This past week, I gave a presentation to a group interested in a particular type of renewable energy–solar energy that is deployed in space, so it would provide electricity 24 hours per day. Their question was: how does the production cost of electricity really need to be?

I gave them this two-fold answer:

1. We are hitting something similar to “Peak Oil” right now. The symptoms are the opposite of the ones that most people expected. There is a glut of supply, and prices are far below the cost of production. Many commodities besides oil are affected; these include natural gas, coal, iron ore, many metals, and many types of food. Our concern should be that low prices will bring down production, quite possibly for many commodities simultaneously. Perhaps the problem should be called “Limits to Growth,” rather than “Peak Oil,” because it is a different type of problem than most people expected.

2. The only theoretical solution would be to create a huge supply of renewable energy that would work in today’s devices. It would need to be cheap to produce and be available in the immediate future. Electricity would need to be produced for no more than four cents per kWh, and liquid fuels would need to be produced for less than $20 per barrel of oil equivalent. The low cost would need to be the result of very sparing use of resources, rather than the result of government subsidies.

Of course, we have many other problems associated with a finite world, including rising population, water limits, and climate change. For this reason, even a huge supply of very cheap renewable energy would not be a permanent solution.

This is a link to the presentation: Energy Economics Outlook. I will not attempt to explain the slides in detail.

–

Some people falsely believe that energy supplies are “only needed for industrial purposes.” Energy supplies are, in fact, needed for many things: cooking our food, keeping our homes warm, and creating the clothing we expect to wear. It would be impossible to feed, house, and clothe 7.3 billion people without supplemental energy of some kind.

–

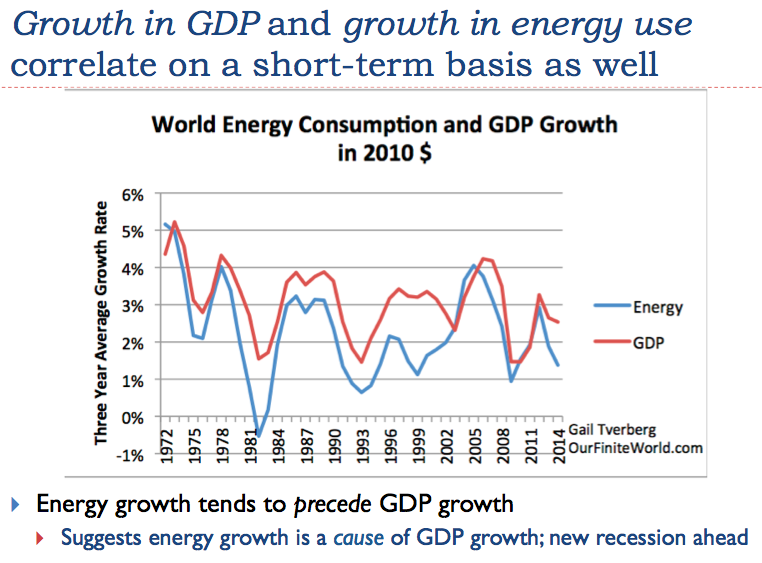

Slide 4 suggests that the world economy is heading into recession, because recent growth in the use of energy supplies is very low recently. Another sign that we are headed into recession is that fact that CO2 emissions fell in 2015. They usually don’t fall unless a global crisis exists. Emissions fell when the Soviet Union collapsed in 1991, and they fell during the economic crisis in 2008. Perhaps the world economy is hitting headwinds that are not being picked up well in conventional calculations of GDP growth.

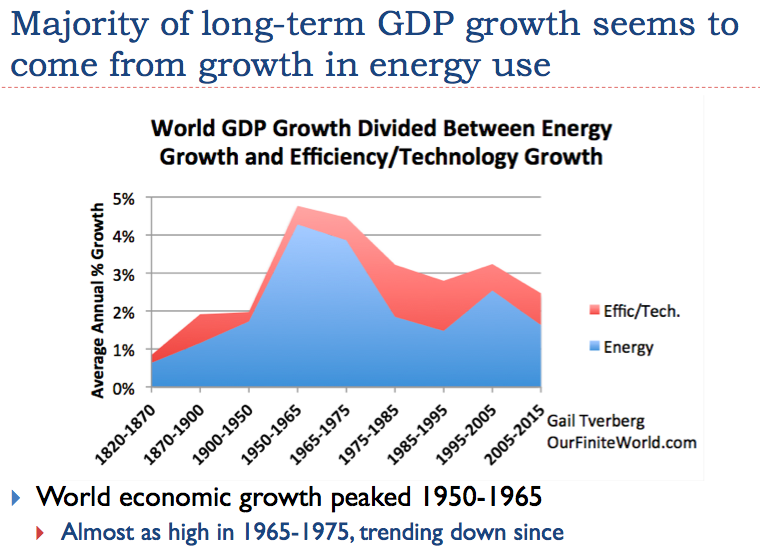

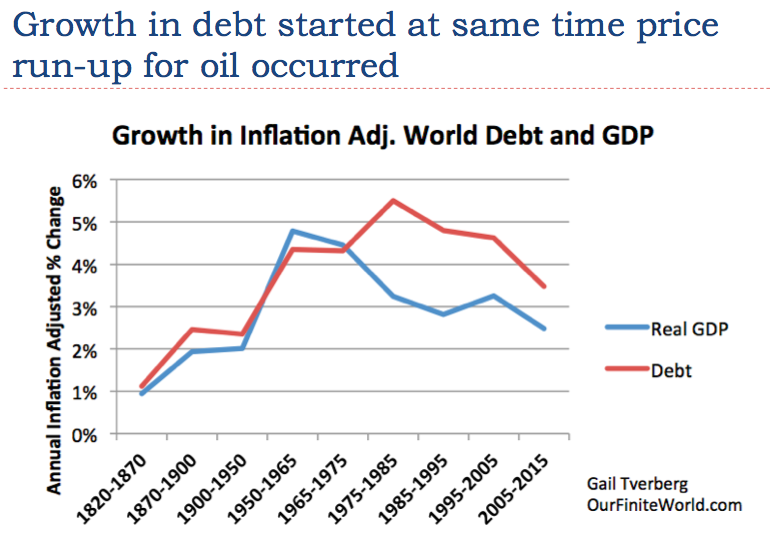

Slide 5 shows a chart I put together, using data from several different sources, showing how growth in energy consumption has compared with growth in GDP. Growth in GDP tends to be somewhat higher than growth in energy consumption.

Economic growth (and growth in energy use) was low prior to 1950. There was a big jump in economic growth immediately after World War II, in the 1950-65 period. There was almost as much growth in the 1965- 75 period. Since 1975, economic growth has generally been slowing.

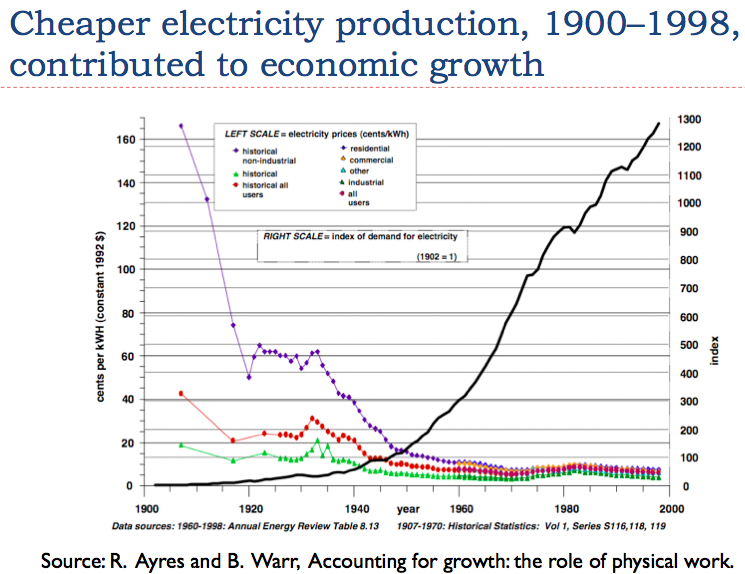

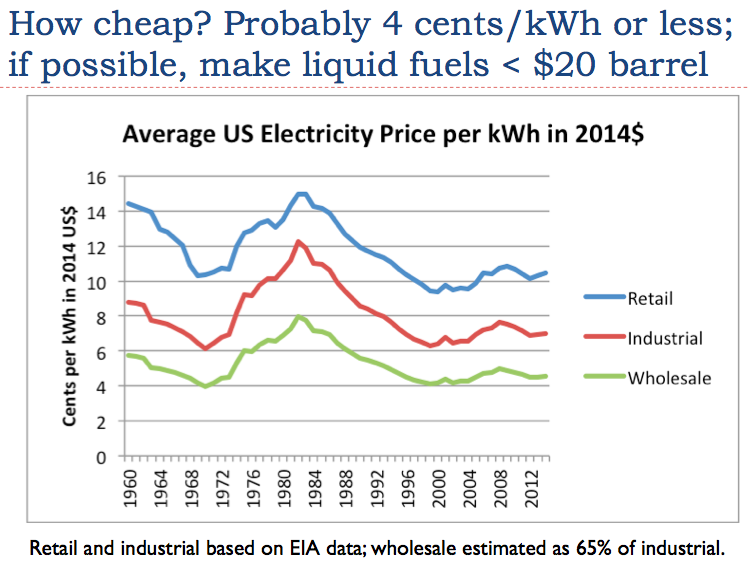

Between the years 1900 and 1998, the use of electricity rose (black line) as the cost of electricity fell (purple, red, and green lines). Electricity consumption could rise because it was becoming more affordable. Rising electricity consumption allowed the economy to make more goods and services. Workers (with the use of electricity) were becoming more efficient, so wages could rise. With higher wages, workers could afford more products that used electricity, such as electric lights for their homes and radios.

If electricity prices had risen instead of fallen, it seems doubtful that this pattern of rising consumption could have taken place.

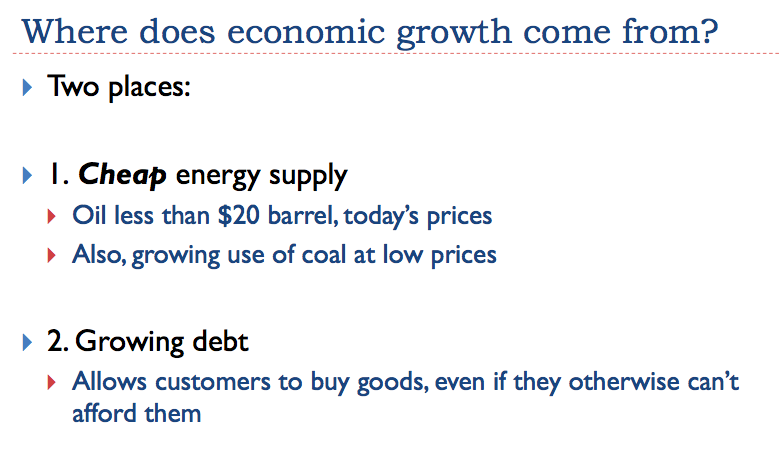

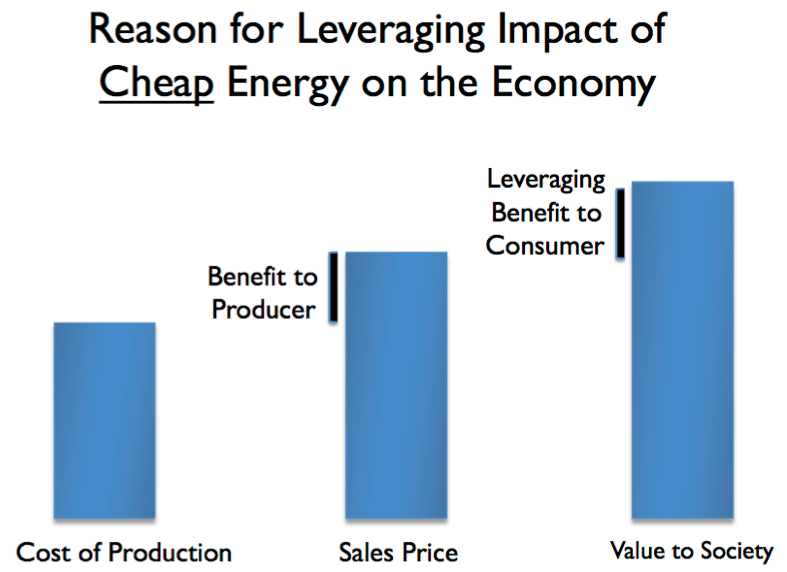

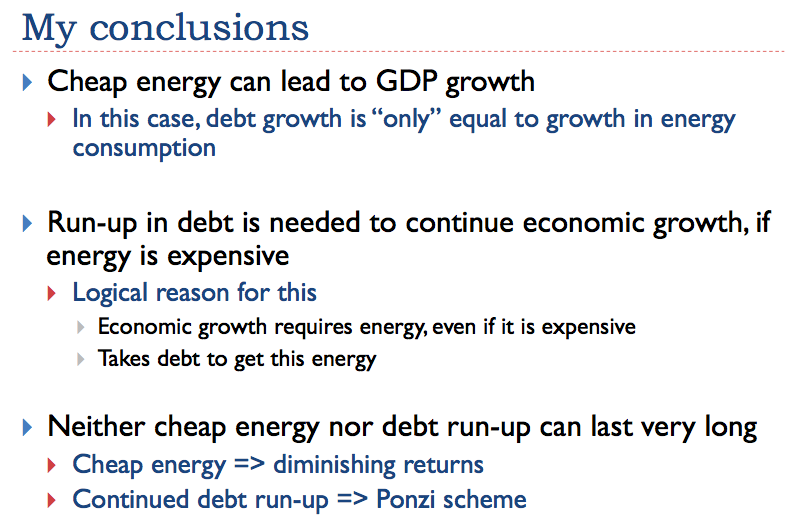

The comments in Figure 7 represent my own view. It is based on both theoretical considerations and historical relationships. Many who have studied the economy believe that energy is important for economic growth. In my view, the real need is for cheap-to-produce energy, not just any energy. If cheap energy is not really available, then adding more debt can somewhat make up for the high cost of energy production.

Debt is important because it makes goods affordable that would not otherwise be affordable. For example, having a loan for a house or a car makes a huge difference regarding whether such an item is affordable.

Even when energy products are cheap, debt seems to be needed to get oil or coal out of the ground, or to make a new device such as a wind turbine. Part of the problem is the cost of the capital equipment needed to extract the oil or coal, or the cost of the wind turbines themselves. Another part of the problem is paying for factories to make devices that use the energy product. A third problem is making it possible for users to afford the end products, such as houses and cars. It is much easier to borrow the money for a new tractor, and pay the loan off as the tractor is put to use, than it is to save money in advance, using only the funds earned when farming with simple hand-held tools.

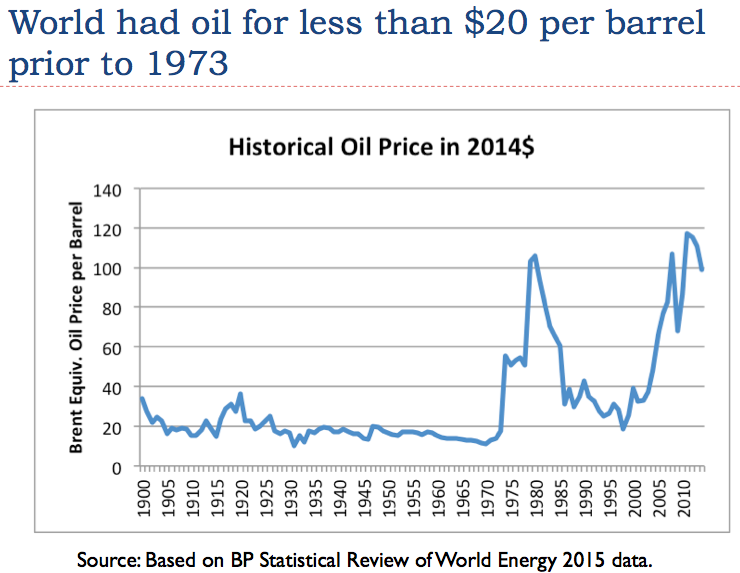

I mentioned the need for $20 per barrel oil on Slide 7. This is a very inexpensive price. Slide 8 shows that the only time when oil prices were that low was prior to the mid-1970s. The cost of oil production is now far above $20 per barrel. The sales price now is about $37 per barrel. This is below the price producers need, but still above my target price level.

Slide 9 explains where I got my $20 per barrel price target. Back prior to 1975–in other words, back when oil prices were generally low, $20 per barrel or less–the increase in debt more or less corresponded to the growth in GDP. Once prices rose above $20 per barrel, the amount of debt needed to produce a given amount of GDP growth rose dramatically.

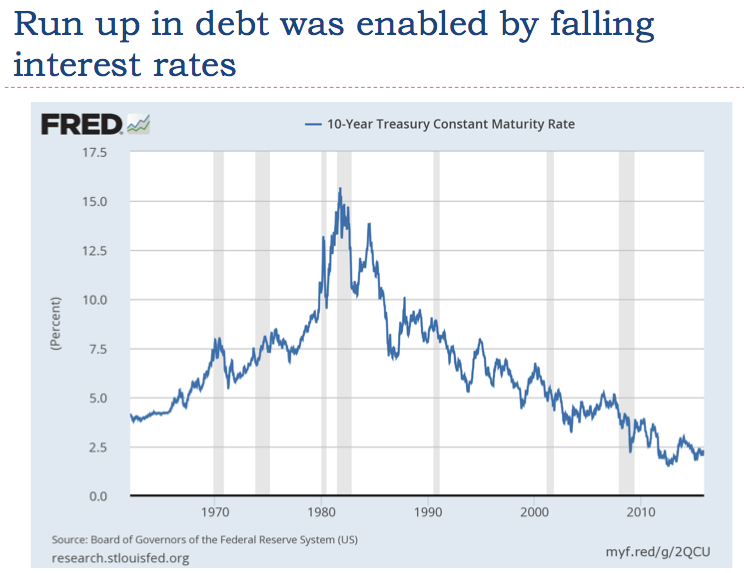

Slide 10 shows interest rates for US debt with 10-year maturity. These interest rates often underlie mortgage rates. As interest rates fall, homeowners can afford increasingly expensive homes. If shorter-term interest rates fall as well, auto loans become cheaper too.

The value to society of a barrel of oil is determined by how many miles it can make a diesel truck go, or how far it can make an airplane fly. This value to society is more or less fixed. The only change is the small increment each year from efficiency changes, making a barrel of oil “go farther.”

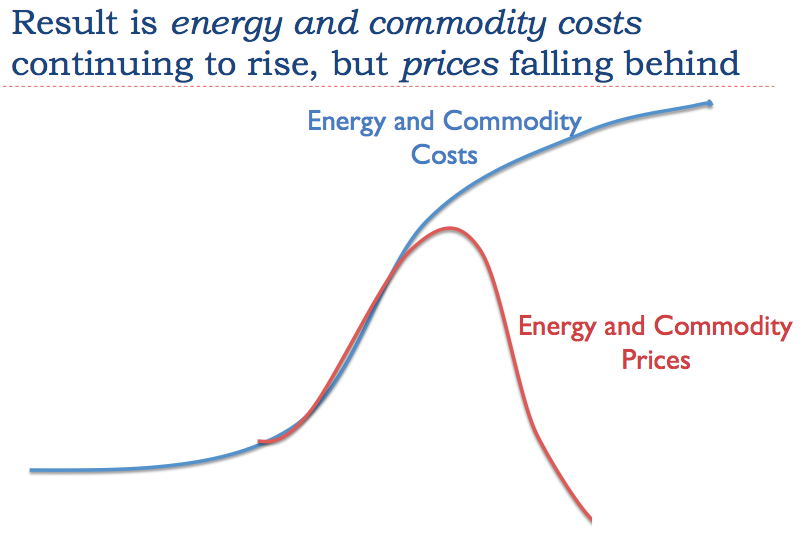

In the 2000-14 period, the cost of new oil production was increasing very rapidly–by more than 10% per year, by some estimates. The rising cost of oil production occurred much more quickly than efficiency changes. The result was a falling difference between the value to society and the cost of production. When oil prices are high, oil-importing nations tend to suffer recession. When oil prices are low, oil-exporting nations find it hard to collect enough taxes to support their many programs.

The fact that we need energy for economic growth means that we somehow must obtain this energy, even if doing so costs more. The big run-up in oil prices is a major reason for the historical run-up in debt levels. China’s big build-out of homes, roads, and factories was also financed by debt.

The higher cost of oil affects many things that we don’t think are related, including the cost of building new homes, the cost of building cars, and the cost of building roads. As consumers are forced to buy increasingly expensive homes and cars, and as governments find that the building of roads is increasingly expensive, more debt is used. The terms of loans are often longer as well, to hold down monthly costs.

If we still had cheap oil, this oil by itself could provide a “lift” to the economy. An increasing amount of debt can “sort of” compensate for the absence of cheap oil.

The problem we encounter is that neither cheap energy nor the continued run-up of debt is sustainable. Cheap energy tends to change to expensive energy, because we use the cheapest sources first. The continued debt run-up becomes more and more difficult to handle, unless interest rates fall lower and lower. At some point, interest rates can’t fall enough, and the whole pile of debt tends to collapse, like a Ponzi scheme.

I gave this talk on December 15; the first increase in interest rates took place on December 16. With rising interest rates, we suddenly have “the prop” that was attempting to hold up economic growth taken away.

We need ever expanding debt–that is, debt rising faster than GDP levels–to try to keep the world economy growing, so that the whole pile of debt doesn’t fall over and collapse. If we are to have non-debt growth in the future (because we are reaching limits on debt), it needs to again come from cheap energy alone. We need to get back to something similar to the low-cost energy that fueled the economy before the debt run-up.

Most of us have heard the Peak Oil story, and assume it represents a reasonable view of where we are headed. I think it is close to 180 degrees off course.

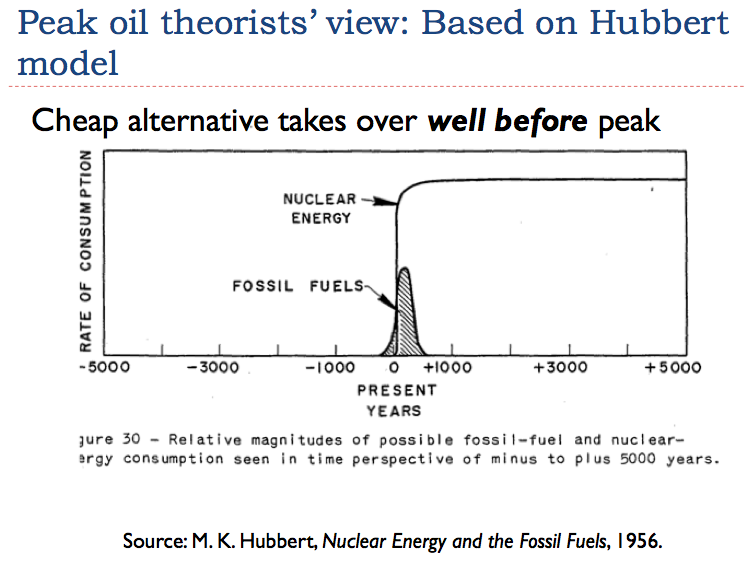

M. King Hubbert talked about a very special situation–a situation where another cheap, abundant fuel took over, before fossil fuels began to decline. In this particular situation (and only in this particular situation), it is reasonable to assume that production will follow a symmetric “Hubbert Curve,” with half of the production coming after the peak, and half beforehand. Otherwise, the down slope is likely to be much steeper.

Many peak oilers missed this important point. We certainly are not in a situation today where another very cheap fuel has taken over.

Slide 16 represents what I see as the predominant “Peak Oil” view of the oil limits situation. Some individuals will of course have different opinions.

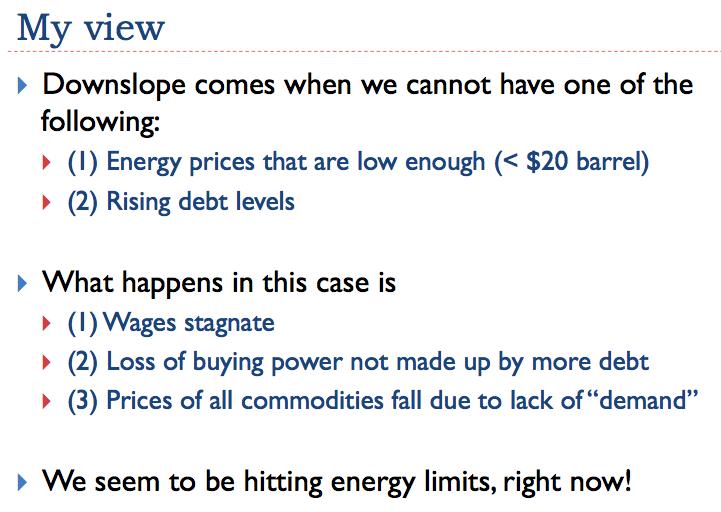

Peak oilers certainly did get part of the story right–at some point, the cost of oil extraction would rise. What they got wrong was how the whole scenario would play out. It turns out, it plays out pretty much the opposite of what most had supposed–that is, with stagnating wages, loss of buying power, and prices of all commodities falling because of lack of “demand.”

We seem to be hitting energy limits, right now. That is why debt is such a problem, and it is why prices of many commodities, including oil, are far too low compared to the cost of production.

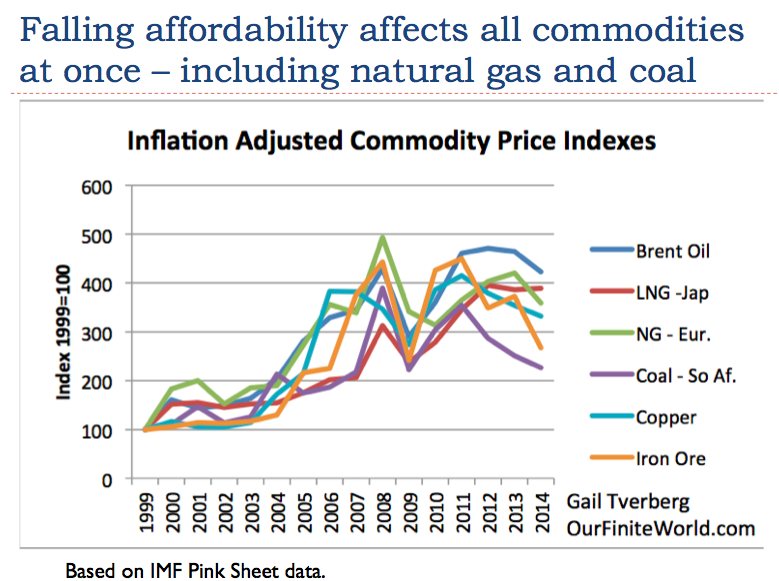

Slide 18 shows the fall of commodity prices up through 2014. The fall in commodity prices has continued in 2015 as well. The story we frequently hear is about low oil prices, but there is also a problem with low natural gas prices. Coal prices are low now too, and, in fact, many coal producers are near bankruptcy. Prices of iron ore, steel, copper, and many other metals are very low, as are prices of many kinds of staple foods traded internationally.

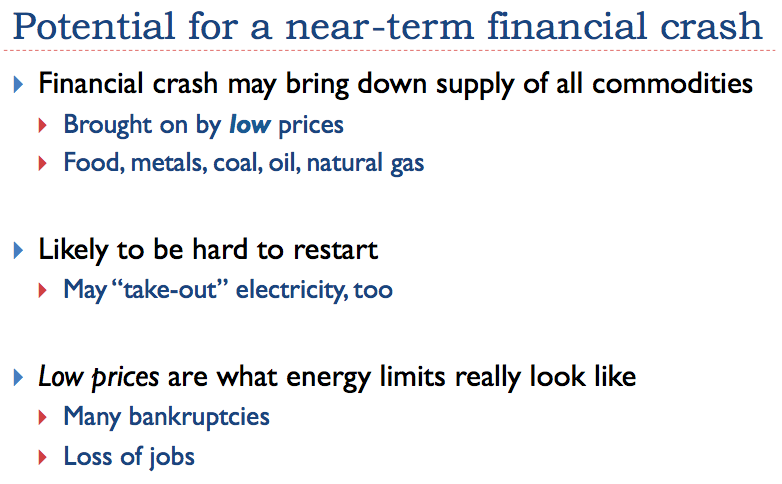

The problem with low commodity prices is that there are many loans that have been taken out to support their production. There is a significant chance of default, if prices remain low. Also, low commodity prices affect asset prices–for example, prices of coalmines, or prices of agricultural land. As the prices of commodities fall, the price of the land used to produce those commodities falls. When this happens, it becomes difficult to repay the loans on the property.

Peak Oilers were right about the cost of production continuing to rise. What they missed was the fact that prices would at some point fall behind the cost of production because of affordability issues. Low prices would then bring the economy down, as it did in the Depression in the 1930s, and in quite a few earlier collapses.

I think of increased demand, provided by debt, as being like a rubber band. Just as a rubber band can stretch for a while, the price of oil can rise for a while, fueled by more and more debt. At some point, debt can’t rise any higher–the rate of return on investments made using debt is too low, and defaults become too frequent. Instead of continuing to rise, commodity prices fall back. Market prices of commodities fall to much lower prices than the costs of production.

In order to get oil prices up higher, the wages of factory workers, restaurant workers, and other non-elite workers need to rise, so that they can afford to buy nice cars and nice homes. Commodities of many types are used both in making homes and cars, and in operating them.

If space solar (or for that matter, any renewable energy) is to be helpful, it needs to be very cheap, so that products made using renewable energy are affordable.

If the replacement energy source is cheap enough, perhaps there will not be a huge run-up in debt to GDP ratios, to finance the new devices used to provide electricity or other energy.

We are encountering problems now, so we need a replacement now, not 20 or 50 years from now.

We cannot expect the cost of electricity production to be more than the current wholesale selling price of electricity. Thus, it needs to be four cents per kWh or less. Ideally, the price of electricity should be falling, as in Slide 6.

Another consideration is that we need to be able to operate our current vehicles using a liquid fuel, made with electricity, because of the time and materials involved in switching over to electric vehicles. This requirement likely reduces the maximum cost of electricity even below four cents per kWh.

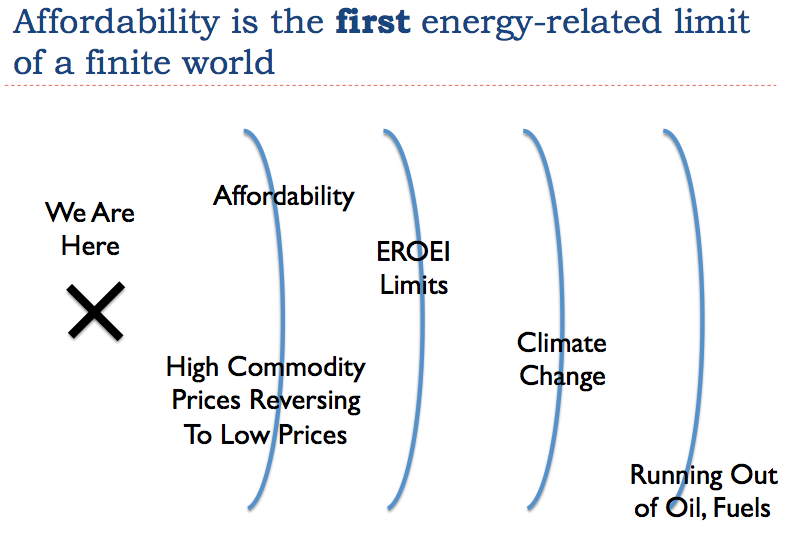

It is possible to run into many different kinds of limits, over a period of time. In my view, the first limit we reach is an affordability limit. We can tell we are hitting this limit when high prices reverse to low prices, as they have done since 2011. The fact that prices are continuing to fall is especially worrisome.

There has been a popular myth that it is OK for energy costs to rise. We will just choose the least costly of the high-priced alternatives. This approach doesn’t really work, because wages do not rise at the same time.

Also, we have to compete with other countries. If their energy costs are cheaper, their manufacturing costs are likely to be lower.

If conditions existed that allowed oil prices to rise endlessly (in other words, rising wages of non-elite workers together with debt that could spiral ever higher, as a percentage of GDP), we wouldn’t really have a problem–we could afford increasingly expensive substitutes. Unfortunately, the story of ever-rising oil prices is simply fiction. It is a pleasant story, but not really true. I explain some of the issues further in “Why ‘supply and demand’ doesn’t work for oil.”

onlooker on Mon, 21st Dec 2015 3:32 pm

How nice the author understands the inner workings of the economy related to oil and other commodities. His solution is cheap energy. Pray tell us how and when are we to expect this “cheap energy”? Does not offer a clue except to say “The only theoretical solution would be to create a huge supply of renewable energy that would work in today’s devices. It would need to be cheap to produce and be available in the immediate future”. How to accomplish this huge transition and soon. Well as they say the Devil is in the details. Divert fossil fuel energy to building out this Renewable infrastructure would further debilitate the already tumbling economy. As for cheap yeah right Renewable providing less total net energy spells more expensive energy not cheaper. Basically just wishful thinking.

Newfie on Mon, 21st Dec 2015 3:45 pm

Gail Tverberg wrote this. She is a smart cookie. Probably the smartest of the peakers.

penury on Mon, 21st Dec 2015 4:04 pm

I think the point that Gail was making although in a very obfuscatory kind of way is.There is no cheap energy known or available at this time. The economies of the world cannot continue to function without said cheap energy. Gail is too much of a lady to say it, so I will say it. We are all f(((ked.

Pete Bauer on Mon, 21st Dec 2015 4:17 pm

The finite world seeks to reinforce the opinion that without Oil, the World will end which is pretty much what the Oil companies are saying. This is not correct.

We can run the world on Renewable + Nuclear.

If a electric vehicle can run 100 miles for a gallon of gas equivalent (3 time more than gas car), then the World needs only 30 million b/d of oil instead of current 90 million b/d.

That’s why Chinese and Europeans are racing to buy more Electric & Plugins.

USA is catching up fast.

Similarly an LED bulb can produce as much power with 9 watts as a 60 watt incandescent bulb. So if there is Peak Oil, don’t worry just look for an alternative and buy it.

Apneaman on Mon, 21st Dec 2015 6:09 pm

Peter, are you aware of any heavy equipment that is electrified? Cranes, back hoes, bulldozers, mining equipment, ocean transport (bunker fuel)? There is no EV’s or much of the stuff we run on electricity without that equipment.

Take a look at just the erection process for 1 wind tower/turbine. Can all the equipment these guys use/need be electrified?

https://www.youtube.com/watch?v=84BeVq2Jm88&app=desktop

danny on Mon, 21st Dec 2015 6:22 pm

ape man I think he is saying that there is a great reduction in energy use…you will still need airplanes and heavy machinery etc..but with the decrease in energy consumption we might come up with cheap energy in the mean time…

JuanP on Mon, 21st Dec 2015 7:03 pm

I stopped reading Gail’s articles a few months after she created “Our Finite World”. She has nothing new to teach me and her writing is to wordy and disorganized. I learnt a lot from her at TOD back in the days and respect her as an original thinker, though, and I recommend people who have been researching Peak Oil for less than a decade read her stuff.

I miss TOD so much, there were so many excellent comments there that I read them all for many years, but never bothered to post any because I felt I had little to add to the conversation. I am glad that we have some of those people here, too, like Rockman. Their knowledge is invaluable.

GregT on Mon, 21st Dec 2015 7:56 pm

So if there is Peak Oil, don’t worry just look for an alternative and buy it.

So if there is Peak Oil, where do you propose people will get the money from to buy “an alternate”?

makati1 on Mon, 21st Dec 2015 8:04 pm

Well said, penury. Gail is just trying to make a buck while her specialty still has an audience. Not much use for ‘economists’ after the crash. There will be no one to read or listen to her. I certainly don’t bother, even now.

The financial Titanic has hit the iceberg of reality and is sinking. Like Climate Change, we are no longer in control. Why spend time reading about some off-the-wall idea from a dying breed who should have taken a physics course along with all of that econobabble? Better to use that time to learn skills that will be useful after and to gather the necessary tools.

JuanP on Mon, 21st Dec 2015 8:13 pm

Pete Bauer “If a electric vehicle can run 100 miles for a gallon of gas equivalent (3 time more than gas car), then the World needs only 30 million b/d of oil instead of current 90 million b/d.” Pete, by the time we replaced the global vehicle fleet with electric ones, if that were possible, we wouldn’t be producing 30 Mbpd of oil since that would take many, many decades. There have been electric vehicles in the world for more than a hundred years, since the mid 19th century, and they are still only an insignificant part of the fleet, not even one percent.

http://energy.gov/articles/history-electric-car

https://en.m.wikipedia.org/wiki/History_of_the_electric_vehicle

Pete Bauer on Mon, 21st Dec 2015 8:46 pm

apneaman

Here is 1 heavy vehicle that is electrified.

http://insideevs.com/converting-commercial-vehicles-to-plug-ins-a-no-brainer-video/

China has 80,000 electric buses.

http://cleantechnica.com/2015/11/26/electric-bus-adoption-taking-off-china/

GregT on Mon, 21st Dec 2015 8:57 pm

“Here is 1 heavy vehicle that is electrified.”

One electric vehicle is certainly a good thing, however, It would take decades to build out the world’s current fleet to all electric, and even if we did, some 70% of the world’s electricity is generated with fossil fuels.

“China has 80,000 electric buses.”

70% of china’s electricity is generated with coal. So 56,000 of those buses are in essence running on coal.

Pete Bauer on Mon, 21st Dec 2015 9:07 pm

JuanP

What you are talking about is history.

The modern EVs with Lithium battery has already crossed 1 million in sales worldwide.

This year alone, the sales have crossed 500,000 mark.

China is accelerating the use of EVs to reduce pollution.

Pete Bauer on Mon, 21st Dec 2015 9:08 pm

GregT

Even if the electric vehicle runs on Coal, it goes 200% electric distance while Coal emits only 50% more pollution than Oil. So even the electric vehicles running on Coal is far more cleaner than vehicles running on gasoline/diesel.

JuanP on Mon, 21st Dec 2015 9:19 pm

Pete, the global vehicle fleet is around one billion vehicles so your million electric vehicles are aproximately 0.1% of the fleet. https://en.m.wikipedia.org/wiki/Motor_vehicle

If we build half a million electric cars per year, we will never replace the fleet with electric vehicles. Even if those vehicles lasted FOREVER it would still take 2,000 years to replace all oil burning vehicles. If you stay here at PO long enough, you might eventually get it, though some never do.

Apneaman on Mon, 21st Dec 2015 9:20 pm

Greg, I’m getting too tired to spar with the techno savior greenies anymore. Faith cannot be reasoned with.

GregT on Mon, 21st Dec 2015 9:43 pm

I find it bizarre how some people simply cannot face reality, and are really poor with simple arithmetic.

JuanP on Mon, 21st Dec 2015 9:51 pm

Ap, Keep up the good work! I really appreciate your comments and all the links you provide. Your presence enriches the site!

GregT on Mon, 21st Dec 2015 9:56 pm

Seconded.

Thanks, by the way Apnea, for providing the link to the “War with Gwynn Dyer” series. Fascinating.

Apneaman on Mon, 21st Dec 2015 10:04 pm

Thanks fellas.

GregT on Mon, 21st Dec 2015 10:05 pm

It’s as if he was documenting a primitive, irrational, species of wild animal. 🙂

makati1 on Mon, 21st Dec 2015 11:20 pm

Isn’t it amazing? We here have access to ALL of the info/education we could possible want/use just for the cost of the time to use our favorite search engine to pull it out of the cloud and read it. But many here never do. They want to keep believing their personal fairy tale until the 2X4 of reality smacks them in the face and then they will claim: “I didn’t know!”

I would have given a year of my life if I had such access to that kind of knowledge at my fingertips when I was young. A Websters dictionary and a cheap set of encyclopedias were my only reference source. Now, I would bet that not one in 100 American homes have either of those on the shelf, but they may have 2-3 computers that will be dead bookends when the SHTF … or before.

My library here has a number of dictionaries in several languages. And over 100 reference books from reading, biology, medicine, physics, engineering, all levels of math, etc., starting at the kindergarten level thru college. If you cannot read, books are just paper for starting fires. Schools will be among the things that disappear. Home teaching will be the only alternate. What is in your library?

onlooker on Tue, 22nd Dec 2015 2:27 am

“Faith cannot be reasoned with.” No truer statement has ever been uttered.

shortonoil on Tue, 22nd Dec 2015 7:28 am

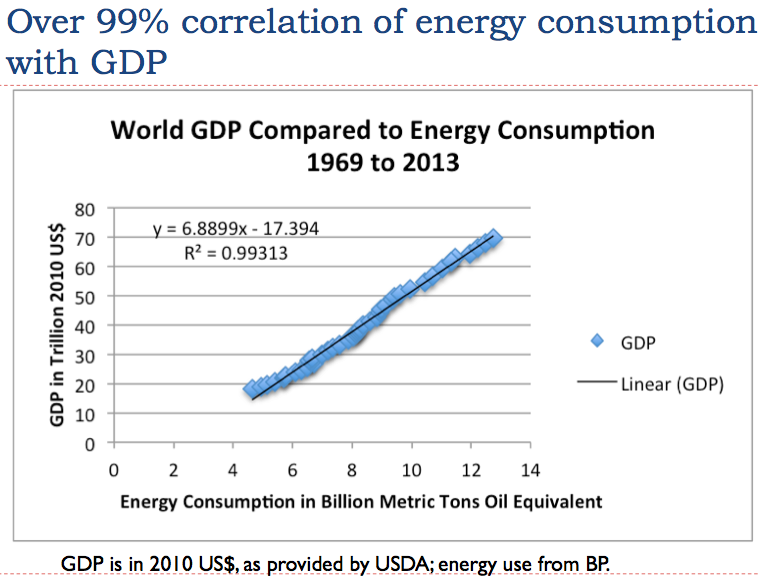

The BP graph; I just don’t buy it:

World GDP compared to Energy Consumption

It is a linear function with a negative Y intercept. Which makes no sense at all? The graph is saying that in constant 2010 dollars the value of a barrel of oil to the economy has always been, is, and always will be $947.

The graph of World GDP vs Cumulative World Production is a power function:

http://www.thehillsgroup.org/depletion2_012.htm

This graph tells us that the value of a barrel of oil has gone up over time as more oil was produced; it added to existing infrastructure, which added to GDP. That curve is flattening out as we pass the 2012 energy half way point.

Bob on Tue, 22nd Dec 2015 10:51 am

I’m always amazed that the ‘solution’ is to come up with ‘cheap energy’ at $20/bbl for liquid fuel. Folks have been trying that for 4 decades now with zero success. Only Brazil, with tropical climate, comes close with ethanol, but it too is ramping up its oil use year after year after year

we face an interesting future where oil producers are going to be reluctant to invest in future projects with low price oil. In a few years, the surplus capacity will be wrung out of the system, then what? we could be in for yo-yo type violent ups and downs in energy prices that will slam business and consumers. Multi year cycles of ‘shortage’ and then adequate supplies.

EV’s? the percentage sold in the US drops year after year now with low gas prices. The only people buying them are die hard Greenies, and folks being able to ride in car pool lanes in some states – while getting $10,000 rebates for buying the car.

And just ‘what’ are you going to turn into liquid fuels? The current ethanol production, of 10%of the fuel consumed in vehicles, takes 40% of the US corn crop. Likely it saves no carbon but is just a big money redistribution scheme to farmers and ethanol refineries. So all we need to expand to 100% ethanol use in vehicles is about 5 more USA’s to produce the corn to turn to ethanol. A few more Earth like planets that we can take over, and just grow corn to supply the Earth with ethanol. Whatever you come up with to ‘turn into fuel’ will take more land than there is in the world to grow.

Until Greenies get over their anti-nuke thinking, there is no hope. It’s already too late. You can’t build enough wind machines to ‘save the planet’. There aren’t enough places to put them with sufficient wind speed. Nor sites that people will LET folks ut them.

A financial crash is much more likely. There are something like 50 trillion in derivatives out there. One day it will all come crashing down, we’ll be in a 1932 type Depression, and of course, oil use will plummet to the basement as folks scrimp just to survive.

shortonoil on Tue, 22nd Dec 2015 12:51 pm

The author completely misses the point in her attempt to reduce the problem to an Econ 101 exercise. It is not the price of oil that is significant; it is the price of oil in relation to the amount of energy it delivers that is the prominent factor. If a barrel of petroleum in 2015 delivered the same amount of energy to the end consumer that it did in 1975, $100 oil would be no problem for the economy. $35 oil is giving the end user a very good deal on the energy that they receive, but the producer can not continue to produce it at that price. The producers can no longer afford to replace the reserves that they are extracting. Once the present fields are pumped out, without replacement, they will cease operations. The increased amount of energy that it takes to produce petroleum, and its products has reduced petroleum’s ability to supply the energy needed for both the producer, and consumer. One, or the other will suffer. Presently, the petroleum industry is doing the majority of the suffering. Once they begin shutting in their operations for lack of an adequate profit, both will feel depletion’s impact.

http://www.thehillsgroup.org/

Truth Has A Liberal Bias on Tue, 22nd Dec 2015 2:05 pm

It seems to me people can and will afford higher priced energy. They will have to reduce all other discretionary spending. No $5 coffee and a muffin. No new iPhone every 18 months. Etc etc. We need oil or we starve. So we will sacrifice all to get it once it gets bad enough.

shortonoil on Tue, 22nd Dec 2015 3:39 pm

“It seems to me people can and will afford higher priced energy.”

That’s called can’t see the forest for all those dame trees. If the petroleum industry fails, 38% of the world’s economy fails with it. At $35/ barrel it is failing. There is no one, neither the President and all his men, the military, or the Pope that can get it produced anymore efficiently than the industry can. When that industry is gone, it is all over; and all the need in the world is not going to pump one single barrel!

Joe D on Tue, 22nd Dec 2015 4:30 pm

“So we will sacrifice all to get it once it gets bad enough.”

‘Cutting off the nose to spite the face’ is an expression used to describe a needlessly self-destructive over-reaction to a problem.

Accordingly, a gallon of gas will cost you an ARM and a LEG! LOL

makati1 on Tue, 22nd Dec 2015 7:52 pm

Truth, no you won’t as it has to make a profit to exist in a capitalist world. Your income will be maybe $10,000/year and the price of gasoline will be maybe $100 per GALLON, if it is available at all, which is unlikely as the system that makes it possible disappears.

You seem to not be able to think beyond the oily world you grew up in, but a decent world existed for thousands of years before oil. You can survive without it.

Boat on Thu, 24th Dec 2015 1:56 am

In the US it takes much less energy and resources to produce nat gas. That is why as coal and fuel oil are being phased out as fast as infrastructure can be built. Look at world nat gas prices. They have also been dropping. Japan is now paying less than $8 when just a few years ago they were paying over $16. BTW nat gas fields are still being discovered all the time. Electricity for the world will be stable to dropping in cost, Another BTW, Nat gas and coal produce most of the electricity that run the factories that produce the next wave of renewables which are very close to competing outright with coal and nat gas.

This is why there will be huge crash in my lifetime. Lots of energy around at decent prices. Climate change will be the big killer decades from now.

Davy on Thu, 24th Dec 2015 4:17 am

You got that right Boat “electricity prices will be dropping”. You just don’t realize the true reason. When the global economy stagnates and slows to stall speed there will be a huge oversupply of energy and resources that will drive price down in a deflationary spiral. I should mention all except food that will skyrocket from shortages.

theedrich on Thu, 24th Dec 2015 5:27 am

Ideology, like religious myths, is ignorant and stupid people’s delusional simplification of reality as a “solution/explanation” of their problems. (Think of the mindless student eruptions over political correctness, eco-causes, etc., at elite universities.) On the current political level, Ø is a perfect example of an ideological despot. The N-word has no idea of what is happening outside his psychotic bubble. His regime’s policy is similar to handing out a $50 loan to a debtor who later reimburses the creditor with $30. (And the $20 difference is subtracted from Whitey’s declining wages.) How much longer can this continue?

Financial manipulations (QE, ZIRP, other interest-rate fluctuations) by a central bank act, yes, as a leaky inner tube to save a person as his boat sinks, but that expedient will not last very long. Thereafter comes war.

“But, but,” the unicornists say, the solution is for at least ¾ths of the global population to become monks and nuns running monasteries. Good luck with that. Especially for the 1½-billion, fast-breeding Musselmen who don’t like monks and nuns.

Apneaman on Thu, 24th Dec 2015 5:58 am

theedick, ideology like race ideologly? Like believing you are a part of something special simply because of shared skin tone? There is a club of special white folks, but you ain’t in it and never will be.

https://www.youtube.com/watch?v=i5dBZDSSky0

JuanP on Thu, 24th Dec 2015 6:27 am

Theedrich, Being a racist is one of the most sick, stupid, lowest, and ignorant things a human being can be. Racists are the lowest life forms on Earth. Your comments fill me with an urge to defecate!

JuanP on Thu, 24th Dec 2015 6:32 am

Ap, I didn’t follow the link, but recognized George Carlin’s quote, so my guess is it leads to his stand up show on the matter. He was the best comedian ever. America should be proud of him. Do you recognize my quote in the comment above? 😉

theedrich on Thu, 24th Dec 2015 6:36 am

Man-ape, I’m sure your “ideologly” is shared by the suicidists who run your half of the continent. Don’t worry. All those neo-Canucks newly imported from Mudland will soon replace your White Guilt with their own “ideologly.” And since you prefer darkies to fornicate with, you may even have a mulatto of your very own to rejoice over. Why worry about one White who does not like the prospect of the obliteration of Nature’s finest species?

Apneaman on Thu, 24th Dec 2015 6:44 am

theedouch, I don’t have a preference – I’ll fuck anyone. Just ask your sister or mother.

theedrich on Thu, 24th Dec 2015 6:55 am

Ah, that explains your dementia, Man-ape. It’s syphilis that’s been eating your brain away all this time. Sic transit gloria mundi.