Page added on January 31, 2014

A Forecast of Our Energy Future; Why Common Solutions Don’t Work

In order to understand what solutions to our energy predicament will or won’t work, it is necessary to understand the true nature of our energy predicament. Most solutions fail because analysts assume that the nature of our energy problem is quite different from what it really is. Analysts assume that our problem is a slowly developing long-term problem, when in fact, it is a problem that is at our door step right now.

The point that most analysts miss is that our energy problem behaves very much like a near-term financial problem. We will discuss why this happens. This near-term financial problem is bound to work itself out in a way that leads to huge job losses and governmental changes in the near term. Our mitigation strategies need to be considered in this context. Strategies aimed simply at relieving energy shortages with high priced fuels and high-tech equipment are bound to be short lived solutions, if they are solutions at all.

OUR ENERGY PREDICAMENT

1. Our number one energy problem is a rapidly rising need for investment capital, just to maintain a fixed level of resource extraction. This investment capital is physical “stuff” like oil, coal, and metals.

We pulled out the “easy to extract” oil, gas, and coal first. As we move on to the difficult to extract resources, we find that the need for investment capital escalates rapidly. According to Mark Lewis writing in the Financial Times, “upstream capital expenditures” for oil and gas amounted to nearly $700 billion in 2012, compared to $350 billion in 2005, both in 2012 dollars. This corresponds to an inflation-adjusted annual increase of 10% per year for the seven year period.

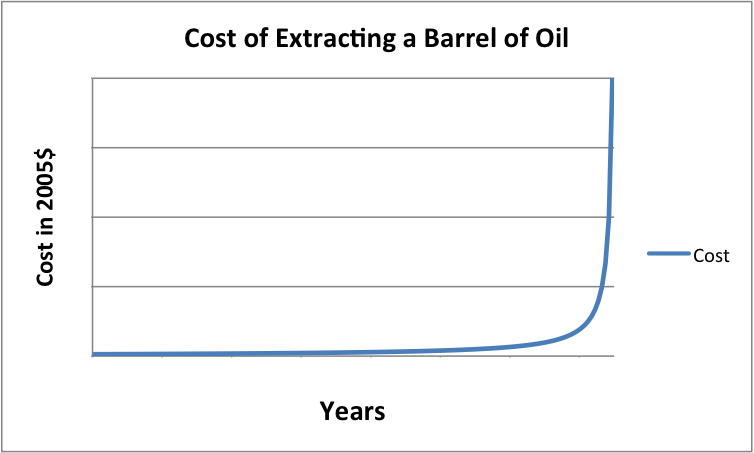

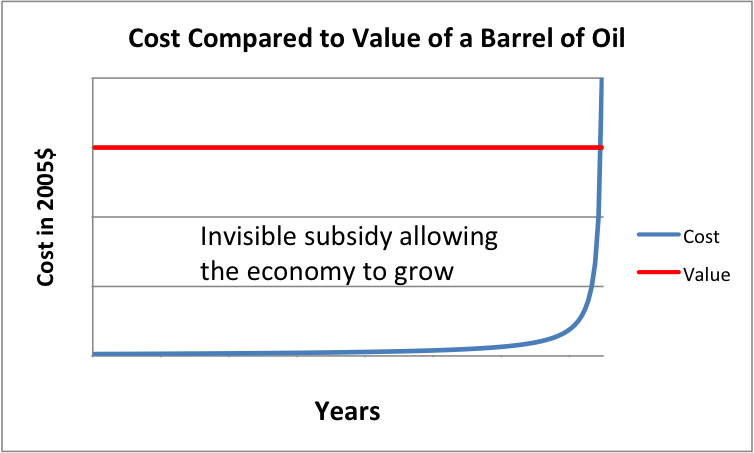

Figure 1. The way would expect the cost of the extraction of energy supplies to rise, as finite supplies deplete.

In theory, we would expect extraction costs to rise as we approach limits of the amount to be extracted. In fact, the steep rise in oil prices in recent years is of the type we would expect, if this is happening. We were able to get around the problem in the 1970s, by adding more oil extraction, substituting other energy products for oil, and increasing efficiency. This time, our options for fixing the situation are much fewer, since the low hanging fruit have already been picked, and we are reaching financial limits now.

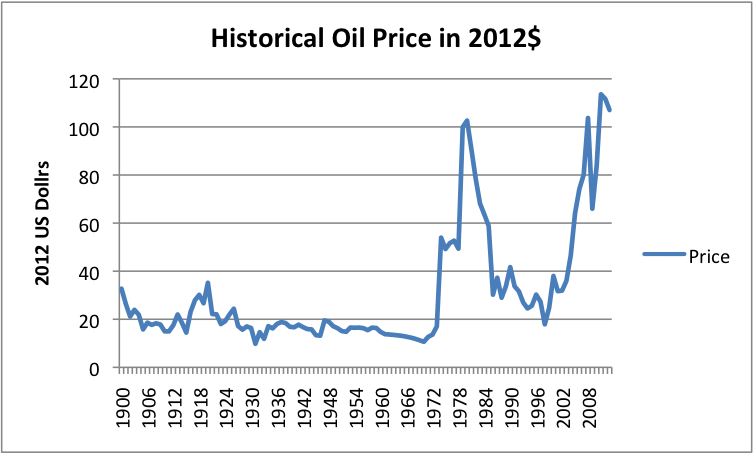

Figure 2. Historical oil prices in 2012 dollars, based on BP Statistical Review of World Energy 2013 data. (2013 included as well, from EIA data.)

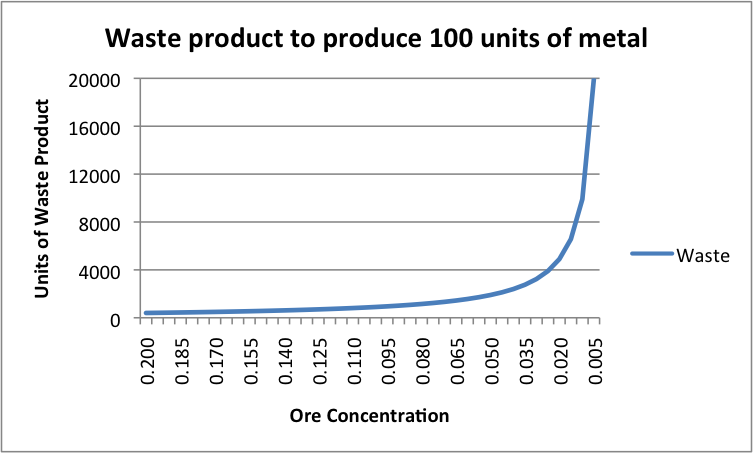

To make matters worse, the rapidly rising need for investment capital arises is other industries as well as fossil fuels. Metals extraction follows somewhat the same pattern. We extracted the highest grade ores, in the most accessible locations first. We can still extract more metals, but we need to move to lower grade ores. This means we need to remove more of the unwanted waste products, using more resources, including energy resources.

Figure 3. Waste product to produce 100 units of metal

There is a huge increase in the amount of waste products that must be extracted and disposed of, as we move to lower grade ores (Figure 3). The increase in waste products is only 3% when we move from ore with a concentration of .200, to ore with a concentration .195. When we move from a concentration of .010 to a concentration of .005, the amount of waste product more than doubles.

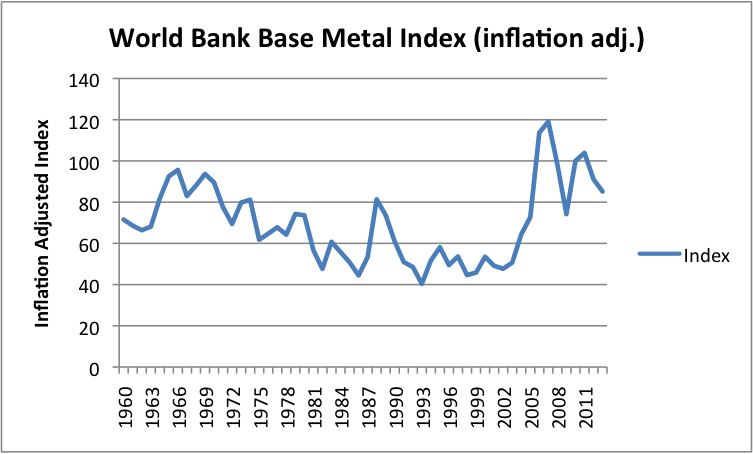

When we look at the inflation adjusted cost of base metals (Figure 4 below), we see that the index was generally falling for a long period between the 1960s and the 1990s, as productivity improvements were greater than falling ore quality.

Figure 4. World Bank inflation adjusted base metal index (excluding iron).

Since 2002, the index is higher, as we might expect if we are starting to reach limits with respect to some of the metals in the index.

There are many other situations where we are fighting a losing battle with nature, and as a result need to make larger resource investments. We have badly over-fished the ocean, so fishermen now need to use more resources too catch the remaining much smaller fish. Pollution (including CO2 pollution) is becoming more of a problem, so we invest resources in devices to capture mercury emissions and in wind turbines in the hope they will help our pollution problems. We also need to invest increasing amounts in roads, bridges, electricity transmission lines, and pipelines, to compensate for deferred maintenance and aging infrastructure.

Some people say that the issue is one of falling Energy Return on Energy Invested (EROI), and indeed, falling EROI is part of the problem. The steepness of the curve comes from the rapid increase in energy products used for extraction and many other purposes, as we approach limits. The investment capital limit was discovered by the original modelers of Limits to Growth in 1972. I discuss this in my post Why EIA, IEA, and Randers’ 2052 Energy Forecasts are Wrong.

2. When the amount of oil extracted each year flattens out (as it has since 2004), a conflict arises: How can there be enough oil both (a) for the growing investment needed to maintain the status quo, plus (b) for new investment to promote growth?

In the previous section, we talked about the rising need for investment capital, just to maintain the status quo. At least some of this investment capital needs to be in the form of oil. Another use for oil would be to grow the economy–adding new factories, or planting more crops, or transporting more goods. While in theory there is a possibility of substituting away from oil, at any given point in time, the ability to substitute away is quite limited. Most transport options require oil, and most farming requires oil. Construction and road equipment require oil, as do diesel powered irrigation pumps.

Because of the lack of short term substitutability, the need for oil for reinvestment tends to crowd out the possibility of growth. This is at least part of the reason for slower world-wide economic growth in recent years.

3. In the crowding out of growth, the countries that are most handicapped are the ones with the highest average cost of their energy supplies.

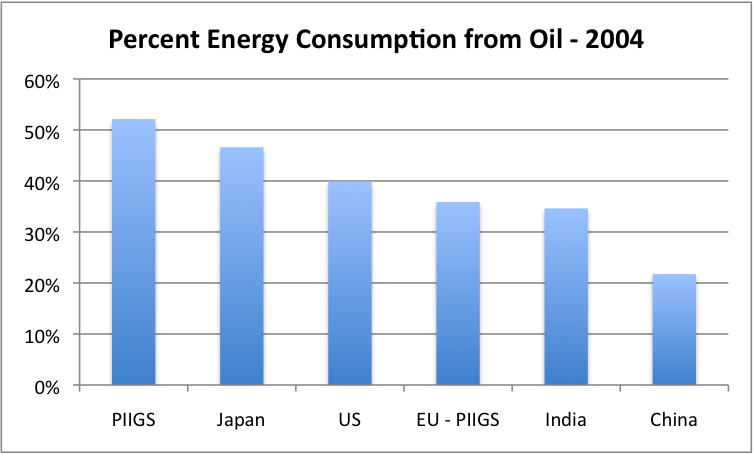

For oil importers, oil is a very high cost product, raising the average cost of energy products. This average cost of energy is highest in countries that use the highest percentage of oil in their energy mix.

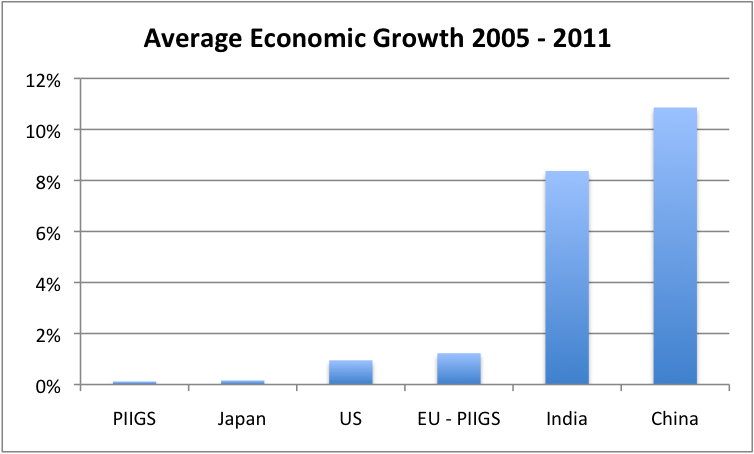

If we look at a number of oil importing countries, we see that economic growth tends to be much slower in countries that use very much oil in their energy mix. This tends to happen because high energy costs make products less affordable. For example, high oil costs make vacations to Greece unaffordable, and thus lead to cut backs in their tourist industry.

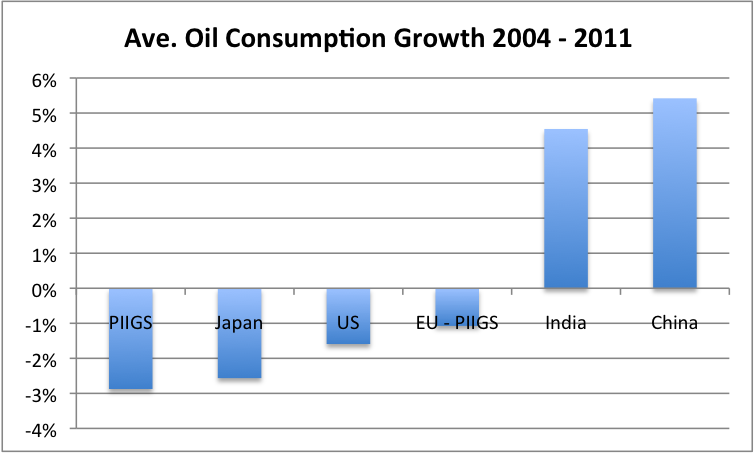

It is striking when looking at countries arrayed by the proportion of oil in their energy mix, the extent to which high oil use, and thus high cost energy use, is associated with slow economic growth (Figure 5, 6, and 7). There seems to almost be a dose response–the more oil use, the lower the economic growth. While the PIIGS (Portugal, Italy, Ireland, Greece, and Spain) are shown as a group, each of the countries in the group shows the same pattern on high oil consumption as a percentage of its total energy production in 2004.

Globalization no doubt acted to accelerate this shift toward countries that used little oil. These countries tended to use much more coal in their energy mix–a much cheaper fuel.

Figure 5. Percent energy consumption from oil in 2004, for selected countries and country groups, based on BP 2013 Statistical Review of World Energy. (EU – PIIGS means “EU-27 minus PIIGS’)

Figure 6. Average percent growth in real GDP between 2005 and 2011, based on USDA GDP data in 2005 US$.

Figure 7. Average percentage consumption growth between 2004 and 2011, based on BP’s 2013 Statistical Review of World Energy.

4. The financial systems of countries with slowing growth are especially affected, as are the governments. Debt becomes harder to repay with interest, as economic growth slows.

With slow growth, debt becomes harder to repay with interest. Governments are tempted to add programs to aid their citizens, because employment tends to be low. Governments find that tax revenue lags because of the lagging wages of most citizens, leading to government deficits. (This is precisely the problem that Turchin and Nefedov noted, prior to collapse, when they analyzed eight historical collapses in their book Secular Cycles.)

Governments have recently attempt to fix both their own financial problems and the problems of their citizens by lowering interest rates to very low levels and by using Quantitative Easing. The latter allows governments to keep even long term interest rates low. With Quantitative Easing, governments are able to keep borrowing without having a market of ready buyers. Use of Quantitative Easing also tends to blow bubbles in prices of stocks and real estate, helping citizens to feel richer.

5. Wages of citizens of countries oil importing countries tend to remain flat, as oil prices remain high.

At least part of the wage problem relates to the slow economic growth noted above. Furthermore, citizens of the country will cut back on discretionary goods, as the price of oil rises, because their cost of commuting and of food rises (because oil is used in growing food). The cutback in discretionary spending leads to layoffs in discretionary sectors. If exported goods are high priced as well, buyers from other countries will tend to cut back as well, further leading to layoffs and low wage growth.

6. Oil producers find that oil prices don’t rise high enough, cutting back on their funds for reinvestment.

As oil extraction costs increase, it becomes difficult for the demand for oil to remain high, because wages are not increasing. This is the issue I describe in my post What’s Ahead? Lower Oil Prices, Despite Higher Extraction Costs.

We are seeing this issue today. Bloomberg reports, Oil Profits Slump as Higher Spending Fails to Raise Output. Business Week reports Shell Surprise Shows Profit Squeeze Even at $100 Oil. Statoil, the Norwegian company, is considering walking away from Greenland, to try to keep a lid on production costs.

7. We find ourselves with a long-term growth imperative relating to fossil fuel use, arising from the effects of globalization and from growing world population.

Globalization added approximately 4 billion consumers to the world market place in the 1997 to 2001 time period. These people previously had lived traditional life styles. Once they became aware of all of the goods that people in the rich countries have, they wanted to join in, buying motor bikes, cars, televisions, phones, and other goods. They would also like to eat meat more often. Population in these countries continues to grow adding to demand for goods of all kinds. These goods can only be made using fossil fuels, or by technologies that are enabled by fossil fuels (such as today’s hydroelectric, nuclear, wind, and solar PV).

8. The combination of these forces leads to a situation in which economies, one by one, will turn downward in the very near future–in a few months to a year or two. Some are already on this path (Egypt, Syria, Greece, etc.)

We have two problems that tend to converge: financial problems that countries are now hiding, and ever rising need for resources in a wide range of areas that are reaching limits (oil, metals, over-fishing, deferred maintenance on pipelines).

On the financial side, we have countries trying to hang together despite a serious mismatch between revenue and expenses, using Quantitative Easing and ultra-low interest rates. If countries unwind the Quantitative Easing, interest rates are likely to rise. Because debt is widely used, the cost of everything from oil extraction to buying a new home to buying a new car is likely to rise. The cost of repaying the government’s own debt will rise as well, putting governments in worse financial condition than they are today.

A big concern is that these problems will carry over into debt markets. Rising interest rates will lead to widespread defaults. The availability of debt, including for oil drilling, will dry up.

Even if debt does not dry up, oil companies are already being squeezed for investment funds, and are considering cutting back on drilling. A freeze on credit would make certain this happens.

Meanwhile, we know that investment costs keep rising, in many different industries simultaneously, because we are reaching the limits of a finite world. There are more resources available; they are just more expensive. A mismatch occurs, because our wages aren’t going up.

The physical amount of oil needed for all of this investment keeps rising, but oil production continues on its relatively flat plateau, or may even begins to drop. This leads to less oil available to invest in the rest of the economy. Given the squeeze, even more countries are likely to encounter slowing growth or contraction.

9. My expectation is that the situation will end with a fairly rapid drop in the production of all kinds of energy products and the governments of quite a few countries failing. The governments that remain will dramatically cut services.

With falling oil production, promised government programs will be far in excess of what governments can afford, because governments are basically funded out of the surpluses of a fossil fuel economy–the difference between the cost of extraction and the value of these fossil fuels to society. As the cost of extraction rises, the surpluses tend to dry up.

Figure 8. Cost of extraction of barrel oil, compared to value to society. Economic growth is enabled by the difference.

As these surpluses shrink, governments will need to shrink back dramatically. Government failure will be easier than contracting back to a much smaller size.

International finance and trade will be particularly challenging in this context. Trying to start over will be difficult, because many of the new countries will be much smaller than their predecessors, and will have no “track record.” Those that do have track records will have track records of debt defaults and failed promises, things that will not give lenders confidence in their ability to repay new loans.

While it is clear that oil production will drop, with all of the disruption and a lack of operating financial markets, I expect natural gas and coal production will drop as well. Spare parts for almost anything will be difficult to get, because of the need for the system of international trade to support making these parts. High tech goods such as computers and phones will be especially difficult to purchase. All of these changes will result in a loss of most of the fossil fuel economy and the high tech renewables that these fossil fuels support.

A Forecast of Future Energy Supplies and their Impact

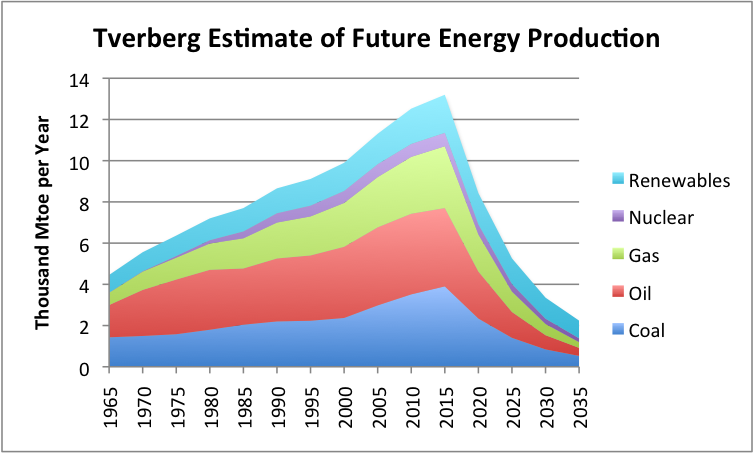

A rough estimate of the amounts by which energy supply will drop is given in Figure 9, below.

Figure 9. Estimate of future energy production by author. Historical data based on BP adjusted to IEA groupings.

The issue we will be encountering could be much better described as “Limits to Growth” than “Peak Oil.” Massive job layoffs will occur, as fuel use declines. Governments will find that their finances are even more pressured than today, with calls for new programs at the time revenue is dropping dramatically. Debt defaults will be a huge problem. International trade will drop, especially to countries with the worst financial problems.

One big issue will be the need to reorganize governments in a new, much less expensive way. In some cases, countries will break up into smaller units, as the Former Soviet Union did in 1991. In some cases, the situation will go back to local tribes with tribal leaders. The next challenge will be to try to get the governments to act in a somewhat co-ordinated way. There may need to be more than one set of governmental changes, as the global energy supplies decline.

We will also need to begin manufacturing goods locally, at a time when debt financing no longer works very well, and governments are no longer maintaining roads. We will have to figure out new approaches, without the benefit of high tech goods like computers. With all of the disruption, the electric grid will not last very long either. The question will become: what can we do with local materials, to get some sort of economy going again?

NON-SOLUTIONS and PARTIAL SOLUTIONS TO OUR PROBLEM

There are a lot of proposed solutions to our problem. Most will not work well because the nature of the problem is different from what most people have expected.

1. Substitution. We don’t have time. Furthermore, whatever substitutions we make need to be with cheap local materials, if we expect them to be long-lasting. They also must not over-use resources such as wood, which is in limited supply.

Electricity is likely to decline in availability almost as quickly as oil because of inability to keep up the electrical grid and other disruptions (such as failing governments, lack of oil to lubricate machinery, lack of replacement parts, bankruptcy of companies involved with the production of electricity) so is not really a long-term solution to oil limits.

2. Efficiency. Again, we don’t have time to do much. Higher mileage cars tend to be more expensive, replacing one problem with another. A big problem in the future will be lack of road maintenance. Theoretical gains in efficiency may not hold in the real world. Also, as governments reduce services and often fail, lenders will be unwilling to lend funds for new projects which would in theory improve efficiency.

In some cases, simple devices may provide efficiency. For example, solar thermal can often be a good choice for heating hot water. These devices should be long-lasting.

3. Wind turbines. Current industrial type wind turbines will be hard to maintain, so are unlikely to be long-lasting. The need for investment capital for wind turbines will compete with other needs for investment capital. CO2 emissions from fossil fuels will drop dramatically, with or without wind turbines.

On the other hand, simple wind mills made with local materials may work for the long term. They are likely to be most useful for mechanical energy, such as pumping water or powering looms for cloth.

4. Solar Panels. Promised incentive plans to help homeowners pay for solar panels can be expected to mostly fall through. Inverters and batteries will need replacement, but probably will not be available. Handy homeowners who can rewire the solar panels for use apart from the grid may find them useful for devices that can run on direct current. As part of the electric grid, solar panels will not add to its lifetime. It probably will not be possible to make solar panels for very many years, as the fossil fuel economy reaches limits.

5. Shale Oil. Shale oil is an example of a product with very high investment costs, and returns which are doubtful at best. Big companies who have tried to extract shale oil have decided the rewards really aren’t there. Smaller companies have somehow been able to put together financial statements claiming profits, based on hoped for future production and very low interest rates.

Costs for extracting shale oil outside the US for shale oil are likely to be even higher than in the US. This happens because the US has laws that enable production (landowner gets a share of profits) and other beneficial situations such as pipelines in place, plentiful water supplies, and low population in areas where fracking is done. If countries decide to ramp up shale oil production, they are likely to run into similarly hugely negative cash flow situations. It is hard to see that these operations will save the world from its financial (and energy) problems.

6. Taxes. Taxes need to be very carefully structured, to have any carbon deterrent benefit. If part of taxes consumers would normally pay to the government are levied on fuel for vehicles, the practice can encourage more the use of more efficient vehicles.

On the other hand, if carbon taxes are levied on businesses, the taxes tend to encourage businesses to move their production to other, lower-cost countries. The shift in production leads to the use of more coal for electricity, rather than less. In theory, carbon taxes could be paired with a very high tax on imported goods made with coal, but this has not been done. Without such a pairing, carbon taxes seem likely to raise world CO2 emissions.

7. Steady State Economy. Herman Daly was the editor of a book in 1973 called Toward a Steady State Economy, proposing that the world work toward a Steady State economy, instead of growth. Back in 1973, when resources were still fairly plentiful, such an approach would have acted to hold off Limits to Growth for quite a few years, especially if zero population growth were included in the approach.

Today, it is far too late for such an approach to work. We are already in a situation with very depleted resources. We can’t keep up current production levels if we want to–to do so would require greatly ramping up energy production because of the rising need for energy investment to maintain current production, discussed in Item (1) of Our Energy Predicament. Collapse will probably be impossible to avoid. We can’t even hope for an outcome as good as a Steady State Economy.

7. Basing Choice of Additional Energy Generation on EROI Calculations. In my view, basing new energy investment on EROI calculations is an iffy prospect at best. EROI calculations measure a theoretical piece of the whole system–”energy at the well-head.” Thus, they miss important parts of the system, which affect both EROI and cost. They also overlook timing, so can indicate that an investment is good, even if it digs a huge financial hole for organizations making the investment. EROI calculations also don’t consider repairability issues which may shorten real-world lifetimes.

Regardless of EROI indications, it is important to consider the likely financial outcome as well. If products are to be competitive in the world marketplace, electricity needs to be inexpensive, regardless of what the EROI calculations seem to say. Our real problem is lack of investment capital–something that is gobbled up at prodigious rates by energy generation devices whose costs occur primarily at the beginning of their lives. We need to be careful to use our investment capital wisely, not for fads that are expensive and won’t hold up for the long run.

8. Demand Reduction. This really needs to be the major way we move away from fossil fuels. Even if we don’t have other options, fossil fuels will move away from us. Encouraging couples to have smaller families would seem to be a good choice.

63 Comments on "A Forecast of Our Energy Future; Why Common Solutions Don’t Work"

Nony on Fri, 31st Jan 2014 3:15 pm

1. Why do you have nuclear, gas, and coal dropping at the same time (approx.) as oil? Surely if we are running out of oil, these other energies will take off as substitutes?

2. Don’t you think the market will just price in the danger of oil dropping? IOW, if we’re really on the last gasp, then Hotelling (look him up, amazing economist and statistician…should have won Nobel price, not kidding) theory implies the price today will be higher because of future shortage.

3. (speculation for Rock man): Is it possible that shale (and the like, sands…other high cost oils) are sort of setting a ceiling for price? IOW, if we had not had the couple million of tight oil, what would price be now? that can be calculated, with an assumption of elasticity of demand (demand is inelastic but not perfectly so). And it’s not just the actual production, but the “threat” of it. If we have $500/bbl oil, the Eurocoms, libruls, etc. will get over their GMO-style fear of fracking. And I find it hard to believe only the US has the rocks needed for shale oil production. So, the threat of shale is an implicit limiter on future scarcity, and thus current pricing.

Northwest Resident on Fri, 31st Jan 2014 3:19 pm

As far as I can tell, Gail is presenting nothing but the facts here, putting it all together in a way that leads to some inescapable conclusions. My “take-away” from reading this article (again) is, prepare for a time which is fast approaching when I’m going to need to guarantee my own food supply and other necessities, because those things won’t be at the local convenience store for much longer.

Northwest Resident on Fri, 31st Jan 2014 3:24 pm

Nony — in answer to your question #1, let me take a crack at it.

I think the reason that nuclear, gas and coal dropping at the same approximate time as oil is due to the fact that without oil (and fully operational transportation both on a national and on an international basis, which is conventional-oil dependent), it won’t be possible to dig out the coal or drill for the NG, or manufacture, build and service nuclear plants. Once transportation starts dropping off due to lack of oil inputs, everything else will come to a complete stop also. IMO.

Nony on Fri, 31st Jan 2014 3:34 pm

NW, gotcha. Still, that doesn’t make complete sense to me. Think about basic supply and demand from microeconomics. What is the demand curve? It can be approximated as a set of rectangles. Different segments have different willingness to pay. So, industries with the ability to switch out drop out first, people who are poor drop out first, etc. I have to think that diesel fuel to run the truck to haul the nuclear fuel is going to have a very high willingness to pay, especially considering that the price of the nuke fuel will be rising as well!

P.s. I just looked up the futures market and it looks like 3 year out crude is priced at ~75. So the market is not assuming a calamity or even continued scarcity. Of course the market could be wrong on the low or the high side. Still, it’s our best guess. If I’m going to invest in production, then I can hedge the energy price. Capital is the ultimate commodity. It can flow with the push of a button. Easier than men and machines and technical expertise.

P.s.s. I don’t see how we can simultaneously fear “Simmons cliff” type scarcity (and the 500 bbl oil, from his youtube vids), while also saying that the Bakken may go bust to boom since we could have a price crash.

ghung on Fri, 31st Jan 2014 3:37 pm

“1. Why do you have nuclear, gas, and coal dropping at the same time (approx.) as oil?”

Gail’s contention is that oil, as the master resource, largely underwrites the production and availability of all other major energy sources, physically and financially. Without ‘cheap’ oil, economies won’t be able to support other energy sources or the process of substitution at scale. If the money (credit) isn’t available to bring evermore expensive oil to market, it won’t be available for ramping up, or maintaining, other sources. It’s a systemic catch 22. We simply won’t have the ability to do much of anything because the global economy will be in contraction.

The true master resources, currently, are credit and growth. Without that, the other things are simply not supportable at scale.

Nony on Fri, 31st Jan 2014 3:44 pm

I really think the Bakken is amazing. Yeah, it hasn’t driven $20/bbl oil. And yeah, it will run out. And yeah, even 7 billion barrels is less than 10% of the world’s usage. But it’s still freaking brave and American and all. Before raining on the parade, can’t we rejoice in it, for just a second? I remember reading all the mid-2000s peak oil calamity stuff. And NO ONE predicted the Bakken. And when new sources were talked about, they downplayed them (sands will be dirty oil and expensive, blabla). And even at low 100s, old disucssions said it would not go high. Even the Red Queen thing said 600-700 max and in just a few months, we were at 800 (now 900).

Just the whole movement of men and gear and heavy metal…it just seems cool. You want some “good jobs”, not flipping a sign in Cali or working in Wal-Mart. These are. Maybe it’s a last gasp of oil (or even a last gasp of capitalism), but I just think it’s cool…and let me enjoy it for a few months. 🙂

Maybe it’s a spiritual thing, but I wonder if some people (like a friend I have at MSFT, who is all Democrat and all and earns multi-hundred K and hates fracking, but has two houses and flies to Europe, blabla) don’t like the oil biz…because of how American and brave it is.

ghung on Fri, 31st Jan 2014 3:44 pm

Nony: “Capital is the ultimate commodity. It can flow with the push of a button. Easier than men and machines and technical expertise.”

Some believe we’re reaching criticality in capital markets. Good evidence for that, currently. “Extraordinary measures” have their own limits. Big reset ahead, which doesn’t bode well for future energy production/substitution at scale.

Nony on Fri, 31st Jan 2014 3:48 pm

Don’t get me started on the banksters. I think the whole bailout took what would have been a finance industry haircut and transformed it into an industrial slowdown.

It’s amazing to me that liberals, conservatives and moderates ALL hated the bailouts. Milton Friedman is turning over in his grave. Screw Goldman. I’ve worked with some of those people…they ain’t that smart…and they definitely aren’t brave and true.

Davy, Hermann, MO on Fri, 31st Jan 2014 3:50 pm

I share Gail’s view of the clear and present dangers. It is all about Economics both in the financial and energy sectors. The financial system will most likely falter first. If it limps along then the energy trap/brick wall kicks in. We have a very short time for this new normal we are in to change to a new and gloomier normal. It is the stair step down the growth curve. We are in the gentle part now. My projections are like hers with a year either side of 2020 as crunch time for energy. Finance is happening now but finance is so wrapped up in psychology it is hard to say if a significant correction is in the offing now. Finance is too hard to predict especially in the new normal we are in. Yet every indication points to a dramatic drop at some point in the near future

ghung on Fri, 31st Jan 2014 3:51 pm

Just remember, the longer the party gets dragged out, the worse the hangover,, and it’s usually those who weren’t invited (i.e. our children) who get left to clean up the puke and mess.

Jerry McManus on Fri, 31st Jan 2014 3:57 pm

Gail’s analysis is consistent with the one published 40 years ago in the book “Limits to Growth”.

As non-renewable resources become more difficult and more expensive to extract then that will in turn suck more capital (in the broad sense of the word, not just money) out of the rest of the economy.

Eventually the returns diminish to a point where a threshold is crossed and the global economy crashes.

This is also similar to Tainter’s analysis in the book “Collapse of Complex Societies”, although he didn’t put it in the context of resources.

The basic idea being that the harder we try to sustain the unsustainable the worse the resulting collapse will be.

At the most fundamental level it is the imperative for growth that must change, but don’t try telling that to the world.

It didn’t work 40 years ago and it isn’t working today.

Davy, Hermann, MO on Fri, 31st Jan 2014 4:35 pm

Jerry McManus on Fri, 31st Jan 2014 3:57 pm

Gail’s analysis is consistent with the one published 40 years ago in the book “Limits to Growth”.

Jerry, I would agree but with one caveat that is “immediacy”. We are now here and not 40 years ago. We are now in hard reality and not Tainters view in writing.

Of all the writers on the subject now Gail best exposing the mixture of finance and energy and the resulting systematic risk.

I do not want to brag here and be a Pops. How many of you have been at this for 11 years or more. I started my tour originally in 1985 in college in geology class with an into to Hubert. I have taken allot of turns since then. I have gone from hell bent to prepare to gliding along. Currently I am slowly building my life boat.

My point is that many who are new to this concept have not walked through the valley of the fallen so to speak. If you are just bloggin, great, but are you livin it too.

ghung on Fri, 31st Jan 2014 5:06 pm

“If you are just bloggin, great, but are you livin it too.”

Nah, Dave, most aren’t. If you’re like us, they probably plan to show up at your place if this crisis becomes deep and sudden. We have friends and family who’ve said as much as they humour my ‘eccentricities’.

My wife laughed her ass off when we watched the Twilight Zone episode “The Shelter” a couple of weeks ago. Every lifeboat builder should watch it.

I’m still wondering what Gail’s plan is since she’s such a doomer. She hasn’t said anything about that, that I recall. In fact, she doesn’t say much regarding responses or preps at all.

Nony on Fri, 31st Jan 2014 5:10 pm

(caveat, this is a swag, but at least it shows effort to analyze)

Based on an estimate of 0.3 for inelastic demand for crude, the extra US production being about 3% of world supply, that implies that 3/.3=10%. Therefore, US production led to a price that was 10% lower than what it would have been without it. Yeah, the actual production is small, but the impact of price is significant. A 10% lower or higher price affects the economy.

I would also think that the implicit “threat” of future global shale production has an impact on prices also. It’s not some corny wet dream of drinking light sweet crude (yummy yummy). But it is keeping the Simmons cliff 200/bbl++ wolf away from the door.

ghung on Fri, 31st Jan 2014 5:11 pm

The Shelter: http://www.youtube.com/watch?v=961rUJyRHiM

rollin on Fri, 31st Jan 2014 5:25 pm

Put aside some extra shoes and socks. There may be lots of walking in your future.

babumai on Fri, 31st Jan 2014 5:49 pm

I believe copper ore grades have fallen from about 2% to about 1% over the past thirty years, and are improving slightly now, at the cot of building infrastructure to remote areas.

Iron ore “grades” are more like 50%. Coal is coal, though the higher BTU may be diminished.

So while the ore grade chart shown is interesting and has some truth, it is highly deceptive if you think we’re anywhere near that curve.

Overburden is a bigger issue, but also has nothing like that curve.

Cost is a significant problem, but charts like that make folks think doomers are doomers instead of analytical.

rockman on Fri, 31st Jan 2014 5:55 pm

Nony – “Is it possible that shale (and the like, sands…other high cost oils) are sort of setting a ceiling for price?” I know this can be confusing for the non-geonerds. No…the cost of developing the shales, Deep Water fields, etc. doesn’t set the price of oil. It’s the price of oil that determines what we drill. The folks that buy my oil couldn’t care less what it cost me to produce: they’ll pay me the same if it cost me $40/bbl or $140/bbl. They pay the current market price. What always sets the price for Oil/NG is what price the buyers can pay. In 1986 oil fell to almost $10/bbl because that’s all the buyers would pay. Oil cost significantly more to develop then $10/bbl at thy time. But the market place didn’t care.

If the world dives into another recession as it did in the mid 80’s and oil falls to $40/bbl then most if not all the shale development will stop. The cost to drill the shales won’t drop significantly and what ever that cost might be it won’t change the $40/bbl market price of oil.

It might sound counterintuitive but I’ll stand by my previous observation: the boom in unconventional production is one of the best evidences of the PO dynamic. It’s that dynamic that has pushed the price of oil up and that has justified the drilling of the expensive shales and other reserves. IOW the increase in US oil production is not a good thing. We may be producing more domestic oil but the same forces that brought that about has led Americans to paying 3X as much for oil today as 10 years ago. And while we are importing fewer bbls of oil we are paying more for those imports then when we were importing more.

IOW the US was doing much better from the oil energy standpoint before the unconventional boom then we are now. The only exception is the Rockman and his oil patch cohorts. We are doing much better now. Thank you, suckers. LOL.

Nony on Fri, 31st Jan 2014 5:58 pm

Rockman makes a (great) point about how much money we are spending and sending overseas for oil. It really is the wealth transfer to SA that matters as well as the (Gail is right here) brake that high oil puts on the rest of economy. I lurve the plucky Bakken boom. But if I had to choose $40/bbl at the cost of the boom going bust, it’s a no brainer to me.

Additive to my back of the envelope above, is some followup on Rockman comments. So, the Bakken (and EF and other US response) has had a double benefit. The direct one of replacing money heading to ME* as well as the direct replacement. So…yes, we are not in corny heaven. But Bakken (and EF, etc.) has HUGE impacts on the economy here. Imagine what things would be like without them. All the analysis about how “things are still bad” (Rockman’s points, which I agree with) just even reinforce how much benefit we’ve had from the old oil patchers, from little oil.

Nony on Fri, 31st Jan 2014 6:03 pm

*I consider oil fungible (yes, not perfectly, but implicitly). So, I could care less about “who supplies who”. If the world price goes up, net exporters benefit and net importers are hurt. And the world as a whole is hurt, because oil is an important input to production.

rockman on Fri, 31st Jan 2014 6:09 pm

Nony – “Therefore, US production led to a price that was 10% lower than what it would have been without it. Yeah, the actual production is small, but the impact of price is significant”. And there’s the chicken/egg contradiction. As I just pointed out had oil prices not increased we would not have seen the increase in US oil production. The “if” portion of the statement fails IMHO: “If US oil production had not increased would we be paying more?” US oil production would not have increased IF WE HADN’T been paying more for oil.

Nony on Fri, 31st Jan 2014 6:09 pm

Thank you, to who ever posted the Twilight Zone episode. I found it interesting for many reasons. Not just the neighbors willing to kill for survival, but even the impact on the doctor of deciding to exclude his neighbors. From a personal perspective, I have been around men who gave their lives for others. And every day that goes by, I think about a marine who dived on a hand grenade…it’s not just a sea story. I guess I would say that people can be base, but I’ve also seen amazing acts of courage (not the grenade…that still affected me, though, back in my 20s).

eugene on Fri, 31st Jan 2014 6:16 pm

In the whole scope of things, Bakken/Eagle Ford are a drop in the bucket. And I fully understand that Americans who, typically, have great difficulty thinking outside the borders of America, are extremely hyped/optimistic about shale. Unfortunately, if one thinks on a global scale they account for 1 or 2 percent of world consumption. And world decline rates run +/- 5% per yr. Plus if one stops to calculate rates of decline which equals ever increasing drilling, the picture darkens considerably. I agree with Rockman re shale. I think all shale has done is set us back considerably as Americans will simply think all is BS and press on. And we Americans do love happy bullshit. Makes me think of the old days when I had a toke too many.

Nony on Fri, 31st Jan 2014 6:19 pm

Rockman, of course. I’m not a brainless cornie (although I wish it were the case, my sympathy is there) nor am I a “nosedive to the desert” doomer.

Of COURSE production of tight oil (you don’t even need to go there, just the DAMNED price itself!) is evidence of running out of oil.

But I’m into a level of nuance. Consider a mathematical thought experiment (don’t get all burly, salty oilman on me. ;))) What if we were (realio trulio) running out of cheap oil, but there was an infinite supply of oil at 100/bbl. Obviously, this would set a ceiling, no? Life would still suck. But not as bad as the Simmmons style (2005ish) peak oil speculation. No? I mean, the natural gas market functions like this, no? I mean…peak gas…give me a break. That is a commodity cycle market and we can get more gas when we need it. yeah, it may never be as easy as it was a long time ago….but also no “cliff”. No way. People pulled out because it got too cheap. There is an implicit ceiling.

GregT on Fri, 31st Jan 2014 6:20 pm

“How many of you have been at this for 11 years or more.”

We were actually taught most of this in high school back in the 70s. The population explosion, the greenhouse effect, exponential growth, finite resources, etc.. Strange how so many appear to have forgotten, or perhaps have chosen to forget. People generally don’t like to think about ‘negative’ things. We need hope for the future. Maybe deep down inside people are mostly unable to face their own deaths, and this is the way that they deal with it? Just a thought.

For myself, life just kept going on. Education, a career, relationships, parties, vacations, deaths, marriage, children, all of the usual stuff. Then one day, back around 2002, I had concerns over what was occurring with the west coast salmon stocks. ( I have always been an avid fisherman and outdoorsman ) The numbers of returning salmon had crashed, and I needed to know why. The usual finger pointing; commercial overfishing, native fisheries, sport fishing, stream erosion, etc., wasn’t making much sense any more. Too much had changed in too short a period of time.

That was the first time that I became aware of ocean acidification. At first I couldn’t believe what I was hearing, which made me search for more answers. Over the next couple of years I read every paper, I watched every video, every lecture, and every talk that I could find. The hole just kept getting deeper and deeper. Then one day I stumbled onto a website called; The Wolf at the Door, the beginner’s guide to peak oil. It was as if somebody had smacked me squarely in the forehead with a 2 x 4.

I have gone through all of Kübler-Ross’s stages, not necessarily in any order, spent a long time swinging back and forth through the denial stage, and have finally come to some form of acceptance. It has been a long journey. I am fortunate to have a wife that understands, although I really can’t say I ‘know’ exactly what stage she is at, she does appear to accept where we are headed. At least she is involved with our plans for a sustainable future. If that is even a possibility.

Probably the most difficult aspect for me, has been the lack of people that I am able to discuss things with. It has come to the point, that part of my acceptance is that I must mostly keep what I understand, to myself.

So yes, I guess you could say that I have been AT this for 11 years or more, and yes I have most definitely been living it. I am also sure, that most of the people that have come to accept the reality of what we face, have similar stories, and have gone through a similar emotional, roller coaster ride.

Northwest Resident on Fri, 31st Jan 2014 6:23 pm

Nony, I think there is a limit to how badly “net importers are hurt” before they simply roll over and shout “uncle”. Gail and many others have made the convincing argument that it is the sudden and skyrocketing increase in the price of oil back in 2007 – 2008 that pushed our economy over the cliff (and we are still in free-fall with the Fed wildly flapping its wings trying to keep us aloft for a little while longer but that rocky bottom is coming up fast).

If it wasn’t for all the unconventional oil, rockman previously made a very good point — fifty percent (or so) of the current oil industry workers would be sitting idle AND the “reserves” on public oil company books that Wall Street (and all investors) look at before making their bets on oil investments would be far fewer. Those two things combined — armies of unemployed oil workers and extremely low reserves showing for future development — would KILL the illusion of “BAU forever — let the good times roll”. Investors would head for the caves with their money, the panic would spread, the global economy — maintained as it is by faith and trust — would take a big hit, probably a final, fatal hit.

Nony on Fri, 31st Jan 2014 6:25 pm

Rockman: moving off the econ/geo stuff. I’ve always been intrigued by the oil business and geology. I never did it. Went different ways in my life, military and bounced around industries. But I always thought of geology as something cool. I mean you get to do science, but also wear blue jeans, drive a jeep, fight beduins, spud in oil wells, taste the dirt. Work outdoors and also do science. It’s kind of cool, no? The balance of science and adventure. Even the bets are big bets of money. And they’re really doing things. Not putzing around in some big corporate structure, kissing your bosses ass. Or like pure finance or insurance. Where it’s all an intangible product. But an actual input to production, pulled out of the Earth. Almost like the zen of being a farmer.

Dave Thompson on Fri, 31st Jan 2014 6:34 pm

Plus or minus energy inputs, equals, the economy. The economy equals, energy inputs, plus or minus. This I have learned on my D- average, high school education. The money don’t mean a thing, the money is used to distract the truth. Great article by the way, this should be screamed out in the news headlines. It will not however, the bankers and corporations need us all to think otherwise.

Northwest Resident on Fri, 31st Jan 2014 6:34 pm

GregT — I was always aware that things would eventually not be able to continue going as they have — that BAU would eventually come to a halt. But even though my brother and a number of people that we hung out with were “doomer types” from way back, I always scoffed at their predictions of approaching doom. Then, one day about seven or eight months ago, reading financial news as I do from time to time, it occurred to me that our economy was facing significant challenges. That lead me to dig into the matter further, and I began to find information that I hadn’t previously been exposed to — especially concerning the oil business. In about a 2-day period I went from “BAU will last far into the future” to “BAU will come to an end within my lifetime, and quite possibly within the next couple years or so”. What an adrenaline rush that was! Since then, I have been on a MISSION, to get ready for whatever and whenever, and I’m just about to complete my “master plan” for survival in the new world. I hope that everybody coming to this website and reading these articles will get that same sense of urgency that I felt and still feel, because this balloon is about to pop.

ghung on Fri, 31st Jan 2014 6:44 pm

Nony: Probably the most telling metric regarding the oil depletion situation is that (IIRC) a 300+% increase in global oil prices has gotten us a whopping 12% increase in production. Maybe Rock, et. al., can correct my numbers. Whatever they are, it seems like an extreme case of diminishing returns to society, which world markets can only compensate for temporarily. Most peak oilers underestimated the ability of markets to extend, pretend, and ‘rob Peter to pay Paul’s fuel bill’.

I expect markets will be reacting more ‘honestly’ to this reality in the near future. We’re already seeing exporting nations crash and burn as they approach the point of being ex-exporters. Egypt is a classic case. Who’s next? Argentina? As for heavy importers, the list of countries in dire straits is long and growing.

Nony on Fri, 31st Jan 2014 6:48 pm

Thank you, to whoever posted the TZ episode. I enjoyed it, even if I am different from you all. Thank you.

I think I am more of a critic, writer type than a completely self interested economic actor. I (really did) saw the dotcom crash when my HBS buddies were head over butts in love with it. I did stay out of doing dotcom work and concentrated on “real product” econ. But I didn’t short. I didn’t even get out of high end work that ended up being impacted by the dotcom crash.

Similarly with Enron. I had inside connections to some of the people doing smoke and mirrors stuff. I didn’t know the extent. And didn’t know about the accounting fraud. But I did know that when I pushed these Skilling types, they could not answer hard questions about the real value creation. I do feel proud that I kept them out of a chemical industry client of mine. But other than that, I didn’t do anything to benefit myself. I didn’t build a bomb shelter, if you get my drift.

GregT on Fri, 31st Jan 2014 7:07 pm

NWR,

The only questions I have at this point, are how long do we have until this all comes crashing down, and how much damage are we going to do to the planet in the interim? I have explored every possible avenue that I can think of, and they all lead me back to the same place. What we are presently doing is unsustainable, and the harder and longer we attempt to sustain it, the worse the consequences will be. Ghung’s analogy above; the longer the party gets dragged out, the worse the hangover, I believe, is spot on.

Interestingly enough, I can see in others, what I have already been through. The bargaining, the denial, the anger, the depression, been there done that. In some strange way, I now feel a calmness. Other than doing my best to prepare for whatever may come, I know that there is nothing that can change the direction that we are headed in. As I have said before, my biggest hope, is that we can end this insanity sooner than later. This Earth truly is an amazing and wonderful place, and it will be the greatest tragedy ever, for us humans to destroy so much life.

Nony on Fri, 31st Jan 2014 7:12 pm

Why are the futures markets anticipating cheaper oil? Rockman is right to watch price. It’s what matters. They assuming an additional recession? But we already had one and other indicators point the opposite way. Assuming that peace will break out in the ME? (don’t see that indication). Assuming that SA will have mercy and crash price out of goodness of heart? (give me a break). That OPEC will lose discipline? (but is it really a functioning cartel, now? I think price more impacted by the real geology than cartel action).

I think the implicit answer is the shale “ceiling”. It’s NOT a corny wet dream. high oil prices SUCK. but still 75/bbl is much better than 200/bbl.

GregT on Fri, 31st Jan 2014 7:21 pm

Nony,

Oil is a finite resource. The implications of that are inevitable. It is only a matter of time. On the other side of the coin, is the damage that we are causing to the Earth by continuing to burn it. Pick your poison, one way or the other, oil is a serious threat to our survival.

Nony on Fri, 31st Jan 2014 7:26 pm

But the Bakken is light and sweet. Like maple syrup. Yummy, yummy. Don’t be a buzz kill.

http://www.youtube.com/watch?v=WeYsTmIzjkw

Northwest Resident on Fri, 31st Jan 2014 7:32 pm

Nony — the only thing “bad” about 75/bbl is that it isn’t a high enough price for oil companies to make a profit (or break even) in the shales. The ONLY reason we’re getting shale development is because the price is high enough to justify going after that oil, and chances are, those companies still aren’t making much of a profit if any. I know all of this because I am a careful student of rockman’s posts…:-)

GregT — I totally agree with your POV. Based on the way things ARE, I completely discount all of the hype and speculation that BAU will somehow manage to keep going for another 10 – 20 or more years. Since my initial “awakening”, I have spent hours and hours educating myself on the situation, and being a straight-A student and very perceptive type, my interpretation is that we don’t have a lot of time. And to me, that is a good thing because, like you, it makes me sick to see the destruction that humans are doing to planet earth. If I worship anything, it is nature. Knowing that entire species are being decimated, that vast tracts of pristine nature are being turned into toxic glowing cesspools of waste, that our magnificent bodies of salt and fresh water are being poisoned — it just turns my stomach. Enough is enough. It is time to bring this phase of human civilization to an end, to give planet earth a chance to heal. I hope that people like you and me and others who post on this site are lucky and prepared enough to make it through the bottleneck, and to be the catalysts for a new phase of human existence where we exist in harmony with nature and limit our technology to sustainable proportions. The big concern, is that dragging BAU too far into the future will waste all or most of the dwindling/scare resources that future humans will need to rebuild and survive. That is a very real danger, IMO.

Stilgar Wilcox on Fri, 31st Jan 2014 7:44 pm

Ghung wrote:

“I’m still wondering what Gail’s plan is since she’s such a doomer. She hasn’t said anything about that, that I recall. In fact, she doesn’t say much regarding responses or preps at all.”

I broached the topic of surviving collapse with Gail at one point, and her take on it was for most people the attempt will be futile due to all the things we take for granted suddenly being gone. That it will much more difficult than most realize.

I know from your posts you are prepared much more than most. But 99%+ are not, and I don’t think Gail has made any preparations.

She has a point – I mean what do you do if you need anti-biotics? What if you need a root canal? How do you get your teeth cleaned. I go every six months and without regular cleaning stuff would build up really fast. Take one week and write down everything you eat. Then multiply by 52 weeks. Where do all those calories come from post collapse? Speaking of which, I know more and more people now that have chickens. Guess they are reading the writing on the wall. The people directly below us have chickens. Guess I’ll be looking for stuff to trade to get eggs. But even then where do you get chicken food whatever that is, seeds? What happens when that supply runs out? It gets very complicated very quickly, keeping in mind one goes from a life of leisure to one of manual labor. Not an easy transformation for most.

Stilgar Wilcox on Fri, 31st Jan 2014 7:58 pm

Ghung, you mentioned you have friends that have joked about showing up at your place should a collapse occur. Well, maybe you remember or should watch the twilight Zone episode, ‘The Shelter.’ Below is a synopsis:

As panic ensues, the doctor locks himself and his family into his shelter. The same gathering of friends becomes hysterical and now wants to occupy the shelter. All of the previous cordiality is now replaced with soaring desperation; pent-up hostility, searing racism, and other suppressed emotions boil to the surface. Stockton offers his basement to the guests, but the shelter itself has sufficient air, provisions, and space for only three people (the Stocktons themselves). The once-friendly neighbors don’t accept this; they break down the shelter door with an improvised battering ram. Just then, a final Civil Defense broadcast announces that the objects have been identified as harmless satellites and that no danger is present. The neighbors apologize for their behavior; yet Stockton wonders if they have destroyed each other without a bomb.

I guarantee any people you know will head for your place post collapse. So better have a plan to accept them or turn them away, but it won’t be pretty either way.

GregT on Fri, 31st Jan 2014 7:59 pm

NWR,

My daughter just got engaged last weekend. Her fiancé and herself are planning on having children. My wife and I are going to do everything that we can, to leave a legacy for all of them. There is little doubt in my mind, that the ‘bottleneck’ will occur in my lifetime. I have no doubt what-so-ever, that their lives will be greatly impacted. If anyone makes it through this, I will make sure that my kids, and my grandkids will.

All my best to you, and yours. Cheers.

GregT on Fri, 31st Jan 2014 8:10 pm

Stilgar,

Not an easy transformation for sure, but you ARE describing the life that my parents grew up in. My parents are still very much alive, and well. That being said, they both lost siblings at a very young age, and my Dad lost all of his teeth by his early 20s.

There are plenty of good books to read, if you are so inclined. People have survived for tens of thousands of years without modern industrial society. Much longer without, than with.

Northwest Resident on Fri, 31st Jan 2014 8:20 pm

Stilgar — I get the same impression from reading Gail’s posts for these last six to seven months or so. Especially her comments. She is all about “enjoying what we have now because it isn’t going to last.” She mentioned her concern that water will be a problem for her in post-collapse. I get the impression that Gail may not be the most physically robust type of individual, and that growing her own food and arming herself isn’t really up her ally. I can testify that growing any amount of vegetables for food involves some physical labor, and the more you grow, the harder you work. For me, that isn’t an issue because I’ve always made physical fitness a top priority and still do — to me, its just another work out. But for a lot of people, most people perhaps, the amount of physical labor involved is just too much. And then, we have individuals who are huge — talking for example along the lines of pro football and/or basketball players. Do you realize how much food it takes to keep that guys going — a lot! How are they going to survive in a collapse world — good question.

rockman on Fri, 31st Jan 2014 9:01 pm

Nony – As a rule I don’t like hypotheticals very much since there are typically not enough specifics laid out. But I’ll play this time. “What if we were running out of cheap oil, but there was an infinite supply of oil at 100/bbl”. And if the global economy could only afford to buy $70/bbl oil…we wouldn’t have an infinite supply of oil. So what would oil sell for? Easy answer: $70/bbl. And that’s what I would sell my producing oil for even if I spent $80/bbl developing it. At that point cash flow trumps profit. And that isn’t theoretical: there were billions of cubic feet of NG sold for less than what it cost the shale gas players back in the ’08 boom.

So how much of that infinite supply of that $100/bbl oil would be developed in a world where no body could pay more than $70/bbl? None. But I can promise you that every ounce of $50/bbl oil available would be drilled. But if the consumers could afford to buy $100/bbl oil they would do so whether there’s an infinite supply or not. Which is exactly where we are today. The oil patch will drill for expensive oil as long as they sell it for a profit. Doesn’t matter if oil is $40 – $70 – $100 per bbl. We’ll develop whatever oil the market place can afford. We don’t get to decide what oil sells for. We only get to decide if it’s worth drilling for.

J-Gav on Fri, 31st Jan 2014 9:05 pm

Rich comments! Well done, guys (and gal). What I might have to add can wait for another occasion after all that … except to say I respect Gail’s sobering analysis in this article even if her physical robustness isn’t up to snuff (getting mid-sixty-ish, I’m not quite as robust as I used to be either…)

ghung on Fri, 31st Jan 2014 9:15 pm

Thanks, Stilgar. I had posted a link to “The Shelter”, above, for folks’ viewing pleasure. Baring all out nuclear war, I expect we’ll have a longer adjustment period, though not as long as most people would like. Also, having been involved in triage situations, I’m the most likely candidate in my family to make hard decisions. I’ve also had discussions with immediate family about what’s expected, and what they can expect, though I consider such as a worst-case scenario. Still, ‘The Shelter’ is an interesting and useful study, IMO. Like the Doc, we’ll protect and support our own first. It’s a Darwinian thing that most folks dare not contemplate.

As for your suggestion that Gail has determined that resistance is futile, I’m more inclined to believing the old saying; you’re either part of the problem or part of the solution. That said, I grew up, in part, in precisely the area where Gail resides, and know full well how screwed those entitled, upper middle class consumers will be. I watched the north side of Atlanta explode into senseless layers of suburbia, and can’t remember when I didn’t think it was crazy; utter folly. Those folks won’t handle contraction well at all. The vast majority are utterly unprepared for any lifestyle other than the one they are living now. I suspect that Gail may have made other arrangements that she feels prudent not to mention, or has accepted her current role as the right one, wherever it leads.

As for the rest, we have millenia of pre-industrial human experience to call on. I was fortunate enough to have outward-bound parents who saw this coming decades ago, bought land and built a second home where we are now in the southern Apps, and encouraged me since childhood to learn the old ways here, which are still practised by many. Not bad for a couple of school teachers. I suggest folks view the PBS program “Mountain Talk”, interviews with folk from our area about how they lived before TVA and other outside intervention. One woman spoke: “Life was hard but we was happy. We didn’t even know we was poor ’til the government came here and told us we were”. Fortunately, one of my daughters married into such a family who has accepted us into their circles. I was out late last night hunting a wild hog in the snow on our place with her ex (hog won this one). Even though they split up, I’ll always be part of their family via my grandchildren. That’s the way it works around here, and we can ask each other for anything, but usually don’t need to ask.

I suggest those who take this subject seriously seek out a place where things will unfold more slowly, where folks are already living, at least in part, in a less complex world, and make social connections. Or ask yourself if simple faith is enough. Many folks don’t have the wiggle room to make these changes; others are making excuses, but if you live somewhere that doesn’t have a strong sense of community, I suggest you make other arrangements.

As for antibiotics, etc., a store of such things may be worth a lot. Go to the feed store and get livestock meds. Dose as for swine. Most meds keep for years in the root cellar or fridge. Study up on native medicinal plants and ways to avoid infections.

It’s as much of a head game as it is physical preparation. The point is to be doing something.

Gotta go get the firewood in…

simonr on Fri, 31st Jan 2014 9:19 pm

As in all things we either mortgage our present to pay for our future, or mortgage our future to pay for the present.

Trick is getting the timing and balance right

ghung on Fri, 31st Jan 2014 9:19 pm

View “Mountain Talk”: https://www.youtube.com/watch?v=wTa23GH289w

Nony on Fri, 31st Jan 2014 9:25 pm

Rockman: I’m not trying to trap you. when I do a thought experiment, it is obvious that the predicate does have to be assumed (for the experiment to be examined), but that does not make the predicate true. It just explores the response of the system to the perturbation. Similarly, implicitly, that is the single hypothetical we change (i.e. the demand curve…not the demand response(!), but the demand curve is fixed). Otherwise, you can’t analyze anything.

And of course, what matters is the marginal production and marginal supply. The point of the thought experiment is that even if there were people who WOULD pay 200+/.bbl (like the military, aviation, chem feedstocks) that they would not have to do so given the hypothetical shelf of 100 supply. That’s the concept being explored.

also, demand curves are not monolithic. I’m totally in agreement with you that what matters is what the market will pay. Well in addition, what can be supplied. The supply and demand curves cross with marginal supply and demand.

GregT on Fri, 31st Jan 2014 11:45 pm

Nony,

Sorry, more ‘buzz kill’.

“Many of the world’s biggest troubles are not the result of pointless consumption, excessive borrowing and government bailouts. They are not caused by over-mining, plundered oceans, rising CO2 levels, greed and dumbing-down. Those are just the symptoms. The cause and solution to many of our troubles lie with the economic system we now use. This greatly determines what we value, how we think and the way we behave. It is a vital foundation of our political systems. Yet modern economics is no longer functioning properly. In the last 30 years, like some poisoned gene, it has mutated. It is in desperate need of a rethink, repair and reform.”

“We have adopted a system which has allowed the financial services industry to wreak havoc, just as it did in the 1920s. It has encouraged us to squander the world’s resources. And it has manipulated our values. We have been gravely misled by modern economics, cheated into thinking that this adulterated form can provide a sound base for society. It cannot.”

http://www.insightbureau.com/insight_articles/FTDO.No52.GraemeMaxton.Sep10.pdf

J-Gav on Fri, 31st Jan 2014 11:54 pm

Yes,Greg T! But, as you well know, it goes beyond that (i.e. economics). Without a major mindset change, we’re pretty much screwed. And that, while not impossible, doesn’t appear to be just around the corner, if you see what I mean.

GregT on Sat, 1st Feb 2014 12:07 am

J-Gav,

I totally agree with you. We need to completely rethink our relationship with the Earth. The Earth is not ours to turn into a ‘profit’, it is our responsibility to take care of it for future generations, and all life on it. I was merely trying to point out how modern economics is a very large part of our problem, but alas, I have been down this road before. As my great grandfather used to say; “You can lead cattle to water, but you can’t make them drink”.