Page added on September 21, 2014

The US Ponzi Economy

When the most persistent, most aggressive, and most sizeable actions of policymakers are those that discourage saving, promote debt-financed consumption, and encourage the diversion of scarce savings to yield-seeking financial speculation rather than productive investment, the backbone that supports a rising standard of living is broken.

…

Meanwhile, financial repression by the Federal Reserve has held interest rates at zero, discouraging savings while encouraging and enabling households to go more deeply into debt. Various forms of deficit-financed government assistance and unemployment compensation have also been used to make up the shortfall, allowing consumption, and by extension, corporate revenues and profits, to be sustained. As long-term economic prospects have deteriorated, the illusion of prosperity has been maintained through soaring indebtedness, coupled with yield-seeking speculation in risky assets that has repeatedly (albeit not always immediately) been followed by crashes throughout history

The U.S. Ponzi Economy is one where domestic workers are underemployed and consume beyond their means, household and government debt make up the shortfall, corporate profits expand to a record share of GDP as competitive pressures are reduced and cheap goods and labor are outsourced, corporations both accumulate the debt of other companies and issue new debt of their own, primarily to repurchase their own shares at escalating valuations, our trading partners (particularly China and Japan) become our largest creditors and accumulate trillions of dollars of claims that can effectively be traded for U.S. property and future output, Fed policy encourages the yield-seeking diversion of scarce savings toward speculation in risky securities, and as with every Ponzi scheme, everyone is happy as long as nobody seeks to be repaid.

Buybacks are not a return of capital to shareholders – they are partly a leveraged speculation on shareholder’s behalf, partly a strategy to enhance per-share earnings by reducing share count, and partly a way to reduce the dilution from stock-based compensation to corporate insiders. Moreover, repurchases move in tandem with corporate debt issuance, which is another way of saying that the history of stock buybacks is one of companies using debt to buy their stock at overvalued prices.

Keep in mind also that corporate share repurchases have no tendency to concentrate at points of depressed valuation, and but have instead been most aggressive at points that have historically represented severe overvaluation.

* * *

An important note on the equity markets

We’re observing a continued deterioration in market internals at extremely elevated valuations, much as we observed in July 2007 (see Market Internals Go Negative). Credit spreads have widened in recent weeks, breadth has deteriorated (resulting in weakness among the average stock despite marginal new highs in several major indices), and downside leadership is also increasing. As a small example that illustrates the larger point, despite the marginal new high in the S&P 500 last week, the NYSE showed more declines than advances, and nearly as many new 52-week lows as new 52-week highs. About half of all equities traded on the Nasdaq are already down 20% from their 52-week highs and below their 200-day averages. Small cap stocks have also weakened considerably relative to the S&P 500.

Indeed, though it’s not a signal that factors into our own measures of market internals (and we also wouldn’t put much weight on it in the absence of deterioration in our own measures), it’s interesting that Friday also produced a “Hindenburg” signal as a result of that lack of internal uniformity: both new highs and new lows exceeded 2.5% of issues traded, the S&P 500 was above its 10-week average, and breadth as measured by advance-decline line is deteriorating.

One can certainly wait for greater internal deterioration before raising concerns, but my impression is that this confirmation is likely to emerge in the form of a steep, abrupt initial decline (which we call an “air pocket”). That isn’t a forecast, but an observation based on prior instances of deteriorating uniformity following extended overvalued, overbought, overbullish periods. This time may be different. Needless to say, we aren’t counting on that.

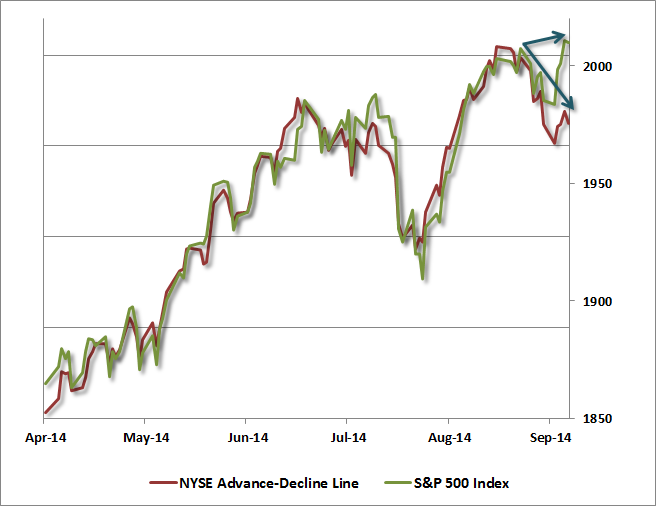

The chart below shows the cumulative NYSE advance-decline line (red) versus the S&P 500.

While the divergence is not profound, similar and broader divergences are appearing across a wide range of asset classes and security types, and it’s the uniformity of those divergences – not simply the extent – that contains information that suggests that investor risk preferences are subtly shifting toward risk aversion.

John Hussman’s Weekly Market Comment

28 Comments on "The US Ponzi Economy"

Makati1 on Sun, 21st Sep 2014 8:48 pm

This one is going to open a big can of worms. I cannot wait for the comments to ensue.

The USSA is running on toilet paper and the rest of the world is beginning to notice. Hence, the effort to sideline the USD and cripple the Empire. And the US efforts to take down the other currencies that might replace it, the Yuan, Euro, Ruble, and, especially, gold, which the US no longer has in any meaningful quantity.

World War 3 is underway and has been since at least 2000, maybe 1970. It is financial and resources now, but soon it will be bombs and worse. If I am wrong, and I wish I was, my grand kids may have a decent life. But…

eugene on Sun, 21st Sep 2014 8:58 pm

Personally, I believe it has been bombs (ours)for some time. As an old vet, I feel sorry for the “patriots” buying the killing for the sake of democracy. Most will pay for their folly the rest of their lives with physical/emotional problems. At home, millions of us are already paying as unemployed, elderly, disabled and others who are on the bottom of the economic tier. The game is, of course, keep us out of sight.

Northwest Resident on Sun, 21st Sep 2014 9:07 pm

It isn’t so much that the backbone that supports a rising standard of living is broken, it’s more like it has run out of gas. It takes a lot of energy to keep the economy growing, more energy than is available. The only way to simulate growth is by adding debt – as in trillion$ and trillion$ worldwide — and by perpetuating the illusion that “all is well” and “we have plenty of oil”. So, what we have in these “end days” is a global financial situation run amuck, shale oil/ng development fueled by all the trillions in debt, and the MSM propaganda machine blaring the message through every outlet night and day that “all is well”.

But it isn’t. And the game will soon be up. Like all Ponzi’s, this one is about to end badly.

Makati1 on Sun, 21st Sep 2014 10:10 pm

FYI: “The PetroYuan Cometh: China Docks Navy Destroyer In Iran’s Strait Of Hormuz Port”

“Since China fired its first ‘official’ shot across the Petrodollar bow a year ago, there has been an increasing groundswell of de-dollarization across the world’s energy trade (despite Washington’s exclamations of ‘isolated’ non-dollar transactors). The rise of the PetroYuan has not been far from our headlines in the last year, with China increasingly leveraging its rise as an economic power and as the most important incremental market for hydrocarbon exporters, in the Persian Gulf and the former Soviet Union, to circumscribe dollar dominance in global energy – with potentially profound ramifications for America’s strategic position. And now, as AP reports, for the first time in history, China has docked a Navy Destroyer in the Southern Iranian port of Bandar-Abbas – right across the Straits of Hormuz from ‘US stronghold-for-now’ Bahrain and UAE….”

http://www.zerohedge.com/news/2014-09-21/petroyuan-cometh-china-docks-navy-destroyer-irans-strait-hormuz-port

And the beat goes on…

Plantagenet on Sun, 21st Sep 2014 10:16 pm

The US is producing more oil and more energy then it has in decades thanks to fracking, and gasoline prices are lower then they’ve been in years. The problem right now with the US economy isn’t lack of oil but lack of intelligent economic policies from the Fed and the Obama administration. The Fed has destroyed the value of the dollar through QE, and Obama’s huge deficits have run the federal government deeply into debt to the point that we now waste over 200 billion dollars a year just servicing the federal debt.

Perk Earl on Sun, 21st Sep 2014 11:40 pm

Slightly off topic from this article, however recently on this site there was an extensive discussion about oil price. Here is Gail’s latest posting on the topic:

http://ourfiniteworld.com/

Low Oil Prices: Sign of a Debt Bubble Collapse, Leading to the End of Oil Supply?

Plantagenet on Sun, 21st Sep 2014 11:53 pm

Thanks for the link to Gail’s latest screed, Perk Earl.

Gail suggests that oil prices are falling because consumers can’t afford to pay more. But basic economics tell us that price reflects both SUPPLY and DEMAND, and falling prices means oversupply relative to current DEMAND, while lower prices will tend to increase DEMAND, not decrease it as Gail seems to think.

Similarly, Gail thinks falling oil prices are somehow linked to falling production prices. But the price has nothing to do with the production cost—price is a function of the balance between SUPPLY and DEMAND. Whether OPEC produces oil at $1 a barrel or the Bakken produces it at $80 a barrel the market doesn’t care— the oil will still sell at at $90 a barrel is the DEMAND is there, no matter what the production cost is. Conversely, if suppliers want to sell below their price of production, the market doesn’t care. Its up to producers to stop producing if they can’t get the price they want—that will reduce SUPPLY which will cause the price to go up if DEMAND remains healthy.

Northwest Resident on Mon, 22nd Sep 2014 12:11 am

Plant — Nowhere in Gail’s article is she making the argument that “falling oil prices are somehow linked to falling production prices.” NO-WHERE. She explains the exact opposite — that in order to COMPENSATE for falling commodity (oil included) prices the cost of production would also need to fall.

Plant, you frequently and consistently make false accusations, you FAIL to understand plain English, you prove repeatedly that you JUST DON’T GET IT.

Plant, Gail writes straight-forward facts and comes to logical conclusions based on those facts. Any smart person could see that, which obviously leaves you OUT.

trickydick on Mon, 22nd Sep 2014 12:21 am

Plant, you do realize that the U.S. government is a scam, right? They don’t operate in our best interests, have not done so in a long time and will not do that in the future. Obama is just another Fed puppet in a long line of Fed puppets. Things are the way they are because TPTB want them that way. Everything is exactly as it should be. Obama is running up debt because he thinks it will benefit the American people. He runs up debt because it benefits the bankers.

Norm on Mon, 22nd Sep 2014 2:51 am

Plant, you had to blame it all on Obama. Knew it. The reason Obama ran the trillion dollar deficits is it took that much printed worthless money to stimulate the Bush Jr. recession back towards recovery.

Hey Plant, you live in your parents basement right? Next to the water tank? hey just wondering is it an A.O. Smith, or is it a Bradford White? Did they hook the relief valve up to the outside? You don’t want the relief valve to get your mattress soggy…

MSN Fanboy on Mon, 22nd Sep 2014 3:09 am

The Fed is keeping everything togeather, as they only know how.

If they had “done the right thing” 2008 would have been the beginning of the end.

Be careful what you wish for, when their monetry stimulus fails, you will have your chaos and human misery.

Makati1 on Mon, 22nd Sep 2014 3:22 am

MSM, 2008 was just a melting ice plug in the collapse dam. It never did anything except rescue the Banksters from having to pay for their greed at the taxpayer’s expense. A collapse then would seem like nothing compared to the one we are going to have soon.

‘O’ is on course to add $10,000,000,000,000.00 to the National Debt. More than twice what it was when he ‘took office’ and ~60% of the US GDP. The next sock puppet will make that seem like chicken feed, until the whole Ponzi scheme blows up. Why do you think the neocons are so determined to get a hot WW3 going? To cover their asses, that’s what. Then Weimer Republic, here we come!

Davy on Mon, 22nd Sep 2014 6:53 am

Planter, there is much to crow about for the cornucopian love of fracking and how it has save the world from a PO fall. A PO fall could have ended the BAU debt Ponzi scheme a few years ago. Without growing energy supplies the debt injections would not have made a difference. The central banks emergency drugs (debt) have become maintenance drugs. Like many emergency drugs they are meant to only be used in a short duration and intermittently. When they become maintenance drugs real damage is done. There is no healing only new problems. We are in the position today of “bubble inflation” in multiple areas most profoundly the equity markets. Fracking being among the most expensive of production is likewise an emergency drug that will run its course. Fracking worked great short term but its cost will end its economic effectiveness. Fracking was a consequence of the “risk on” speculation of the central bank debt orgy. Fracking was fantastic in its initial results as all orgies are initially. We are now seeing the compression of oil supply and demand dynamics. It is well researched here on PO by experts. Consumers are unable to economically afford oil to grow “their” economy i.e (middle class). Producers are finding lower quality/quantity is leading to lower ROI reflected in capex and reserve growth. This is a double edged sword of doom for a healthy symbiotic relationship that must be present in the consumer/producer oil market segment of BAU. Being the most vital market to the health of globalism this does not bode well for a stable BAU globalism. It seems diminishing returns is popping up yet again. The beginning of the descent is showing itself. We are going to see a whirlwind of converging and reinforcing problems in many segments of BAU globalism manifesting themselves as intractable predicaments. This negative oil dynamics is the most troubling. A simple take on it is no time no money. The party is over.

GregT on Mon, 22nd Sep 2014 9:46 am

Infinite exponential growth, in a finite environment, is a mathematical and physical impossibility.

As long as we allow a group of powerful individuals, the ability to print money out of thin air, with interest attached, the entire system will continue to demand growth until energy, environmental, or resource limits are met.

That is when the entire ponzi based system will come crashing down. It is a mathematical, and physical certainty.

shortonoil on Mon, 22nd Sep 2014 9:53 am

Perk Earl dropped us a note at the site email address early this morning about Gail’s new post. Thanks Perk. I’m sure that the little elves with purple fingers, and broken fingernails here at PO News will post her latest, so I won’t now go into any detail on it. But, I will say that her assessment of a collapse in the credit bubble corresponding with a decline in production corresponds very closely with our energy dynamics evaluation. Conventional peaked at the end of 2005 (beginning of 2006), as our model predicts. The model predicts that all liquid hydrocarbon production will peak in late 2016 at $117/b. If you take a look specifically at her figure# 8, its shows the same event taking place in late 2015. Dam good shot for a barrel counter/economist.

As far as the article above is concerned, it is certainly not surprising that investors are getting a little nervous. Like sheep, when one of them gets a good whiff of the wolf, they all stampede. If it is in the direction of a cliff – they go that way anyway.

http://www.thehillsgroup.org/

Don on Mon, 22nd Sep 2014 10:32 am

I’m coming, Elizabeth! It’s the big one!

robert on Mon, 22nd Sep 2014 10:45 am

The hubris of the FED has evolved into nothing more than white collar crime against the Amer. public sanctioned by

congress. It is now plain to see that “America” is being run by and for the money center banks. The total power structure is in on this scam.

dog on Mon, 22nd Sep 2014 11:28 am

Why we elected Obama twice? and why Obama win the Nobel Price on 2009 ?? This will be the lesson for human being in the future (same as from Adolf!). IMHO, the prices we pay for Obama and Bush’s irresponsibility are well of 10 times of $10,000,000,000,000.00 ($10 Trillion). it could even cause the democratic system if we cannot lean lesson from the mistake we made.

Plantagenet on Mon, 22nd Sep 2014 11:53 am

@Norm

Your suggestion that obama’s huge federal deficits are Bush’s fault is silly. It reminds me of a medieval cleric claiming sin was all Eve’s fault.

Man up and let Obama take responsibility for his own poor judgement and the resultant weak US economy and record US deficits.

Kenz300 on Mon, 22nd Sep 2014 12:03 pm

An economy dependent on finite fossil fuels that are contributing to Climate Change has no future. The old guard is doing all they can to slow the transition to cleaner alternative energy sources. They will not succeed.

———

Charles Koch Linked To Creation Of Fossil Fuel-Defending Nonprofit: Report

http://www.huffingtonpost.com/2014/08/29/charles-koch-institute-for-energy-research_n_5738868.html?utm_hp_ref=energy

———–

Some of the old guard see the future.

Rockefellers, Heirs to an Oil Fortune, Will Divest Charity of Fossil Fuels

http://www.nytimes.com/2014/09/22/us/heirs-to-an-oil-fortune-join-the-divestment-drive.html?emc=edit_th_20140922&nl=todaysheadlines&nlid=21372621

Plantagenet on Mon, 22nd Sep 2014 12:06 pm

For the simple minded people who can’t see any link between Obama’s economic policies and the weak US economy, consider this one: Obamacare puts a tax on employers for full time workers, but not for part-time workers. As a result we have an increase in employers offering only part-time jobs.

One of the most basic principles of taxation is that if you want less of something, put a tax on it. We’ve now got an extra tax on full time workers and an increase in the number of part time workers. Hhhhmmmmmm…..

Northwest Resident on Mon, 22nd Sep 2014 12:50 pm

The King and Poster Child of Simplemindedness has spoken. All heed the words of the village idiot, the blame-placing simpleton, the moron who misinterprets simple facts and twists them to suit his own absurd points of view. But THIS TIME he is really on to something big, an idea so brilliant and a perception so deep that normal folks like us can only stand in jaw-dropping awe at the plain truth this simpleton has revealed. It is all Obama’s fault!!! Why oh why couldn’t we have seen that sooner, before it was too late?

Perk Earl on Mon, 22nd Sep 2014 2:25 pm

Shortonoil, yes, I went and looked at Gail’s shark fin in 2015 – looks like same school of thought.

“The model predicts that all liquid hydrocarbon production will peak in late 2016 at $117/b. If you take a look specifically at her figure# 8, its shows the same event taking place in late 2015.”

Question; is 117 optimistic for 2016? I know it is difficult to know at this point but even if that is the affordability ceiling amount and date is correct, it’s still bad news.

In the following paragraph, Gail ends it with the steeper recent drop (in oil prices) is what many are concerned about. I wonder if this latest price is cause for concern or if it is just a temporary drop down? The way I figure it; when price drops like it has recently, it won’t return to the previous high, undulating on a downward trend.

“A person can tell from Figure 1 that since the first part of 2011, the prices of Brent oil, Australian coal, and food have been trending downward. This drop in prices continues into September. For example, as I write this, Brent oil price is $97.70, while the average price for the latest month shown (August) is $105.27. It is this steeper, recent drop, which many are concerned about.”

Allen Sanford on Mon, 22nd Sep 2014 2:44 pm

Unless “shadow banking” is regulated soon, the disparity of income, wealth, and opportunity in America will be unrepairable. This article clearly explains the government sanctioned racketeering that has occurred. For the solution to the problem read “Real Estate Crisis Or Government Sanctioned Racketeering?

Ricardo on Mon, 22nd Sep 2014 3:08 pm

It´s time for European Americans to regain control of their country and the economy, let´s beat the kosher nostra right where it hurts them, the pocket!

shortonoil on Mon, 22nd Sep 2014 3:37 pm

“Question; is 117 optimistic for 2016?”

The 2016, $117/b projection is derived from a thermodynamic model. What it gives us is the upper most boundary confidence limit. It tells us that the consumer can not pay more than $117/b for oil, regardless of who, or what, does what! As far as we know, these laws of physics can not be breached by human intervention.

If you are asking have we already seen the limit to oil price, all I can say is “it’s possible”. The model has a 4 1/2% margin of error. We could be on the bottom of that margin now, or this could be just a short term dip. I just read that condensate production in the Eagle Ford is now displaying a drastic decline. This was expected, and will be followed by other condensate fields of the same vintage. They are reaching the dew point of the fields which is caused by their declining pressure as the fields are produced. Since a large number of these wells were drilled at about the same time, many of them will reach their dew point at about the same time. Once the industry begins to understand what is happening, there is likely to be upward pressure on price from a sudden supply constraint shock.

However, if it does happen, it won’t last very long. A $20 increase in the price of petroleum would have an almost immediate effect on the economy, and demand would plunge. Expect huge variability in the oil market over the next couple of years. Although we are bound by the laws of physics, not many of us are fully aware of it!

http://www.thehillsgroup.org/

GregT on Mon, 22nd Sep 2014 8:54 pm

“For the simple minded people who can’t see any link between Obama’s economic policies and the weak US economy………”

Sorry Plant. The simple minded continually blame current political leaders because they don’t understand the following quote by Albert Bartlett:

“The greatest shortcoming of the human race is our inability to understand the exponential function.”

Perk Earl on Mon, 22nd Sep 2014 11:28 pm

Thanks for the clarifications, short.

Those darn laws of physics make it impossible to cheat! – lol.

4.5% margin of error – should be interesting to see which side of the price limit it errs on.