources. In such a scenario, it is doubtful that we can maintain a world population of even 1 billion.

- Economics modeling is based on observations of how the economy worked when we were far from limits of a finite world. The indications from this modeling are not at all generalizable to the situation when we are reaching limits of a finite world. The expectation of economists, based on past situations, is that prices will rise when there is scarcity. This expectation is completely wrong when the basic problem is lack of adequate wages for non-elite workers. When the problem is a lack of wages, workers find it impossible to purchase high-priced goods like homes, cars, and refrigerators. All of these products are created using commodities, so a lack of adequate wages tends to “feed back” through the system as low commodity prices. This is exactly the opposite of what standard economic models predict.

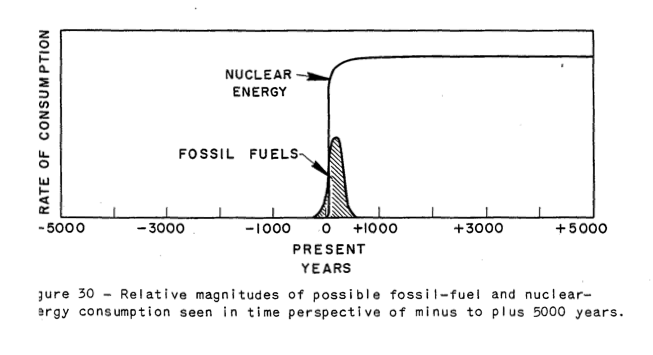

- M. King Hubbert’s “peak oil” analysis provided a best-case scenario that was clearly unrealistic, but it was taken literally by his followers. One of Hubbert’s sources of optimism was to assume that another energy product, such as nuclear, would arise in huge quantity, prior to the time when a decline in fossil fuels would become a problem.

The way nuclear energy operates in Figure 2 seems to me to be pretty much equivalent to the output of a perpetual motion machine, adding an endless amount of cheap energy that can be substituted for fossil fuels. A related source of optimism has to do with the shape of a curve that is created by the sum of curves of a given type. There is no reason to expect that the “total” curve will be of the same shape as the underlying curves, unless a perfect substitute (that is, having low price, unlimited quantity, and the ability to work directly in current devices) is available for what is being modeled–here fossil fuels. When the amount of extraction is determined by price, and price can quickly swing from high to low, there is good reason to believe that the shape of the sum curve will be quite pointed, rather than rounded. For example we know that a square wave can be approximated using the sum of sine functions, using Fourier Series (Figure 4).

- The world economy operates on energy flows in a given year, even though most analysts today are accustomed to thinking on a discounted cash flow basis. You and I eat food that was grown very recently. A model of food potentially available in the future is interesting, but it doesn’t satisfy our need for food when we are hungry. Similarly, our vehicles run on oil that has recently been extracted; our electrical system operates on electricity that has been produced, essentially simultaneously. The very close relationship in time between production and consumption of energy products is in sharp contrast to the way the financial system works. It makes promises, such as the availability of bank deposits, the amounts of pension payments, and the continuing value of corporate stocks, far out into the future. When these promises are made, there is no check made that goods and services will actually be available to repay these promises. We end up with a system that has promised very many more goods and services in the future than the real world will actually be able to produce. A break is inevitable; it looks like the break will be happening in the near future.

- Changes in the financial system have huge potential to disrupt the operation of the energy flow system. Demand in a given year comes from a combination of (wages and other income streams in a given year) plus the (change in debt in a given year). Historically, the (change in debt) has been positive. This has helped raise commodity prices. As soon as we start getting large defaults on debt, the (change in debt) component turns negative, and tends to bring down the price of commodities. (Note Point 6 in the previous section.) Once this happens, it is virtually impossible to keep prices up high enough to extract oil, coal and natural gas. This is a major reason why the system tends to crash.

- Researchers are expected to follow in the steps of researchers before them, rather than starting from a basic understudying of the whole problem. Trying to understand the whole problem, rather than simply trying to look at a small segment of a problem is difficult, especially if a researcher is expected to churn out a large number of peer reviewed academic articles each year. Unfortunately, there is a huge amount of research that might have seemed correct when it was written, but which is really wrong, if viewed through a broader lens. Churning out a high volume of articles based on past research tends to simply repeat past errors. This problem is hard to correct, because the field of energy and the economy cuts across many areas of study. It is hard for anyone to understand the full picture.

- In the area of energy and the economy, it is very tempting to tell people what they want to hear. If a researcher doesn’t understand how the system of energy and the economy works, and needs to guess, the guesses that are most likely to be favorably received when it comes time for publication are the ones that say, “All is well. Innovation will save the day.” Or, “Substitution will save the day.” This tends to bias research toward saying, “All is well.” The availability of financial grants on topics that appear hopeful adds to this effect.

- Energy Returned on Energy Investment (EROEI) analysis doesn’t really get to the point of today’s problems. Many people have high hopes for EROEI analysis, and indeed, it does make some progress in figuring out what is happening. But it misses many important points. One of them is that there are many different kinds of EROEI. The kind that matters, in terms of keeping the economy from collapsing, is the return on human labor. This type of EROEI is equivalent to after-tax wages of non-elite workers. This kind of return tends to drop too low if the total quantity of energy being used to leverage human labor is too low. We would expect a drop to occur in the quantity of energy used, if energy prices are too high, or if the quantity of energy products available is restricted.

- Instead of looking at wages of workers, most EROEI analyses consider returns on fossil fuel energy–something that is at least part of the puzzle, but is far from the whole picture. Returns on fossil fuel energy can be done either on a cash flow (energy flow) basis or on a “model” basis, similar to discounted cash flow. The two are not at all equivalent. What the economy needs is cash flow energy now, not modeled energy production in the future. Cash flow analyses probably need to be performed on an industry-wide basis; direct and indirect inputs in a given calendar year would be compared with energy outputs in the same calendar year. Man-made renewables will tend to do badly in such analyses, because considerable energy is used in making them, but the energy provided is primarily modeled future energy production, assuming that the current economy can continue to operate as today–something that seems increasingly unlikely.

- If we are headed for a near term sharp break in the economy, there is no point in trying to add man-made renewables to the electric grid. The whole point of adding man-made renewables is to try to keep what we have today longer. But if the system is collapsing, the whole plan is futile. We end up extracting more coal and oil today, in order to add wind or solar PV to what will soon become a useless grid electric system. The grid system will not last long, because we cannot pay workers and we cannot maintain the grid without a financial system. So if we add man-made renewables, most of what we get is their short-term disadvantages, with few of their hoped-for long-term advantages.

Conclusion

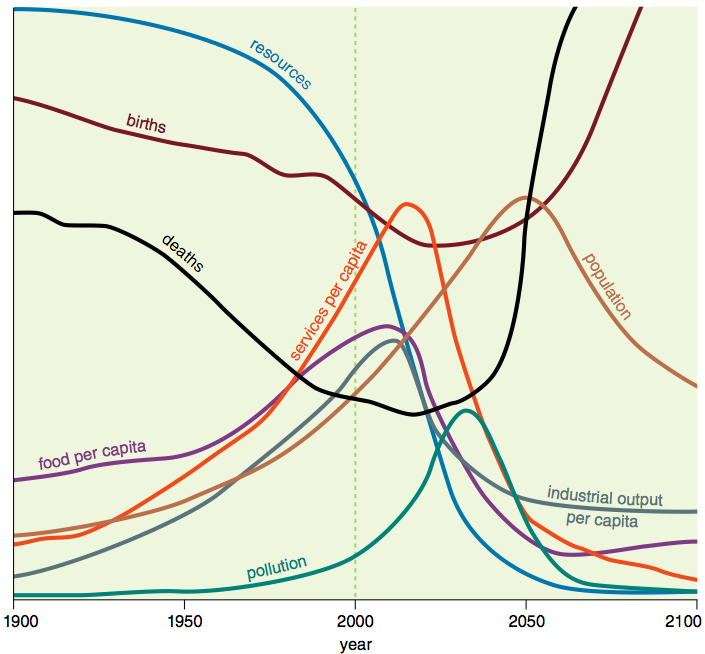

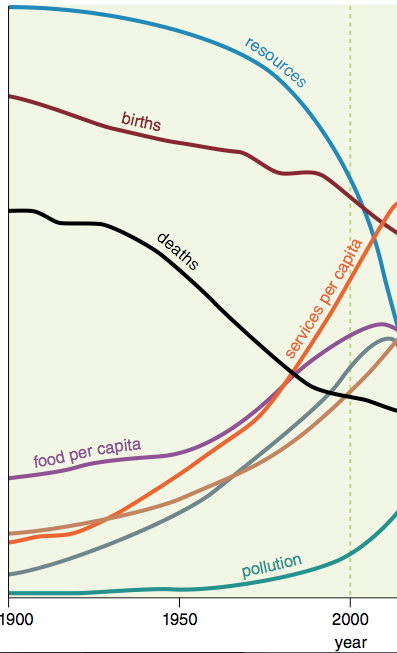

The analysis that comes closest to the situation we are reaching today is the 1972 analysis of limits of a finite world, published in the book “The Limits to Growth” by Donella Meadows and others. It models what can be expected to happen, if population and resource extraction grow as expected, gradually tapering off as diminishing returns are encountered. The base model seems to indicate that a collapse will happen about now.

The shape of the downturn is not likely to be correct in Figure 5. One reason is that the model was put together based on physical quantities of goods and people, without considering the role the financial system, particularly debt, plays. I expect that debt would tend to make collapse quicker. Also, the modelers had no experience with interactions in a contracting world economy, so had no idea regarding what adjustments to make. The authors have even said that the shapes of the curves, after the initial downturn, cannot be relied on. So we end up with something like Figure 6, as about all that we can rely on.

If we are indeed facing the downturn forecast by Limits to Growth modeling, we are facing a predicament that doesn’t have a real solution. We can make the best of what we have today, and we can try to strengthen bonds with family and friends. We can try to diversify our financial resources, so if one bank encounters problems early on, it won’t be a huge problem. We can perhaps keep a little food and water on hand, to tide us over a temporary shortage. We can study our religious beliefs for guidance.

Some people believe that it is possible for groups of survivalists to continue, given adequate preparation. This may or may not be true. The only kind of renewables that we can truly count on for the long term are those used by our forefathers, such as wood, draft animals, and wind-driven boats. Anyone who decides to use today’s technology, such as solar panels and a pump adapted for use with solar panels, needs to plan for the day when that technology fails. At that point, hard decisions will need to be made regarding how the group will live without the technology.

We can’t say that no one warned us about the predicament we are facing. Instead, we chose not to listen. Public officials gave a further push in this direction, by channeling research funds toward distant theoretically solvable problems, instead of understanding the true nature of what we are up against. Too many people took what Hubbert said literally, without understanding that what he offered was a best-case scenario, if we could find something equivalent to a perpetual motion machine to help us out of our predicament.

31 Comments on "Deflationary Collapse Ahead?"

Fat Lady on Wed, 26th Aug 2015 5:32 pm

“We can’t say that no one warned us about the predicament we are facing.” TRA LAAAAAAAAAAAAAAAA!

Rodster on Wed, 26th Aug 2015 5:46 pm

Speaking of Deflation:

“China Stunner: Real GDP Is Now A Negative -1.1%, Evercore ISI Calculates”

http://www.zerohedge.com/news/2015-08-26/china-stunner-real-gdp-now-negative-11-evercore-isi-calculates

shortonoil on Wed, 26th Aug 2015 6:52 pm

We have been discussing this for some time:

“A deflationary crisis is now baked into the cake. One look at the petroleum industry confirms it. Determining how the industry, or any oil producer is fairing is quit simple. You take their profit that was generated during the last high priced year (such as 2013) and divide by the number of barrels produced. That gives profit per barrel for that year. Then subtract the difference in per barrel price between now, and then. That gives present profit, or loss per barrel.”

08/16/15 PO News

Approaching A Global Deflationary Crisis?

As far as affordability we posted this page almost a year ago:

http://www.thehillsgroup.org/depletion2_022.htm

(the date is on the second graph)

Interesting article but it lacks the rigid mathematical, and thermodynamic analysis provided by the Etp Model. That is unfortunate as it is an issue of extreme importance, and it is being mostly ignored by those who are in significant enough positions to take some action concerning it. They have heard so many economic analysis over time they may have become immune to them. Historically, most of them have not been particularly accurate, and many of them have been outright wrong.

Never the less, the issue is of extreme importance. By our calculations the world will be required to find $39 trillion over, and above the price of oil during the next decade to finance oil production at its present level. As oil is an essential commodity for the functioning of modern civilization, and this needed financing will have tremendously negative consequences for the economy, it should certainly not be taken lightly!

Perhaps better minds will begin to realize the impact that petroleum depletion will soon be having on the world. The tenuous power balance that has dominated the world for the last century is soon to be broken. Many nation states will undoubtedly collapse, and the global economic structure that makes modern live possible will be in serious jeopardy!

http://www.thehillsgroup.org/

BobInget on Wed, 26th Aug 2015 6:59 pm

To Hell with the Donald!@

Zero Hedge for World Leader!

Back in the good old days, before desegregation, we had Zero Hedgers too.

A certain portion of Political candidates today

think being against certain human behaviors will buy them votes among the pious.

Articles like above play on one’s fears and trepanations. Inflation fears were popular on these comment pages for years. Doubtless they will be hot again soon.

Let’s see. Because Saudi Arabia and Iran are fearful, we have once again, cheap oil.

The billion dollar question remains. How much longer will the shelves be over-filled?”

Can the US resupply itself once the Mideast

catches fire? (ok, its already on fire)

Now What?

AS we in America’s West, fighting hundreds of separate forest fires, say. “That blaze is 20% controlled” or ” The XXX fire turned into a fire-storm” “The such and such burn is out of control”

How do you picture lives of individuals living in oil ‘rich’ nations like Nigeria, Iraq or Venezuela? (average inflation rates above 30%)

Boat on Wed, 26th Aug 2015 7:02 pm

Good good, except shouldn’t we have seen the drop in births already?

Boat on Wed, 26th Aug 2015 7:11 pm

What usually happens? The US will dump tons of grain. That will make our farmers happy and theirs bankrupt. Or do they water for farms anymore.

BC on Wed, 26th Aug 2015 7:40 pm

short, Gail knows of your work. You have presented a profoundly important analysis, so don’t be shy about occasionally participating on her site. She will likely welcome and appreciate your insights, as will her readers.

Cheers.

MSN Fanboy on Wed, 26th Aug 2015 7:41 pm

No boat, we will breed right into the brick wall.

Think of limits to growth as the “moderate scenario”

Human beings however have created an “Extreme Scenario”

Don’t worry, when the financial system implodes i have no doubt the worlds CB’s will pull the white rabbit out of the hat.

Probably by fucking over the bottom 99%.

Thereby making it worse, just as they are now.

Think of limits to growth as a market scenario led by more rational minded folk.

Our “Extreme Scenario” will be more central planned capitalism. Well i’m not even sure its Capitalism anymore.

Just the rich and powerful doing what rich and powerful folk have done throughout history. Maintain and grow that power.

peakyeast on Wed, 26th Aug 2015 7:59 pm

@Boat: That we are able to outfuck the graph – is not a positive factor. Actually its quite the opposite.

Besides there has been a few hitches on the way from 1971 until now – so things are somewhat lagging in time.

Makati1 on Wed, 26th Aug 2015 8:20 pm

“Some people believe that it is possible for groups of survivalists to continue, given adequate preparation. This may or may not be true. The only kind of renewables that we can truly count on for the long term are those used by our forefathers, such as wood, draft animals, and wind-driven boats. Anyone who decides to use today’s technology, such as solar panels and a pump adapted for use with solar panels, needs to plan for the day when that technology fails. At that point, hard decisions will need to be made regarding how the group will live without the technology.”

The collapse is inevitable. The only questions are:

1. How soon?

2. How fast?

3. How deep?

“If we are indeed facing the downturn forecast…”

Still hedging her bets….lol

BobInget on Wed, 26th Aug 2015 9:17 pm

I redoubled my Canadian fertilizer

and oil sands positions during our latest

collapse rehearsal. That’s my way of preparing for ‘End Times’.

Oil companies, pushed to conserve funding,

(drill cheaper) have, during the year managed to knock millions off lifting expenses.

North Americans are sharing new technology,

repurposing existing methods, saving money.

Post 2009 It was shale drillers that stepped up to the plate when oil went below $40 and created a ninth wonder, boom employment, high paying blue-collar jobs during a lower case ‘d’pression.More to the point Cheap Natural Gas saved The Nation’s economy and millions from actual homelessness.

What thanks did these ‘money losers’ get for pulling our bacon? New pejoratives suddenly became part of America’s hate speech:

BAN Fracking!! Fracking, a word that now ranks along with pollution in popularity

spread like a western US grass fire on a hot windy day.

Today, the exact same doom talk repeated ad noisome.

At least Those depression era conversations had meat around them.

Today, in Peak Oil Land we face oil surfeits.

Instead of poking our heads outside our A-holes to nail down the exact reasons for this transitory surplus, we on ‘peakoil.com no less, see only dystopia.

Of course I’m concerned. We’ve turned our minds off about the plights of war and climate victims. There’s almost never any concern expressed about oil war refugees.

If oil wars are mentioned it’s always how these ‘conflicts’ will effect us. (Will oil get delivered on time)

On my list of horrors facing women and mankind fucking deflation ranks along-side

moss in the desert.

BobInget on Wed, 26th Aug 2015 10:58 pm

Pain inside OPEC

Ecuador pumps oil at loss.

http://www.bloomberg.com/news/articles/2015-08-26/ecuador-reveals-the-pain-inside-opec-it-s-pumping-oil-at-a-loss

Poster’s note. Ecuador’s currency is in fact the USD. If Ecuador is getting $30 for oil it’s just $30. (Canada’s currency CAD, is discounted 33% to the USD. IOW’s Canadian oil companies get USD’s and pay wages,

royalties in CAD)

Here’s an excerpt:

President Rafael Correa said on Tuesday that the South American nation is receiving as little as $30 a barrel for its crude, while production costs average about $39. The warning comes after several other members of the Organization of Petroleum Exporting Countries, including Algeria and Libya, said the group should consider holding an emergency meeting to respond to the drop in oil prices.

BobInget on Wed, 26th Aug 2015 11:17 pm

As long as the USD stays at record highs,

(for security reasons) Prices are forced lower to make oil affordable.

Advantage, Canada. quick note; If you not an investor make a note of the current prices on Canada’s prime oil companies for later reference.

I’m of the opinion Russia will lead a coup d’etat replacing KSA as the world’s leading

exporter. When combined with allies Iraq and Iran, Russian forces will put down ISIS .

Saudi Arabia it will be said, brought this on itself by forcing oil prices lower, shorting oil, early backing of al Qaeda. and later ISIS.

Apneaman on Thu, 27th Aug 2015 1:21 am

Just when think it can’t possibly get any more absurd……………….

“Would You Finance Your Kicks?”: Shoe-Backed Securities Are On The Way

http://www.zerohedge.com/news/2015-08-26/would-you-finance-your-kicks-shoe-backed-securities-are-way

shortonoil on Thu, 27th Aug 2015 7:21 am

Here they see the handwriting on the wall; they just don’t see how big it is.

http://www.bloomberg.com/news/articles/2015-08-26/oil-industry-needs-to-find-half-a-trillion-dollars-to-survive

The industry will continue to take ever larger losses as prices continue their long term downward climb:

http://www.thehillsgroup.org/depletion2_022.htm

and production costs continue their century and a half upward march.

The Laws of Physics don’t take sabbaticals!

http://www.thehillsgroup.org/

JuanP on Thu, 27th Aug 2015 9:49 am

I have found it hard these last few years to finish Gail’s articles and this one was no exception. She is really wordy, kind of like JMG, but I find JMG more fun to read most of the time. I liked her better when she wrote at TOD. IMO, she has been stuck in a rut for years now and has nothing new to say. I already know that I agree with her on some things and disagree on others, and I don’t think that is going to change so reading her stuff is no longer a good use of my time.

I do recommend her writings to people who are not familiar with her work, though, as she offers a new perspective and many interesting details to people migrating from MSM or new to these subjects.

ghung on Thu, 27th Aug 2015 11:07 am

Gail continues to promote her binary view of “survivalists” likely wasting their time adopting renewables and alternate lifestyles:

Some people believe that it is possible for groups of survivalists to continue, given adequate preparation. This may or may not be true. The only kind of renewables that we can truly count on for the long term are those used by our forefathers, such as wood, draft animals, and wind-driven boats. Anyone who decides to use today’s technology, such as solar panels and a pump adapted for use with solar panels, needs to plan for the day when that technology fails.”

Well of course we are. She ignores some things, such as that distributed technology like PV doesn’t fail all at once. Off-gridders are generally adept at problem solving and arriving at solutions on their own local level, and have an overall aversion to total reliance upon top-down, centralized, highly complex systems for their day-to-day needs. Unlike gridweenies and corns, we won’t find ourselves competing with the masses for evermore costly and constrained resources with people who have little hope of adapting at all, much less, gracefully. In short, being much more self-reliant means having much more time to adapt to whatever changes come down. As I often point out, the vast majority of folks have very few options outside of BAU; they’re all in. Finances, food, energy, transportation, healthcare, protection, means of exchange, etc.,; all fall within a narrow band of options provided by industrial age continuity.

Gail simply doesn’t acknowledge that some of us will be less fucked than others. That’s a HUGE difference in how one reacts to contraction, collapse, or simple ongoing decline in all things “normal”.

Me? I’ll never panic, and never give up. My list of options outside the mainstream economy is greater, and growing. Gail keeps repeating the same things most of us so-called survivalists have been thinking about, and planning for, for decades. We haven’t been practising these things; we’ve been living and doing these things.

Davy on Thu, 27th Aug 2015 11:13 am

Sound wisdom from the G-man!

steve on Thu, 27th Aug 2015 11:18 am

Gail is plagiarizing Nicole Foss but she has to put a twist on it so she throws in the anti-survivalist rhetoric…I am really surprised out how the people take everything they read here as gospel and don’t question much of there meme…almost like doomerism sheeple… that is why I think Zero Hedge is a much better website…they are always analyzing and reanalyzing….people here just want to be told they are right…

GregT on Thu, 27th Aug 2015 2:25 pm

“people here just want to be told they are right”

I have come to the same conclusions as Gail has above, as have many others.

I would like nothing more than for someone to come along and prove to me that we are wrong.

It is only a matter of time. The laws of physics are non-negotiable.

shortonoil on Thu, 27th Aug 2015 2:40 pm

Alexander the Great was told by his mother that he was the son of the great god Zeus. When some fellow Macedonians disagreed with him he had their heads chopped off.

“people here just want to be told they are right…”

It’s an old, old story!

apneaman on Thu, 27th Aug 2015 3:33 pm

Zero Hedge is for near illiterate wannabe remedial libertarians. They couldn’t analyze a hemorrhoid if they were squatting on a mirror. Just a big confirmation bias rhetoric machine full of climate deniers and the worst sort of permanently paranoid anti everything that is not white male, American, libertarian/right wing. Everything they don’t like and I mean everything is a conspiracy and all the world’s problems can be solved with just a few simple minded solutions- deregulation, small government, border fence, liberty, more guns, bla bla bla. Not that the left are not practicing their own special brand of denial and delusional hopium, but these hedge clowns can’t even be satirized. That goes for most of the Durdans too.

This pukey hopey-changy lefty climate blog gives a perfect example of your typical Zero hedge reader. The picture says it all.

Free Market Free Loaders

“In fire-devastated Washington state, the gentleman on the right is thanking exhausted, hard-working fire fighters for saving his house, while wearing a tee shirt that says, “Lower Taxes + Less Government=More Freedom.

Presumably the gentleman is one of those free market freeloaders who hates the government, hates taxes, but wants to drive on the roads, fly safely in the skies, use the internet, get weather data from satellites, have clean water to drink and safe food to eat, to keep poison tainted toys away from his children, and send them to good schools, but who apparently thinks all these services, including, when needed, police and fire protection, and for that matter, climate protection, will come for nothing, provided by untrained people who work for sub-minimum wages.

Next time there’s a fire, and there will be a next time, perhaps he will ponder whether he can fight it with his garden hose, or form a bucket brigade with his neighbors…”

http://climatecrocks.com/2015/08/25/free-market-free-loaders/

What this article does not mention is that the US government/taxpayer is currently spending 150 million dollars per week fighting these new and improved forest fires and it is barely making a dent – saving lives and some structures, but not the forrests. Have fun steve.

Davy on Thu, 27th Aug 2015 3:55 pm

Ape man I don’t read zero hedge to be enlightened on climate change. I read it to find dirty laundry on the financial system and the bad shit my government does. What’s wrong with that?

apneaman on Thu, 27th Aug 2015 4:12 pm

Nothing Davy. I read some too (between the lines) No need to take my comments/rants directed at others personally.

apneaman on Thu, 27th Aug 2015 4:30 pm

Heads up planty! Your state is taking another infrastructure shit kicking thanks to AGW. Maybe you can plant another couple of trees and fly around the world 3 times to amuse yourself again to help offset the damage….I mean to your psyche.

10-15 Foot Waves Break Seawall at Barrow, Alaska

“This is not something that is normal for typically ice-choked Barrow, Alaska. Today, 25 to 35 mile per hour winds and fetch-driven, 10-15 foot high waves are breaking through coastal barriers and flooding the streets and homes of a town that is used to far more placid seas.”

“(Recently, Barrow city officials had a barrier of sand erected to protect structures from the newly ice liberated waters of the Beaufort Sea. Today, a strong coastal low pressure system’s surf smashed that barrier, flooded the coastal road, broke a channel through to an inland lake, and swamped numerous structures.”

http://robertscribbler.com/2015/08/27/ten-foot-waves-break-seawall-at-barrow-alaska/

Boat on Thu, 27th Aug 2015 4:41 pm

GregT on Thu, 27th Aug 2015 2:25 pm

“people here just want to be told they are right”

I have come to the same conclusions as Gail has above, as have many others.

I would like nothing more than for someone to come along and prove to me that we are wrong.

Part of the problem is establishing the timeline and extent of the crash. And the factors involved. I keep saying every year- we are good for 5 more, I have been saying this for 11 years. What do you say. I am saying the type of mad max crash,

Boat on Thu, 27th Aug 2015 5:33 pm

Apeman. They should have asked the Netherlands for advice, they have reclaimed 2,700 sq miles of coastland.

apneaman on Thu, 27th Aug 2015 5:51 pm

What that cost, boat? Think it will be worth it since it will probably only be for a few decades at best? Most of a good chunk of the Low countries will.

apneaman on Thu, 27th Aug 2015 5:58 pm

Boat the #1 dutch expert already gave his advice to florida on what their future will be. Bet he’s in on it to eh?

DUTCH SEA LEVEL RISE EXPERT: MIAMI WILL BE “THE NEW ATLANTIS,” A CITY IN THE SEA

“A few months after Hurricane Sandy bore down on New York, killing over 150 people and wreaking $65 billion in damage, federal leaders cried for help to make the Northeast more flood-proof. Dutch expert Henk Ovink answered. Ovink had helped make his homeland, where 55 percent of the country is extremely flood-prone, a world pioneer in preparing for sea level rise. With Ovink at the helm, the Hurricane Sandy Rebuilding Task Force put together a groundbreaking plan to make the region more sea-level rise resistant and started a contest to sponsor innovative design plans.

Which is all to say that there aren’t many people alive who know more about helping threatened cities cope with sea level rise.

So there’s good cause to be worried when the Dutch expert says there’s no place in worse shape today than Miami. He’s begun calling the city “the new Atlantis,”

http://www.miaminewtimes.com/news/dutch-sea-level-rise-expert-miami-will-be-the-new-atlantis-a-city-in-the-sea-7628340

Boat on Thu, 27th Aug 2015 6:20 pm

Apeman,

Love the link, basketball courts downtown is my type of innovation. Any drought area might think about this to save rain runoff.

GregT on Thu, 27th Aug 2015 7:32 pm

“Part of the problem is establishing the timeline and extent of the crash. And the factors involved. I keep saying every year- we are good for 5 more, I have been saying this for 11 years. What do you say.”

I say; If you keep saying that “we are good for 5 more years”, it would probably be a very good idea for you to make preparations. Move away from largely populated areas, get out of debt, get involved in a small local community, and learn how to grow your own food.

My timeline was originally for around 2030-2035, but as this mess continues to unfold, my timeline continues to change. I’m thinking now before 2025, but with so many unresolved, and unsolvable predicaments on the horizon, any number of events could push us over the edge within a matter of days.

“A city’s only ever three hot meals away from anarchy” -Alastair Reynolds

Being prepared for unforeseen events is never a bad idea. Being unprepared for events that appear likely, is not only foolish, it is stupid.