Page added on February 4, 2015

Citi: The oil (and gas) plunge isn’t over yet

The oil crash — and cheap gas bonanza — probably isn’t over yet.

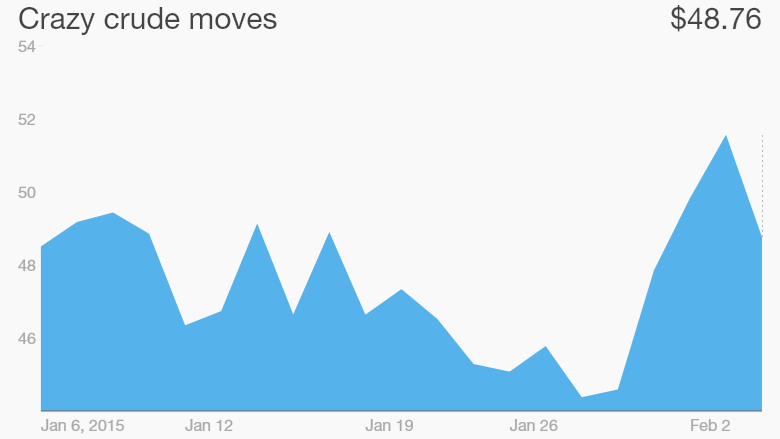

For a few days, oil was showing real signs of life following last year’s meltdown. Prices spiked above $54 a barrel on Tuesday after oil’s best three-day performance in six years.

Drivers may have even noticed a little pop in gas prices. The national average price of gasoline jumped nearly five cents a gallon on Wednesday, according to AAA. The oil bounce also caused stock prices to surge on Tuesday.

But the rebound is already looking like it may be short lived. Oil plummeted nearly 9% on Wednesday to settle at $48.45 a barrel. That’s the commodity’s worst day since November 28 when OPEC rattled the market by deciding to keep production steady.

What’s going on? It all goes back to simple supply and demand. The world is awash in oil — more than it needs, especially given sluggish demand caused by lackluster growth overseas.

Prices did mount a comeback on signs that U.S. oil producers are racing to fix that oversupply problem by shutting down oil drilling rigs. Some experts began calling a bottom in oil prices and a top OPEC official even predicted crude could eventually explode to upwards of $200 a barrel.

But Citigroup doesn’t buy the bottoming out thesis. In a pair of reports released this week, the bank warned crude oil may need to tumble to $30 because the world still has too much oil on hand.

“For the market to truly balance, U.S. oil rig counts would have to fall significantly further and the bottom of the price trading range for 2015 is likely to be a good deal lower,” Citi analyst Seth Kleinman wrote in a research report on Wednesday.

Oversupply problem persists: Citi estimates supply continues to outpace demand by about 1 million to 1.5 million barrels per day. That’s not exactly a recipe for higher prices, especially since OPEC appears unwilling to step in to balance the market like it usually does.

Oil prices spiked after Baker Hughes said U.S. rig counts plunged by a record amount last week. They are now down by 24% from their peak in October.

But just because rig counts are falling doesn’t mean production is, especially given productivity gains U.S. shale producers have achieved in recent years. U.S. production actually increased to a record of 9.3 million barrels per day during the week of January 23, according to Yardeni Research.

“Energy production isn’t like flipping a light switch. Supply response happens in months, not days,” said Art Hogan, chief market strategist at Wunderlich Securities.

Citi also notes that rig counts have only declined by 9% from their peak at the Big 3 shale oil plays: the Bakken, Eagle Ford and Permian. That’s a big deal because these regions are pumping tons of oil.

Without sizeable rig count declines at the Big 3, U.S. oil production could still rise by about 1 million barrels per day in 2015.

Head fake? This wouldn’t be the first time the energy market was faked out by falling rig counts. Back in early 2009 U.S. natural gas prices prematurely rallied on deceptive rig data only to fall to new lows later in the year.

“History appears destined to repeat itself,” Kleinman wrote.

If oil producers fall for another fake, they may end up hurting themselves more in the long run.

“Any expectations of an early price recovery could well ward off deep cuts in production,

thereby prolonging the oversupply and price distress,” Kleinman wrote.

18 Comments on "Citi: The oil (and gas) plunge isn’t over yet"

Plantagenet on Wed, 4th Feb 2015 7:43 pm

Us oil inventories are still building—up 6 million bbls just last week.

Clearly the oil glut isn’t over yet.

GregT on Wed, 4th Feb 2015 8:09 pm

“Us oil inventories are still building—up 6 million bbls just last week.”

1.5 hours worth of world consumption.

shallowsand on Wed, 4th Feb 2015 8:21 pm

Citibank called this many months prior to the June, 2014 peak. I think it is interesting, however, that they were calling for a low of $70-75 WTI and were considered the most bearish of the crude oil analysts. So even though they were right on the call, even they were nowhere close to how low WTI would fall.

When the analysts make price calls, they really are taking a stab in the dark. Not easy to predict the trend, actual price range seem impossible.

For example, active fighting in Libya, Iraq, Syria, and Yemen. There was a time when one truck bomb moved the price. Right now, nothing. Rig count falls off a bunch, spikes over 20%. Inventory build, which was anticipated, and price tanks almost 10% in one day.

Where is all the money coming from to shake the markets on what is less than earth shattering news?

GregT on Wed, 4th Feb 2015 8:58 pm

“Where is all the money coming from to shake the markets on what is less than earth shattering news?”

Where does all of the money come from?

rockman on Thu, 5th Feb 2015 6:48 am

More words from folks with heads stuck up their ass…or just liars….IMHO: “The world is awash in oil — more than it needs.” It’s not even correct to say “the world is awash with more oil than it can afford”. That’s not true either: the world is buying all the oil being produced today except for that very tiny volume being held in temporary storage.

“But the rebound is already looking like it may be short lived.” No rebound IMHO…just relatively normal daily variations. Especially if they are actually referring to future prices and not actual physical oil sales. “Prices did mount a comeback on signs that U.S. oil producers are racing to fix that oversupply problem by shutting down oil drilling rigs.” I talk to those folks daily and not one is cutting back drilling activity as a solution to lower prices. They are simply cutting back on those projects that are no longer viable at the current price levels. And none of those decision are being modified based on a daily price swing of a few $’s per bbl.

“For the market to truly balance…”. The market is balanced today IMHO: every bbl produced has a willing buyer with the funds to buy it. “…rig counts are falling doesn’t mean production is, especially given productivity gains U.S. shale producers have achieved in recent years. U.S. production actually increased to a record of 9.3 million barrels per day during the week of January 23…” And again a very ignorant observation or pure propaganda. It can take several months for a new drilled well to be put on production and then a couple of more months before that production is reported to the regulators. The rigs activity that added to the 23 Jan stat was conducted as far back as last summer. That’s the rig count to be match to Jan production…not the Jan rig count.

“Energy production isn’t like flipping a light switch. Supply response happens in months, not days,” Well, closer to the truth then most of the rest of this BS. Depending on economic activity it can take much longer than a few months for a response. In 2009 the avg oil price for the year was $58/bbl. And how did the global economy respond compared to the avg $98/bbl price it dealt with in 2008: less oil was consumed in 2009 than 2008. It can take a very long time for the global economy to adjust to energy price changes.

shortonoil on Thu, 5th Feb 2015 9:16 am

We called this price decline in May of last year, and put this page up in September. The date is on the second graph:

http://www.thehillsgroup.org/depletion2_022.htm

To bring prices back to the curve above will require about 4 mb/d to be shut in. That is not likely to happen until later this year. Our projections put the price in the $60 range for 2016, and then decline for subsequent years. Since the model has been operating within a 4 1/2 percentage margin of error for the last half century we do not expect it to deviate significantly in the foreseeable future.

http://www.thehillsgroup.org/

bobinget on Thu, 5th Feb 2015 9:28 am

Swiped from investor village..

oil price collapse potentially causing accelerated decline rates

from Reuters:

Production from oil fields falls over time, because reservoir pressure drops as oil is extracted. Fields on average experience natural depletion rates of around 15 percent per year, industry executives say, but companies generally reduce this to 3-5 percent by sinking additional wells, injecting gas or by using other capital-intensive techniques.

Cutting capex will increase depletion rates, if past experience is an indicator.

“That is a growing risk for the industry. If you go back to the 2008 and 2009 period … we saw an increase worldwide in decline rates for all companies, basically for the entire industry, increase by a percent or two. And that’s very significant,” Chevron CEO John Watson told investors last week.

Using data going back to the oil drop in the mid 1980s, analysts at Bernstein calculated the rise in depletion rates was 3 percentage points within two years after an oil price collapse began.

Across the industry, this could mean the loss of hundreds of thousands of barrels of oil production each day.

(Article worth reading also touches on the fact that most majors are not replacing reserves)

http://www.reuters.com/article/2015/02/05/oil-majors-output-idUSL6N0VE2YM20150205

—————-

This is yet another future supply risk that is not often discussed, we often use 5% as an average average for the industry, however based on the above decline rates could rise to 7% or 8% globally by 2017 as companies cancel enhanced recovery projects and reduce investments in their existing fields. Many companies are cutting capex today, but not lowering production in 2015, however often those cuts pertains to long-term investments that must done today to mitigate decline rates in the future such as building water flooding infrastructure.

Regards,

Nawar

bobinget on Thu, 5th Feb 2015 10:31 am

shortonoil managed to locate free oil field labor,

I mean really free, no pay, no food, lodging, beer.

“To bring prices back to the curve above will require about 4 mb/d to be shut in”.

We here at inget believe the US market alone will be short two million p/d, which I believe— was intended by shortonoil to be a worldwide figure.

Currently, US is using some 19.7 M B p/d.

Some (of that 19.7) of course is exported. Without

Venezuela’s or US exports, many Central and South American nations will be in chaos.

China has broken ground for Nicaragua’s grand

environmentally disastrous canal project.

Significantly, China will be laying oil pipe and rail

lines prior to digging the canal. All this to advantage

Asia of access to Venezuela’s Orinoco, largest in the hemisphere oil sands deposits.

If oil prices were to stay in the current trading range

almost no new, replacement oil will be developed.

This means in a very few years driving or flying will be restricted to military adventurism.

Finally, my oil price predictions for 2015;

Both Brent and NYMEX will inter-day print $200.

Crude oil will close out the year trading between $120 and $140.

Shotonoil is mistaken about one more thing, We are constantly improving energy efficiency of everything from aircraft to railroad power plants.

(call them engines no longer)

Thereby extracting MORE energy from each liter of fuel, not less as shorty contends.

bobinget on Thu, 5th Feb 2015 10:46 am

GUNMEN riding in a speedboat kidnapped four Nigerian oil workers in the crude-producing Niger Delta, the military said Wednesday, as fears rise of growing unrest in the region 10 days before national polls. – See more at: http://www.ngrguardiannews.com/news/national-news/196763-gunmen-kidnap-four-in-nigeria-oil-region#sthash.fgh4Msqk.dpuf

bobinget on Thu, 5th Feb 2015 10:48 am

Oil Patch news:

EQT Macellus Drilling CAPEX

On 1/22/15 I posted my conversations with EQT going to announce 30% cut in Drilling here and voila now its public A couple of posters were upset that I forwarded this info and several thought I should be scared of doing so. Those of us that are involved ‘hands on’ in the patch ALWAYS know what is going on long before the WS gang posts the news. Believe me that they are in the know soon after the field gets the info too. The average investor is usually last to be informed IMHO as they need to be fleeced by the professional ‘supposed SMART Money managers’

Well there is now news out here about not only more layoffs, more drilling cuts, further reductions in spending from several public companies that I regularily meet or converse with but there is BIG news out about the money funding sources and their new parameters and forward plans for funding Marcellus and Utica drilling for these same entities. I will not post the names and new $ amounts that are on the table but I will tell you that there is going to be severe reductions going forward in drilling funds available from current very large funds and PE companies. The reductions that may or may not be announced in the future publically will be in excess of 70% to some of the more leveraged guys and almost 100% to the grossly overleveraged shale companies. This info has already been dispersed to local service cos and supply companies and will surely reduce 2015 production coming to the surface from this area. I can only assume it will affect other basins in an equal amount. Bring on the BOOM again. Its just a matter of When for most investors here as we already can read the tea leaves much better than these media so called experts.

shortonoil on Thu, 5th Feb 2015 11:01 am

Finally, my oil price predictions for 2015;

Both Brent and NYMEX will inter-day print $200.

Crude oil will close out the year trading between $120 and $140.

Was that projection done with a dart board, or Ouija board? Makes a difference you know?

It is much harder to calculate a margin of error from a Ouija board operated by two blind bats than from a dart board. A dart board can have hundreds of monkeys working on it. Larger statistical sample, and all that stuff!

We gave up on those approaches a long time ago. It’s too hard to get the bats to cooperate, and we kept losing monkeys!

Pops on Thu, 5th Feb 2015 11:09 am

“We called this price decline in May of last year,”

LOL, I called it in 2012:

http://peakoil.com/forums/2020-oil-price-challenge-t67295.html?hilit=2020#p1134219

We’re right between the g&e in “age”.

bobinget on Thu, 5th Feb 2015 11:19 am

http://www.wsj.com/articles/gunmen-storm-libyan-oil-field-say-oil-company-officials-1423041046

http://www.huffingtonpost.com/2015/02/05/al-qaeda-in-yemen-us-airstrike_n_6620510.html

US protects Saudis from AQ backfire:

CAIRO, Feb 5 (Reuters) – The Yemeni arm of al Qaeda said on Thursday that one of its leading members had been killed by a U.S. air strike while traveling in a car in the southern province of Shabwa on Jan. 31.

Three other al Qaeda fighters were also killed in the strike, Al Qaeda in the Arabian Peninsula (AQAP) said in statement posted on Twitter.

Sheik Harith bin Ghazi al-Nathari was on AQAP’s legal committee and served as an adviser on legal and religious affairs, the statement said.

AQAP claimed responsibility for last month’s deadly attack on France’s Charlie Hebdo newspaper in Paris and is regarded as one of the global militant group’s most potent branches.

Saturday’s strike was followed by at least two more, showing there has been no let up in a U.S. campaign against suspected militants despite a power vacuum created by the advance of Shi’ite Muslim Houthi rebels into Sanaa and the resignation of president Abd-Rabbu Mansour Hadi.

On Monday, at least three al Qaeda suspects were killed by a U.S. drone in southeastern Yemen.

Perk Earl on Thu, 5th Feb 2015 11:23 am

“Finally, my oil price predictions for 2015;

Both Brent and NYMEX will inter-day print $200.

Crude oil will close out the year trading between $120 and $140.”

“It is much harder to calculate a margin of error from a Ouija board operated by two blind bats than from a dart board. A dart board can have hundreds of monkeys working on it.”

Sorry Bobinget, but that’s my pick for the worst oil price prediction for 2015, followed by the best comeback of the year award for Short.

Davy on Thu, 5th Feb 2015 11:51 am

Bobby, good throw, let me try and I will get back to you…..hum…..hum.

bobinget on Thu, 5th Feb 2015 12:06 pm

Sure, I pulled those numbers out of my butt.

However, this butt owner has been ‘tape’ watching six decades of set-ups like the one we are currently experiencing. Experience, the one positive old

age gives a person.

Mine is a ‘board minority’ viewpoint on oil pricing,

understood.

But, ya know, it’s difficult driving by a fatal accident

without looking and speculating on outcomes.

If offering factual evidence concerning US imports

averaging 7.4 million barrels daily is a trivial pursuit,

then simply ignore my posts.

http://ir.eia.gov/wpsr/wpsrsummary.pdf

If offering timely up-dates on world oil wars is below

a person’s interest level, avoid looking as you pass

this accident.

bobinget on Fri, 6th Feb 2015 3:14 pm

http://www.huffingtonpost.com/2015/02/06/houthis-yemen-takeover_n_6630070.html

Rebels knocking on Saudi Doors.

Davy on Fri, 6th Feb 2015 3:55 pm

Bobby, was having fun with you. I enjoy your perspective.

Those price forcasts are worth a bet. I wish there was a way to make you put some money where your mouth is. In any case it should be fun to see this casino in action.