Page added on June 5, 2015

Winners and Losers When Oil is $50 a Barrel

Major technological advances in horizontal drilling and hydraulic fracturing (fracking) have dramatically expanded U.S. oil and gas production. By year-end 2014, U.S. daily crude oil production from shale layers had increased 230 percent over 2010 levels, and total U.S. crude oil production had risen 67 percent.

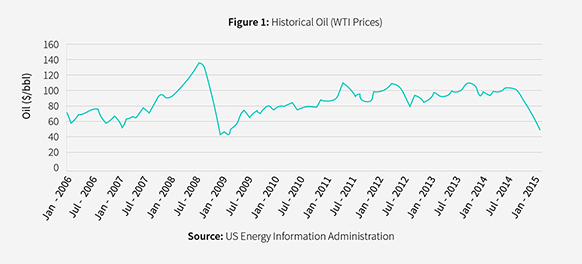

Despite that dramatic, unprecedented growth, the price of West Texas Intermediate (“WTI”), used as a global benchmark for oil pricing, remained between $80 a barrel (bbl) and $110/bbl from October 2010 until late November 2014. The unrelenting and massive increase in U.S. oil supply should have driven down the global price of oil. It didn’t because as these new U.S. supplies were coming online, geopolitical conflicts were flaring up in key oil-producing regions around the world.

For example, there was a civil war in Libya. Iraq faced threats from ISIS. Both the United States and Europe imposed new sanctions on Iran, significantly curtailing its oil exports. All this had the effect of removing more than 3 million barrels per day from the global market, or roughly the same amount that was being added by the United States.

Other factors during this period that kept the price of oil steady include:

- Major supply disruptions in Africa and the Middle East that significantly reduced their contributions to global supply.

- Geopolitical upheaval in the Middle East, Crimea and Ukraine that exerted upward pressure on global crude oil prices.

- The expectation that OPEC would function as it had in the past, as a cartel, cutting oil production and, thereby, stabilizing global crude oil prices.

However, in the last quarter of 2014, Saudi Arabia announced that it would not cut production and that it would not revisit the issue for six months. This was the inflection point, and the market finally began to respond to the increase in supply. A crude oil sell-off began in earnest, and prices began a downward spiral.

In June 2014, WTI peaked at $115/bbl.

Why This Downturn Is Different from Others

Experts disagree about what the future will bring for oil prices and the oil and gas (“O&G”) industry. Some believe that the NYMEX prices will recover this year. In late January, prices rebounded on what Reuters reported to be traders’ hopes that energy companies — including U.S. shale producers — would cut production to stabilize prices. Investor’s Business Daily reported that new permits for oil wells in the United States declined nearly 40 percent from October 2014 to November 2014, signaling a possible pause in shale oil production. Other signals of a potential rise in prices include the worsening political situation in Libya and the possibility that exploration and production (“E&P”) and O&G services companies will cut capital expenditures and reduce the size of their labor force in response to the decline in price and drop in demand.

On the other hand, some experts see the change in the O&G environment as potentially more secular than cyclical, pointing to changing and possibly enduring supply and demand conditions. As production has increased, so has the amount of proved reserves in the United States — by more than 50 percent in the last half decade. And demand for crude oil continues to slide in key markets, decreasing by nearly 300,000/bbl per day in the Organization for Economic Co- operation and Development countries between 2013 and 2014, with those numbers expected to remain essentially flat for 2015 and 2016.

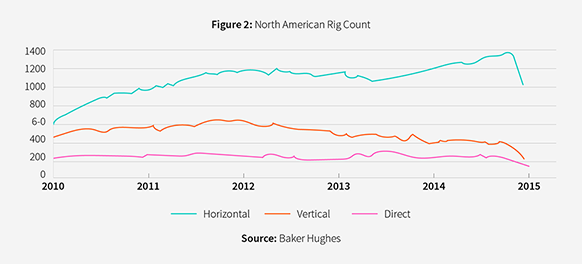

In addition, experts note that a significant share of production comes from low- cost, horizontal wells (see Figure 2) and that their breakeven costs likely will decline over time due to technology improvements, the sunk nature of many costs (including commitments for rail and pipeline transportation), and price reductions for land rigs, pressure pumping and so on. Lower breakeven costs could have the effect of keeping North American oil production steady, prolonging the current low-price environment indefinitely.

The Fallout from $50/bbl

E&P firms will face strong headwinds in 2015, but the dispatchability of shale oil operations — the ability of producers to ramp production up or down quickly in response to market conditions — could lessen the impact of lower prices on nimble operators.

As reported by the Financial Times, Bernstein Research found that from 2000 until very recently, oil companies consistently experienced increases in oil prices following final investment decisions; that is, projects approved between 2004 and 2011 saw an average rise of $18/bbl in the price of crude by the time those investments began producing. Simultaneously, much of this time period coincided with a stretch of very low borrowing costs.

This combination of reliably rising prices and affordable capital created a sustained surge in oil and gas investment, much of which was funded with debt rather than equity. The Financial Times found that oil and gas producers and refiners with debt both at the end of the 2008 crash and at the end of 2014 had, in aggregate, twice the amount of net debt at the end of 2014 and net debt-to- EBITDA ratios that had increased from 0.7 to 1.8.

As reported in mid-December 2014, Goldman Sachs reviewed the Top 400 global oil and gas projects, ranked by size, and concluded that no more than a third would break even at $70/bbl. At the same time, however, many of the highest-cost projects (for example, Kazakhstan’s Kashagan field) exhibit complex ownership structures and government involvement that make stopping them extremely difficult, if not impossible, particularly if the producing country is in need of revenues.

Conversely, shale oil production — the major factor driving the downturn in oil prices — is very easy to dial up or down. Spudding a shale well (commencing drilling) can take just a few weeks; ramping down an operation can be done in a matter of days. And many companies have announced plans in 2015 to continue drilling these wells without actually completing them (that is, beginning fracturing) — thereby conserving funds in the short term while positioning themselves to jump back into the market quickly should prices improve.

Winners and Losers

So who will gain and who will struggle if oil prices remain in the $45/bbl to $65/ bbl range for a sustained period of time?

Simply put, consumers will gain. Consumers include petrochemical producers, energy-intensive manufacturers (especially those that use petroleum or products whose prices correlate with petroleum), other industrial manufacturing operations, transportation, agriculture and the general consumer.

For example, petrochemical companies that use oil and natural gas as raw material will gain. With one of their largest operating costs significantly reduced, these companies will be more profitable and competitive on a global scale. Likewise, the U.S. Energy Information Administration projects that U.S. drivers each will spend about $550 less on gasoline in 2015 than they did last year, assuming prices stay low.

Conversely, most O&G producers and services companies will continue to struggle. This group includes highly leveraged E&P companies that are receiving far less income for every unit produced. E&P companies face difficult options: restructuring or streamlining operations, selling off assets, renegotiating with lenders and leaseholders or going into bankruptcy.

Companies active in the North Sea, for instance, substantially increased capital spending over the past five years. Because of ever-worsening production decline curves, they may flounder, as may regional and municipal governments dependent on oil revenues such as Aberdeen, Scotland, center of the North Sea oil services industry.

Given these financial pressures, there will be rapid consolidation in the U.S. E&P industry and also the O&G services industries. Alternative and emerging fuels — such as biofuels — may become less competitive as traditional fuels remain relatively inexpensive. To the extent there is carryover to natural gas prices, wind and solar companies will see erosion in their market as well. Coal companies and related businesses also may suffer, especially if natural gas prices remain low.

While the E&P sector as a whole will continue to struggle with diminishing returns and capital expenditure reductions, companies with the greatest efficiencies and strongest balance sheet will be better fitted for survival. For example, integrated oil companies engaging in exploration, production, refinement and distribution began cutting operating costs and capital expenditures in advance of the drop in crude oil prices. As a result, their balance sheets are strong and strengthening, with refining becoming more attractive than production.

Finally, investors will begin finding those strong balance sheets more compelling than earnings growth.

41 Comments on "Winners and Losers When Oil is $50 a Barrel"

Nony on Fri, 5th Jun 2015 8:07 am

Winners: consumers, the US economy overall, any nations that are not large net exporters of oil, refiners. Conventional car makers. And most of the posters on this site.

Losers: oil producing companies, especially the non-integrated ones or those that are liquids versus gas weighted. OPEC, especially Saudi Arabia. Canada. And any other nations that are large net exporters. Alternative energy makers (hybrids, electric, natgas). And the Rockman.

Rodster on Fri, 5th Jun 2015 8:07 am

Absolutely disgusting !

“Montana forestry workers kill, blow up orphaned moose reported by Good Samaritan”

http://rt.com/usa/265108-montana-forestry-kills-little-moose/

shortonoil on Fri, 5th Jun 2015 9:14 am

“As reported in mid-December 2014, Goldman Sachs reviewed the Top 400 global oil and gas projects, ranked by size, and concluded that no more than a third would break even at $70/bbl.”

In the present price environment ($60), by our calculations, at least one third of all producers, (based on their full life cycle production costs) are losing money. Reserves that are not replaced are an expense, and one that needs to be included in the total. But, again RIGZONE misses the elephant in the room. They have failed to ask the most important question: “how much can the economy afford to pay for oil”? Until that question is answered there can be no reliable appraisal of forward price development. Oil that no one can afford to purchase ultimately becomes inventory that no one can afford to use. It makes no sense to include it in the total production equation.

Standard economic models that are usually used by analyst offer no means to address that very important question. It is merely “assumed” that the consumer will ante up what ever price is asked. Whether or not they have the means to do that is considered by economists to be irrelevant. They tend to regard petroleum as the holy water of modern society that some celestial deity will insure is always provided!

The question, “how much the economy can afford to pay for oil” is a knowledge vacuum that unless addressed will ultimately come back to bite society in some very tender area. Wishing upon a star is not likely to keep the world’s transportation machinery functioning for very long. We have prepared a 67 page report, and put up this page to demonstrate how to address that most important question:

http://www.thehillsgroup.org/depletion2_022.htm

Our conclusion is that standard analytical techniques (those that employee the guess at it methodology) are a bit optimistic. Maximum end user affordability is much less than generally assumed. This also implies that total world reserves are much less than industry cheerleaders want the world to believe. It seems doubtful that RIGZONE, or any other industry newsletter, is ready to admit that they are promoting an industry where a good sized portion of that industry is composed of producers that are producing a product that now one can afford to buy.

Analysts, that can ignore an elephant, may not be the most reliable sources of information?

http://www.thehillsgroup.org/

rockman on Fri, 5th Jun 2015 9:16 am

And again: there have been no major tech advances in frac’ng…just some nice tweaking. And hz shale wells have not gotten cheaper. Drilling longer laterals and significantly increasing the number of frac stages has greatly increased the cost of wells. So while they may still be making good wells it comes with a hefty price tag.

“Conversely, shale oil production — the major factor driving the downturn in oil prices — is very easy to dial up or down. Spudding a shale well (commencing drilling) can take just a few weeks; ramping down an operation can be done in a matter of days. And many companies have announced plans in 2015 to continue drilling these wells without actually completing them (that is, beginning fracturing) — thereby conserving funds in the short term while positioning themselves to jump back into the market quickly should prices improve.” They shoot themselves in the foot with their own words: why would a company spends tens of $millions to drill and not frac wells to wait for better prices if they could wait to spend any of that capex when prices are higher since it takes so little time (their words…not the Rockman’s) to drill the wells in the first place? And are they going to drill wells and not frac to hold expiring leases? Doesn’t work: you can only extend the primary term of a lease by PRODUCING it…not drilling it. In fact the latest numbers for the Eagle Ford indicates the companies brought more wells to production in April then the trend average. Remember the point made before: in a price down turn companies will actually jump thru the ass to increase production…not delay it.

“As production has increased, so has the amount of proved reserves in the United States — by more than 50 percent in the last half decade.” “Proved reserves” take into account more then the amount of oil in the ground. The price of oil has a very significant impact on the amount of proved reserves on the books of public companies. As a result of the price collapsed all the shale players will see a huge reduction of proved reserves. So why is just a paper number change so important? The borrowing base of every pubco is based upon those proved reserves. IOW every pubco just lost a big chunk of their credit availability. And remember how much drilling was done with borrowed money. Borrowed money that still has to be paid back on schedule regardless of the decline in oil prices. And start missing that repayment schedule? That pubco’s credit line goes into the toilet.

“In addition, experts note that a significant share of production comes from low- cost, horizontal wells…” Low cost horizontal wells??? No comment required. LOL.

“…integrated oil companies engaging in exploration, production, refinement and distribution began cutting operating costs and capital expenditures in advance of the drop in crude oil prices.” With the exception of the Deep Water GOM nearly all the drilling done in the US is NOT being done by integrated companies. IOW virtually none of the shale players are integrated companies and aren’t benefiting from the big margin gains by the refinery/marketing sectors.

Nony on Fri, 5th Jun 2015 10:24 am

If there are no major advances in technology or geological knowledge, then why did the peakers screw up their predictions so bad? Why the need to come back afterwards and say we couldn’t anticipate unconventional?

P.s. on the shale gas side, I think it’s pretty hard to say that there was no evolution when you see the huge increases in per rig production, when you see how volume has increased and how low price is (less than $2 in PA). That’s not just a high price driven increase in production to next resourcs. Someone learned to do something different…

P.s.s. What is really funny is looking at the old comments from 2009-2010 by Berman and Rogers that shale gas would need $8-10+ to be sustained. Look how it has grown at sub 4!

Northwest Resident on Fri, 5th Jun 2015 10:37 am

Nony: “Look how it has grown at sub 4!”

Yeah, and look how the massive debt accumulation of those shale companies has grown right along with it. Which would leave reasonable and logical people to assume that maybe the $8-$10 prediction was correct IF the real costs of production were included in the price — which they aren’t — they’ve been passed off to investment and stock/bond owning suckers. And the extraneous cost of environmental impact — that too has been passed off to others. If the TRUE cost of that increased production were included in the price, it wouldn’t be “sub 4”, it would be in the “10+” range, or much higher.

But don’t let all the inconvenient facts confuse you, Nony. Stay focused on only what the MSM and industry propaganda outlets tell you. That way, you’ll be a lot happier, until reality sets in. Hey, maybe you’ll be “lucky” and you can live out the rest of your life under the illusion of “all is well”.

Nony on Fri, 5th Jun 2015 11:00 am

Every year that goes on without shale gas production crashing shows more and more how wrong Berman was. The weight. It is becoming crushing. Shale…gale!

http://geology.com/articles/marcellus/united-states-shale-gas-production.gif

The cold hard facts. They kick his ass.

Plantagenet on Fri, 5th Jun 2015 11:04 am

There’ no point in planning the rest of your life if you can’t even figure out whats going on right now.

We are in an oil glut thanks to fracking. That doesn’t mean the oil glut will last forever, or oil prices will stay low forever, but it does mean that simple models of peak oil that took into account only conventional oil fields were wrong. Perhaps the most striking example of this is the falsification of M.K. Hubert’s famous call of the US production peak in 1970, which will be surpassed in the next couple of years.

joe on Fri, 5th Jun 2015 11:11 am

Guys the national us debt, which is essentially what the US owes the federal reserve, is at 18trln dollars. That’s the cost of 2 wars and the cost of keeping the economy from imploding. This money is essentially being used to buy stability in the US, it’s also causing a global headache as companies trade at multiples of earnings and shale/fraking benefits from low interest rates which are required to gain so called energy independence. We are definitely at peak oil when we strip out unconventional, right now uncle Sam is picking up the shale tab, hoping the world will start growing at 3% like before the crash. It’s not happening though because absent unconventional peak oil is making us switch to gas and solar etc. It’s a process that MUST happen eventually.

GregT on Fri, 5th Jun 2015 11:20 am

Nony is about to find out the hard way, everything anybody never wanted to know, about cold hard facts.

I’d feel sorry for you Nony, if you were a decent and considerate human being.

marmico on Fri, 5th Jun 2015 11:37 am

Berman was a doofus about nattygas. He has further cemented his doofus status about oil rigs and production in February 2015.

To wit: TIGHT OIL PRODUCTION WILL FALL 600000 BARRELS PER DAY BY JUNE.

GregT on Fri, 5th Jun 2015 11:41 am

planter will never figure it out. The last maniacal words out of planters mouth? Oil glut, hahaha, oil glut, hahaha, oil glut, hahaha, oil glut.

Cheers?

marmico on Fri, 5th Jun 2015 11:43 am

Oopsie, html tag error.

Berman’s Blog on February 17, 2015.

And if that fails, then this:

http://www.artberman.com/tight-oil-production-will-fall-600000-barrels-per-day-by-june/

John Norris on Fri, 5th Jun 2015 11:48 am

GregT: maybe Nony is a decent and considerate human being? And Planter maybe is also, as well as not being a maniac?

GregT on Fri, 5th Jun 2015 11:52 am

Stick around John, you’ll eventually figure it out.

Larry777 on Fri, 5th Jun 2015 12:04 pm

Why are we spending >$60 a barrel to recover Shale Oil, when we can recover (according to the Department of Energy) more than 200-Billion barrels of trapped and “stranded” oil still left unrecovered in America’s old, inactive and non-producing oil fields (at 1/3rd the production cost of shale oil) using portable exhaust gas injection CO2 EOR?

By using newly available portable exhaust gas injection CO2 EOR enhanced oil recovery technologies (from oil tech companies like http://FossilBayEnergy.com ) oil companies can re-enter, re-pressurize and extract new EOR oil from 100s of 1000s of old and abandoned, pressure-depleted, legacy conventional oil fields in America at produciton costs less than $15-$25 a barrel of recovered oil.

Isn’t this the smartest oil to recover first, before we spend the big bucks extracting oil from hard-rock shales, off-shore or the Arctic Seas?

jjhman on Fri, 5th Jun 2015 12:13 pm

I enjoy (well, sometimes) reading the comments on articles like this when knowledgeable commenters use their own knowledge of the subject to elaborate or condradict the article substance.

What is actually painful to read is the petty skirmishing between idologues on the “we’re all gonna die tomorrow” and the “best of all possible worlds” sides. (You know who you are.)

When I can discipline myself to ignore that nonsense the comments can be useful.

Given all that it is pretty clear that virtually any subject in this insane energy world really does have a lot of real evidence pushing society in opposite directions. Only a fool or a knave discounts the scientific data on climate change yet we keep producing and using more and more fossil fuels. Debt keeps rising yet banks keep loaning money to fossil fuel producers. Income inequality keeps threatening western civilization but politicians fiddle with crap like “Bengazi emails” instead of addressing real problems.

Ever since “The Population Bomb” and “Limits to Growth” pessimists have warned of coming calamity and optomists have naysayed the doomsayers both have distorted the facts to support their claims. But who in their right mind thinks we can keep on our BAU path for the next 20 or 30 years without major disruption of society?

Davy on Fri, 5th Jun 2015 12:14 pm

John, they are alright enough just troubled with reality. Greg and I are hard on them because we are asshole moderators. Being assholes ourselves we know assholes and how to deal with them. We are like Robinhoods protecting the board from obnoxious and rude behavior at the risk of being the same ourselves. Yet we do it in the name of humanity. People like the NOo have only personal gain in mind. Does that help explain John?

GregT on Fri, 5th Jun 2015 12:18 pm

” But who in their right mind thinks we can keep on our BAU path for the next 20 or 30 years without major disruption of society?”

The optimists would consider your question to be doomsaying jj. Just saying…..

Davy on Fri, 5th Jun 2015 12:19 pm

Oh JJ, your so boring show some spunk besides I didn’t say we would die tomorrow I have said redundantly ad nauseum we are going to die a slow painful existence. There is a difference!

shortonoil on Fri, 5th Jun 2015 12:26 pm

“Every year that goes on without shale gas production crashing shows more and more how wrong Berman was. The weight. It is becoming crushing. Shale…gale!”

Berman was wrong, like everyone else, because no one expected some player with very deep pockets to come along, and continue to finance a big time losing industry. There is some one out there who isn’t concerned about shoving $20 to $30 billion a year down a rat hole. Chances are pretty good that they expect the consumer, and or the tax payer to pick the tab some place along the line. Welcome to the New Economy – where profit is private, and loses are public! We should all be very proud to have inherited the New System; the one that ensures that all future generations will slave away for the rest of their lives to keep the 0.001% wealthy today. Today’s oligarchs were yesterday’s thieves, and sleaze balls. Those packs with the Devil seem to be working out quit well!

GregT on Fri, 5th Jun 2015 12:31 pm

Also JJ,

The science has been well understood for over a century. The eCONomists, the bankers, and the corporatists, have been shouting down the science. We have already caused irreversible damage to the Earth’s oceans, ecosystems, and climatic systems. If we continue on the path that we are on, we will cause a global mass extinction event. The science is crystal clear on this. We have access already, to more than enough fossil fuels to render the planet, for all intents and purposes, lifeless.

Perk Earl on Fri, 5th Jun 2015 12:48 pm

“So who will gain and who will struggle if oil prices remain in the $45/bbl to $65/ bbl range for a sustained period of time?”

“Simply put, consumers will gain. Consumers include petrochemical producers, energy-intensive manufacturers (especially those that use petroleum or products whose prices correlate with petroleum), other industrial manufacturing operations, transportation, agriculture and the general consumer.”

The consumers will benefit is true, but what that shows us is the consumer needs a low price for oil (and it’s associated products) to get into a better financial position. However it also shows us that oil priced high enough to attain the more expensive oil reserves hurts the consumer, and as the economy contracts oil price must drop down lower and a new balance is set.

That dynamic sets limits as to how much oil can be extracted based on consumer affordability.

Here’s one example though of inflexibility in the dynamic. I purchase 2′ wide perforated 3/4″ bubble-wrap to wrap some of our products for safe shipment. The price not very many years ago was 32 dollars a roll. Now it’s 64, so it has doubled in price. When it went from 48 to 64 it was when oil price was well over 100 a barrel, but now oil price has dropped back down, the price remains 64 bucks a roll. So my business still has to push that higher price on to the consumer.

The question is; how many other products that are oil based and were raised during high oil prices have also not gone down now oil price is lower?

rockman on Fri, 5th Jun 2015 12:49 pm

“If there are no major advances in technology or geological knowledge, then why did the peakers screw up their predictions so bad?” Very easy answer. The same reason so many didn’t anticipate an increase in oil production: they didn’t anticipate the price of oil jumping from less than $40/bbl to over $100/bbl. If it weren’t for that price increase there would not have been a boom in the Eagle Ford et al. No technology is going to make uneconomical oil producible. The shale plays took and high oil prices to justify using the frac’ng tech that had been sitting in the yards gathering dust for a number of years. Even more important it took those high prices to justify building out the frac infrastructure need to handle the surging demand.

If oil prices remain at the current level thru the end of the year we’ll see just how much of that production surge was solely dependent upon high oil prices. The tech is the same we had 6 months ago so any fall off in shale production will be due to pricing. Which would logically imply why shale production boomed in the first place: high oil prices. And thus back to the answer: if one didn’t predict $100+/bbl oil then they would not have predicted a surge in US production. And, conversely, had oil prices not shot up their predictions would have been much more accurate.

rockman on Fri, 5th Jun 2015 1:14 pm

“Isn’t this the smartest oil to recover first, before we spend the big bucks extracting oil from hard-rock shales, off-shore or the Arctic Seas?” Yes…much smarter. With the obvious qualification: if it’s economical. I’ve done EOR in one form or another from time to time over the last 40 years. I’ve just begun working with a group that has a completely unprecedented approach. I’ve heard more pitches about EOR projects that can recover oil for $X/bbl. And the overwhelming majority of the pitches were complete bullsh*t.

You know what EOR projects are commercial? The ones that have been conducted over the last 60+ years. They were successful because they did deliver the oil at economic costs. And there have been thousands of such EOR projects conducted. Which is exactly why the POTENTIAL EOR projects remain: they didn’t work with proven and affordable tech. I always get the feeling that so many outside the oil patch think we’ve ignored EOR. Very odd given that EOR is a huge portion of much of US production over the last half century. You do understand why the average US oil wells produces less than 15 bopd: a huge % still exists because they are part of an EOR effort.

I couldn’t care less if they say they can get the oil out at $15 to $25 per bbl. Show me the infrastructure costs, show me the operational costs, show me the model for the revenue flow. BTW even when economically successful most EOR projects produce at a relatively slow rate. Typically they’ll last 15 to 25 years because it takes that long to get the full recovery.

And when they toss those cost numbers at me I hope they also include the costs to re-drill all those thousands of wells. You do understand that all these abandoned fields have had their wells plugged and abandoned, don’t you? And that all the oil tanks and production equipment has been hauled away long ago.

I have $250 million available to me today to apply to an EOR project. All someone has to do is show me an acceptable rate of return. Of course, industry wide there are tens of $BILLIONS available to do likewise. There is no lack of capex or desire. Just a lack of viable projects. I also find it amusing that we see more chatter about EOR potential now than when oil was selling for ALMOST TWICE THE CURRENT PRICE.

Nony on Fri, 5th Jun 2015 1:34 pm

“they didn’t anticipate the price of oil jumping from less than $40/bbl to over $100/bbl.”

Why not? The inelasticity of demand is well documented and previous price runups had occurred. For that matter Hoteling described his “rule” in the 1930s and it is common sense anyways.

Actually, if you look a lot of the doomster peakers DID predict price runups. But they still failed to predict the new sources coming on line.

P.s. And all that does not explain shale gas which seems competitive even without historically high prices.

Northwest Resident on Fri, 5th Jun 2015 1:39 pm

“I also find it amusing that we see more chatter about EOR potential now than when oil was selling for ALMOST TWICE THE CURRENT PRICE.”

Another sign of desperation? Add it to the long list. Everywhere I look I see koolaid drinkers and BAU forever believers desperately clinging to whatever false hopes that still have a shred of viability left. Even on this forum, where the cold hard reality is presented daily in articles and comments, we still have those who refuse to accept the facts, who are still clinging to false hopes and parroting propaganda as if it were God’s truth. When the brittle ice that BAU stands on finally shatters, there is going to be a lot anguish and screaming, and I do mean a LOT.

rockman on Fri, 5th Jun 2015 2:46 pm

“And all that does not explain shale gas which seems competitive even without historically high prices.” Another easy answer: I don’t think even the folks who were the most knowledgeable about the Marcellus HAD clue what could be done with horizontal wells because they lacked experience with the tech… They aren’t doing anything in the M today they couldn’t have done when NG was selling for 3X the current price.

You know what the rule is: sometime the pioneers get cheap land…sometimes they get arrows. The Marcellus players found gold lying on the ground simply because no one had looked there before. Decades ago I made the suggestion to more than one management group that they should inject geologists/engineers from other basins into such areas. Often times an experienced hand in a play says X can’t be done and stops progress where it can actually be made.

Which is exactly why the Rockman is the first geologist to drill a commercially successful horizontal well in an onshore unconsolidated oil reservoir in the Gulf Coast. Really. No sh*t. LOL. All it took was having a geologist who had witnessed numerous similar wells drilled offshore to understand the same potential for onshore reservoirs.

It was just bridging a gap similar to what I suspect happened with the Marcellus: offshore GOM companies who understood the tech didn’t care about small onshore opportunities. And the small onshore companies didn’t know about the technology. The tech Rockman used 2 years ago to drill that first commercial onshore well was identical to what he used to drill similar wells 20 years ago in La. state waters. IDENTICAL.

Have to stop typing now. My arm is getting sore from patting myself on the back so much. LOL.

Nony on Fri, 5th Jun 2015 2:55 pm

IOW, Nony is right.

Nony on Fri, 5th Jun 2015 3:12 pm

In the Marcellus region, the price is under a dollar!!!

Woot, woot. Shale gale, shale gale!

http://www.cattlenetwork.com/news/markets/natural-gas-prices-decline

GregT on Fri, 5th Jun 2015 3:38 pm

The Climate Risks of Natural Gas

***To effectively address climate change, how much do we need to reduce emissions from the electricity sector?***

The electric power sector is the largest contributor to U.S. global warming emissions and currently accounts for approximately one-third of the nation’s total emissions. To limit some of the worst consequences of climate change, the National Research Council (NRC) recommends an economy-wide carbon budget that would cut U.S. power sector carbon emissions 90 percent from current levels by 2050.

***Are there additional climate risks associated with natural gas***

Yes. Methane – a primary component of natural gas – leaks from drilling sites and pipelines. It is 34 times more potent than carbon dioxide at trapping heat.

An estimated one to nine percent of all natural gas produced escapes into the atmosphere, equivalent to the global warming emissions from 35 – 314 typical-sized coal power plants (600 megawatts). This methane leakage poses additional climate risks and erodes the climate benefits of replacing coal with natural gas.

http://www.ucsusa.org/clean_energy/our-energy-choices/coal-and-other-fossil-fuels/infographic-climate-change-risks-natural-gas.html#.VXIH2us9WLs

Apneaman on Fri, 5th Jun 2015 4:27 pm

Insane Heat Wave in Alaska Put Temperatures Higher Than in Arizona

http://ecowatch.com/2015/06/05/heat-wave-alaska/?utm_content=bufferfd6ba&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

Rodster on Fri, 5th Jun 2015 5:07 pm

“Insane Heat Wave in Alaska Put Temperatures Higher Than in Arizona”

Climate scientists have predicted this kind of stuff happening. Miami Beach and St. Augustine, Florida are both experiencing sea level rise. And this is just the beginning. Just wait for the gigatons of methane to get released into the atmosphere.

GregT on Fri, 5th Jun 2015 5:20 pm

What we are witnessing right now is only the beginning.

It is generally agreed upon that there is approximately a 40 year lag between CO2 accumulations, and temperature rise. We are now seeing the effects from the seventies, before we really ramped up on fossil fuels usage.

Even if we stopped burning all fossil fuels today, climate change would get exponentially worse for at least the next 4 decades.

The IPCC models do not account for self reinforcing positive feedback mechanisms, of which at last count there are at least 17. If any of them are triggered, the climate will runaway on it’s own. Game over.

shortonoil on Fri, 5th Jun 2015 5:30 pm

“Why not? The inelasticity of demand is well documented and previous price runups had occurred.”

It would probably be a good idea to shred those documents. Who ever wrote them obviously never produced a price vs production plot. The plot looks like an L with a horizontal line from $62 upward in price. Although oil appears to have been almost perfectly inelastic between $2.88/ barrel and $62 /barrel, between $62 and $100 it became almost perfectly elastic. That is, increased price above $62 produced almost zero extra demand. From our point of view it is pretty conclusive evidence for maximum consumer affordability.

Although there is a number of people with a religious conviction that oil is a magical substance that the consumer will pay anything to acquire, the data clearly show that nothing could be further from the truth. In spite of that, they are likely to hold on their preconceived notions with the tenacity of a pit bull. Like fifth century Augustinian Monks they believe that reason must be subservient to belief. It is no surprise that the world is walking into one of its most difficult period since the fall of the Western Roman Empire without a clue.

Another Nony hypothesis bites the dust!

http://www.thehillsgroup.org/

Rodster on Fri, 5th Jun 2015 6:21 pm

“It is generally agreed upon that there is approximately a 40 year lag between CO2 accumulations, and temperature rise. We are now seeing the effects from the seventies, before we really ramped up on fossil fuels usage.”

This is article points that out and paints a bleak picture for the future. The things we were warned about are here right now.

—————————————

http://www.truth-out.org/news/item/29930-oceans-in-crisis-one-woman-will-cross-the-pacific-to-raise-awareness

“From a climate change/fisheries/pollution/habitat destruction point of view, our nightmare is here; it’s the world we live in,” Nichols said. “You see evidence of the impact of climate change on the oceans everywhere now. The collapsing fisheries, the changes in the Arctic and the hardship communities that live there are having to face, the frequency and intensity of storms – everything we imagined 30 to 40 years ago when the environmental movement was born, we’re dealing with those now…. The toxins in our bodies, food web, and in the marine mammals, it’s all there.”

Makati1 on Fri, 5th Jun 2015 8:33 pm

jjhman, there are a few here who pretend that they at middle of the roaders, but cannot see their own prejudices, or at least, deny them. They probably don’t even realize they are not as middle of the road as they think. It’s difficult to be objective if you are raising a family or have too much invested in BAU. I actually enjoy Nony and Plantagenet as they add a solid balance to my ‘doomer’ outlook with off the wall comments and ideas.

If we all agreed, there would be no need to comment. But, we are not all under the same delusions as most Westerners/Americans. They cannot help it as most of their info is propaganda and lies. They are the ‘has-beens’ of the 21st century and have not realized it yet.

Apneaman on Sat, 6th Jun 2015 3:42 am

Big Oil Soon to Be Extinct

http://www.truthdig.com/report/item/big_oil_soon_to_be_extinct_20150529

Kenz300 on Sat, 6th Jun 2015 9:30 am

It is time to end the OIL monopoly on transportation fuels……

Bring on the competition……….. electric, biofuel, biodiesel, CNG, LNG and hydrogen are all growing in use.

Better yet cities need to encourage the use of bicycles and mass transit.

Top 10 Cycling-Friendly Cities – YouTube

https://www.youtube.com/watch?v=ycKXeKfu4lo

shortonoil on Sat, 6th Jun 2015 9:44 am

Big Oil Soon to Be Extinct

“The institute’s research suggests that lack of consumer demand may bring the oil industry to its knees. Though this seems impossible to believe now, while gas-guzzling minivans are still the norm in many parts of North America (and elsewhere around the world), Lovins sheds light on where the tide is turning.”

Lovins is correct but it will not be because of Zipcar, hybrids, or bicycles that oil comes to its end. The real reason is a lot more basic than mere substitutes. Substitutes will be a second rate replacement for oil. They will be the effect of oil’s demise not the reason.

The problem will not be a lack of demand, the problem will be a lack of demand at a price at which the industry can make a profit. This relates to the thermodynamic characteristics of petroleum production. The ability of petroleum to power the economy is going down as the cost to produce it is going up. As petroleum’s ability to power the economy declines, its value, and thus price decline with it. When the price becomes less than the cost of production, profits disappear for the industry, and production ceases. There will be no bail out of the petroleum industry except perhaps for short durations. Once oil no longer can power the economy the funds will not be available from any source to save it:

http://www.thehillsgroup.org/depletion2_022.htm

This relates to what we have been saying for some time. Consumer affordability is declining, while production costs are increasing. We’ll put a graph up this week of Price vs Production to demonstrate what is occurring. Depletion is now having its final impact on the age of oil. The time of its conclusion is a calculable quantity.

http://www.thehillsgroup.org/

yoananda on Sat, 6th Jun 2015 4:09 pm

the technological advance of high oil prices and low credits ? lol