Page added on March 26, 2012

Benefiting From $200 Oil

Today we are concerned about peak oil because global demand in oil and gas is increasing 3% a year, while production is decreasing 3% a year. There have been tensions with Iran trying to shut down the Strait of Hormuz, which will affect 35% of seaborne traded oil. The Obama administration itself is already concerned about oil prices and is now focusing on increasing the drilling rate of oil domestically.

The fact is that U.S. imports of oil have skyrocketed. 30 years ago the United States imported 28% of its oil, while today, oil imports are over 60%. Most of those imports are coming from Canada, the country with the third largest oil reserves in the world after Venezuela and Saudi Arabia.

If oil prices were to double, the first and foremost impact will be seen on the national debt of the United States. Oil imports contribute for about $US 100 billion/quarter in trade deficits in the United States. This trade deficit in oil imports accounts for 65% of the total U.S. trade deficit. So if oil doubles, triples or quadruples, we will see the U.S. trade deficit do the same. But that’s not all. If oil prices skyrocket, the net earnings of different enterprises will go down as production costs are going up due to increasing oil prices. This will translate in declining tax revenues for the U.S. government, which in turn results in a higher U.S. government budget deficit. This government budget deficit is already in the trillions as we speak, and it will become completely unsustainable as I already mentioned in this article.

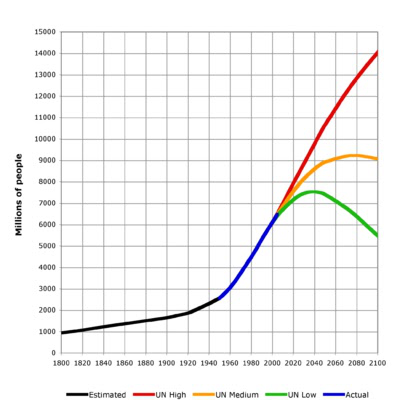

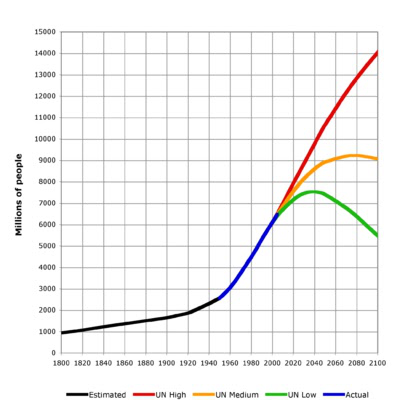

Second, food prices would go up substantially as the world population is still increasing exponentially and would only start to decline in year 2040 (see Chart 1). China will increase domestic consumption and is already changing its food consumption patterns. China is starting to eat more meat instead of grains. This change in behavior will put upward pressure on fertilizer prices. For example, a kilogram of beef yields only half as many calories as a kilogram of cereal, but it takes around seven kilograms of cereal to produce.

|

| Chart 1: Population curve |

Food prices will also be affected by the increase in the oil price. For example, in the UK 25% of all heavy goods transportation costs are due to transportation of food. In the United States, transportation costs account for 14% of the total energy consumed by the American food system. Additionally, foods need fertilizers to grow, which is made by ammonia, which in turn is derived from natural gas. To benefit from this rising trend in food prices, you can buy the Rogers Agriculture ETN.

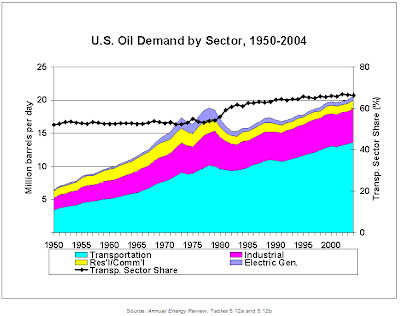

Third, imagine the scenario where the oil price were to double. The economy cannot function with oil prices above a certain level. Pierre Lassonde said that the economy can’t function on $US 200 oil. In extremis, imagine that there is no oil available in the world (equivalent to a skyrocketing oil price). The economy would come to a halt as transportation (the “life blood” of the economy) accounts for more than 60% of the oil demand in the United States (see Chart 2). Today, households use at least 1/5 of their income on transportation. If the oil price were to double, every household would spend half of their salary on transportation.

|

| Chart 2: Oil Demand by Sector |

Overall, inflation will become worse at higher oil prices. Commodities like gold, silver, copper, zinc, potash, etc…, will rise in value together with the oil price. The federal reserve will need to increase interest rates to fight inflation, but will be reluctant to do so as rising interest rates would crash the banking sector and housing market. They would rather vote for a declining dollar than rising interest rates. That’s why shorting U.S. government bonds will not work in the short term (TLT).

To benefit from higher oil prices it’s safe to say that commodities are still your best friend. To follow Jim Rogers’ advice I would recommend buying basic commodity ETFs like agriculture (RJA), gold (PHYS), oil (OIL), silver (PSLV), platinum (PPLT), just to prepare yourself for the worst scenario.

4 Comments on "Benefiting From $200 Oil"

Arthur on Mon, 26th Mar 2012 5:37 pm

That’s what was advised on LewRockwell the other day, if you have surplus cash and dry storage space, fill it with soap, razor blades, bullets, alcohol, silver coins, detergent, matches, sugar, toilet paper, water filters, batteries, candles.

http://lewrockwell.com/rep3/16-shtf-barter-items-to-stockpile.html

Hubbertsfreak on Mon, 26th Mar 2012 5:59 pm

I’m beginning to come around to Arthur’s point of view. I initially was optimistic about tar sands(ENY), oil service stocks (IEZ), Brazil (EWZ), etc. But honestly, when people realize the finality of peak oil, the paper markets will fall and never come back. I even stopped 401k contributions. Buy real things that have real uses.

Baptised on Mon, 26th Mar 2012 7:08 pm

What’s the problem the 1% will still fly around in their planes and helicopters, wine and dine. Remember the poor have no voice even if it is 99%. Then you got TV pastor’s always explaning why the devil is in some other country, that needs to be bombed. It’s all their fault.

TIKIMAN on Mon, 26th Mar 2012 7:43 pm

“The Obama administration itself is already concerned about oil prices and is now focusing on increasing the drilling rate of oil domestically”

Fucking bullshit. Oil production has risen during his administration because Bush increased drilling. It takes years for a new oil rig to come online.

Obama energy secretary has stated on record he wants the price of oil to rise. They are only mad because oil is rising before the election. If he is elected again he will destroy this country.