Page added on June 5, 2014

2014: Peak Oil Sands Investment?

Does the shelving of the Total SA Joslyn mine signal that the recent wave of oil sands investment has peaked?

This past week, Total SA And their business partners decided to shelve the Joslyn Mine project, which places $11 bn in oil sands investment into the “unlikely” category.

As an economist, I always look at other informal indicators of macroeconomic trends. Some other informal indicators are pointing to a crest in the recent wave of oil sands investment.

– The price of diesel at the pump is approaching its 2007 levels, which raises variable costs for operating machinery.

– Multiple fatalities in oil sands projects as S-A-F-E-T-Y is trumped by P-R-O-D-U-C-T-I-O-N.

– Companies shedding contract employees, layoffs or hiring freezes as corporations regroup.

– House flipping is back in Calgary as more people enter the market to sell $600,000 duplexes.

– More frequent instances of rude wait staff at eating establishments as wait staff get over worked.

– Last but not least, the length discarded cigarette butts includes an excess of 1cm of discarded tobacco.

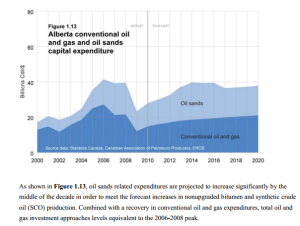

I hate to say I told you so, but I did. Back in 2011, when I was working at the AER, I was tasked with estimating oil sands construction CAPEX for upcoming years. The model is based on some project capex assumptions around construction schedules and announced, approved or projects under construction. You can see a screenshot of the output, as it appears on page 1-15 of the 2011 ST-098 report.

Click to enlarge

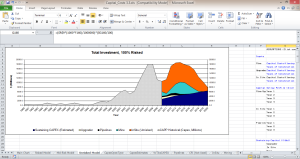

Well, I dug out my old spreadsheet to have a closer look. Here’s a screenshot of where that graph comes from:

Click to enlarge

Look closely at the chart. See the blue mound? That’s oil sands mine investment. See the small black strip? That’s pipelines. What’s that tell you?

First, the lack of pipeline capacity is concerning. Come to think of it, in 2011 I was also writing about the subsequent explosion of bitumen by rail, which has occurred to offset this shortage of pipeline capacity. But this shelving of the Joslyn project is a rational market response to the pricing signals given by labour shortages, material cost escalation and logistical issues.

What does this mean if you are a safety professional? If I’m looking at my linkedin account, it’s telling me that there are a lot of Safety Managers looking to make a jump or transition. Why is this? Are they fed up with their workplace safety culture or management hubris? Do they see the peak coming, too?

As I look at the tea leaves, chicken bones and runes of my excel spreadsheet and assumptions, it’s telling me the following:

1. Contract HSE Work May Become Scarce. Many HSE professionals are contractors. In a stable economy, contractors are the last to be hired and first to be laid off. It can be lucrative work, if you can get it. If you’re a contractor, it may become more difficult to find contract work as the nature of oilsands work shifts from construction spending to maintenance, shutdowns (sustaining capex). There will still be a role for contractors, but the market does appear to be saturated at this point.

2. Go West, Young Man. If you’re looking to get in on the ground level of another boom, try British Columbia for a change.

3. Drill, Baby Drill. Drilling can continue in a low price environment as companies drill wells, cap them, and wait for a better pricing environment. If oil sands investment is suffering from bottlenecks and uncertainty, we will see more tradesmen returning to the rigs to find an income.

4. Merge and Acquire My contacts in the world of banking are licking their chops at the number of prime takeover targets in downtown Calgary. Companies sitting on cash are primed for a round of growth through acquisitions, so if you’re looking to sell your company, you may find a buyer.

5. Get your NEBOSH Safety seems to be the most difficult part of oil sands construction. As these projects come on line, the nature of the HSE portfolio changes from construction safety towards process safety. You will see more demand for safety engineers, process safety analysts, HSE data analysts. In other words the NEBOSH IOGC will displace the NCSO as the incumbent HSE certification.

8 Comments on "2014: Peak Oil Sands Investment?"

rockman on Thu, 5th Jun 2014 7:27 am

Nothing wrong with the piece per se. But not very “shocking” news IMHO. Every newly developing oil/NG play goes thru the same cycle: the more economically viable projects are drilled first with lesser projects coming later. Eventually the limiting economic threshold is reached and investment levels drop. Essentially why oil patch caped levels fell in the 90’s as oil prices declined. But then oil prices increased 300%+ and the threshold changed. This has happened with every oil/NG trend developed. If we’ve reached that point with the oil sands it’s just SOP. And at some point the same profile will be reached by the Eagle Ford, Bakken and Deep Water GOM. All one need do is look at Hubbert’s projection and contemplate the investment fall off paralleling the production decline.

Not exactly an Earth shattering revelation. LOL.

paulo1 on Thu, 5th Jun 2014 8:18 am

re: – Multiple fatalities in oil sands projects as S-A-F-E-T-Y is trumped by P-R-O-D-U-C-T-I-O-N.

This is an outright fabrication. The safety requirements of working at these sites is so rigorous I couldn’t even stand working there. You walk on site…through the gate…without all safety gear on = instant dismissal. Each and every work task/job for trades has a safety plan before work starts. If even a small tool falls to the ground from as little as 8′ up, guess what, the entire crew can get fired.

These statements are bullshit for people who have never worked in heavy industry.

Paulo

Juan Pueblo on Thu, 5th Jun 2014 9:44 am

Nothing new here. Investment goes up and down based on costs and prices. I think it has become clear in the last six months that investment has not been growing as needed to maintain production in the medium term. This will cause prices to rise, eventually leading to more investment. Then costs will rise and the whole thing starts again. This cycle will repeat itself until the SHTF and growth ceases for whatever reason. After that we can only guess what will happen.

bobinget on Thu, 5th Jun 2014 10:13 am

Perhaps labor uncertainty or rather certainty of excess labor cost has something to do with cutting back on cap-ex. Could also be fear of ‘stranded assets’,

no way to economically deliver product to customers.

Any oil sands project start-ups need to compete with established infrastructure on profits. Note that the most recent oil sands projects from Imperial (IMO)

went billions over budget and years and years overdue.

Then again:

EVERY single major is canceling or ‘shelving’ projects.

This at a time when demand is creeping higher in North America and rock & rolling everywhere else.

Today, Statoil Norway’s biggest, also announces cutbacks. (forget about bullshit North Sea and Arctic

Sea statements made recently).

Here IMO, is the skinny. When Shell Oil has to borrow

to pay its dividend when oil prices have been remarkably steady, boards of directors get fidgety.

Peak Oil smells like this in Denmark..

“The Danish state’s oil and gas company, Nordsøfonden, has announced that the search for oil in the Danish areas of the North Sea are too expensive, Berlingske newspaper reports.

During a meeting yesterday at which the energy authorities, Energistyrelsen, opened up the seventh bidding round for offshore drilling permits in the North Sea, Peter Helmer Steen, the head of Nordsøfonden, voiced his discontent.

“The costs associated with drilling and building new platforms in Denmark are far too steep,” Steen said according to Berlingske.

“They need to go down if we want more resources extracted. We can see that some of our drilling costs are twice as high in Denmark as they are in other countries.”

High standards

The high costs in Denmark could stem from the technical areas – such as the number of days it takes to drill – and expenses associated with supply ships, but part of the cost comes from the necessary requirements now needed to operate rig equipment.

The steep costs have weakened competition in Denmark, and stringent regulation is an area that the authorities will look into when they develop a new strategy for oil excavation in the North Sea.”

shortonoil on Thu, 5th Jun 2014 10:35 am

Dave Hughes was 100% correct. Anyone who has worked open pit operations knows the implications of growing overburden; it eventually will put you out of business! As the oil sands move further from Fort McMurray, following the oil bearing sands, the seam gets thinner, and the overburden gets heavier. Production costs increase, and CAPEX declines.

There is another dynamic at play in the oil sands, and it is not just isolated to them. It is affecting the entire petroleum industry. The cost of production is increasing faster than the price. This is a thermodynamic effect that began when we pasted Peak – nine years ago. It hits the lower ERoEI fields first, and bitumen mining is low ERoEI. Shale, extra heavy, and ultra deep water will follow. Conventional crude started the whole show, and it will be the last to leave the stage!

http://www.thehillsgroup.org

Plantagenet on Thu, 5th Jun 2014 11:08 am

Oil from fracking is marginally less expensive then oil from the tar sands. When fracking is used up the focus will shift back to the tar sands.

bobinget on Thu, 5th Jun 2014 11:20 am

Thank you shortonoil, your analysis, short, sweet and

incontrovertible.

Plant forgets to include our most prodigious oil and gas source, ultra deep water, in that ‘tar’ sands comp.

Don’t forget clean-up costs for spill events either.

But…. BP can tell us more on that account.

nemteck on Thu, 5th Jun 2014 4:03 pm

“Companies shedding contract employees, layoffs or hiring freezes as corporations regroup”.

Just the opposite is true:

Canada’s oil patch bracing for coming ‘retirement tsunami’

http://business.financialpost.com/2014/05/29/canadas-oil-patch-bracing-for-coming-retirement-tsunami/?__lsa=28bd-393f

It may be that this fellow is a disgruntled employee who got fired at the AER where he did not followed the rules when discarding cigarette butts that had an excess of 1cm of tobacco left.